Netflix Inc DCF Valuation: Is The Stock Undervalued?

Image Source: Unsplash

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Netflix Inc (NFLX).

Profile

Netflix’s relatively simple business model involves only one business, its streaming service. It has the biggest television entertainment subscriber base in both the United States and the collective international market, with almost 250 million subscribers globally. Netflix has exposure to nearly the entire global population outside of China. The firm has traditionally avoided live programming or sports content, instead focusing on on-demand access to episodic television, movies, and documentaries. The firm recently began introducing ad-supported subscription plans, giving the firm exposure to the advertising market in addition to the subscription fees that have historically accounted for nearly all its revenue.

Recent Performance

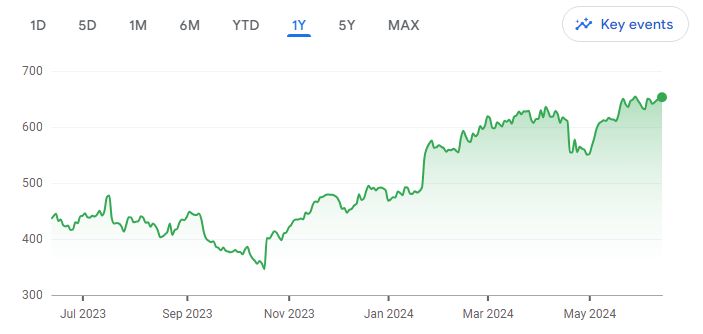

Over the past twelve months, the share price is up 49.92%.

Source: Google Finance

Inputs

- Discount Rate: 9%

- Terminal Growth Rate: 2%

- WACC: 9%

Forecasted Free Cash Flows (FCFs)

| Year | FCF (billions) | PV(billions) |

| 2024 | 1.33 | 1.22 |

| 2025 | 1.52 | 1.28 |

| 2026 | 1.74 | 1.34 |

| 2027 | 1.99 | 1.41 |

| 2028 | 2.28 | 1.48 |

Terminal Value

Terminal Value = FCF * (1 + g) / (r – g) = 33.22 billion

Present Value of Terminal Value

PV of Terminal Value = Terminal Value / (1 + WACC)^5 = 21.59 billion

Present Value of Free Cash Flows

Present Value of FCFs = ∑ (FCF / (1 + r)^n) = 6.73 billion

Enterprise Value

Enterprise Value = Present Value of FCFs + Present Value of Terminal Value = 28.33 billion

Net Debt

Net Debt = Total Debt – Total Cash = 6.97 billion

Equity Value

Equity Value = Enterprise Value – Net Debt = 21.36 billion

Per-Share DCF Value

Per-Share DCF Value = Enterprise Value / Number of Shares Outstanding = $49.44

Conclusion

| DCF Value | Current Price | Margin of Safety |

|---|---|---|

| $49.44 | $653.26 | -1221.37% |

Based on the DCF valuation, the stock is overvalued. The DCF value of $49.44 share is lower than the current market price of $653.26. The Margin of Safety is -1221.37%.

More By This Author:

Why Dell Technologies Inc Stock Is A BuyMicrosoft Corp DCF Valuation: Is The Stock Undervalued?

Why Philip Morris International Inc Stock Is A Buy?

Disclosure: None.