S&P 500 Low Volatility Index May 2023 Rebalance

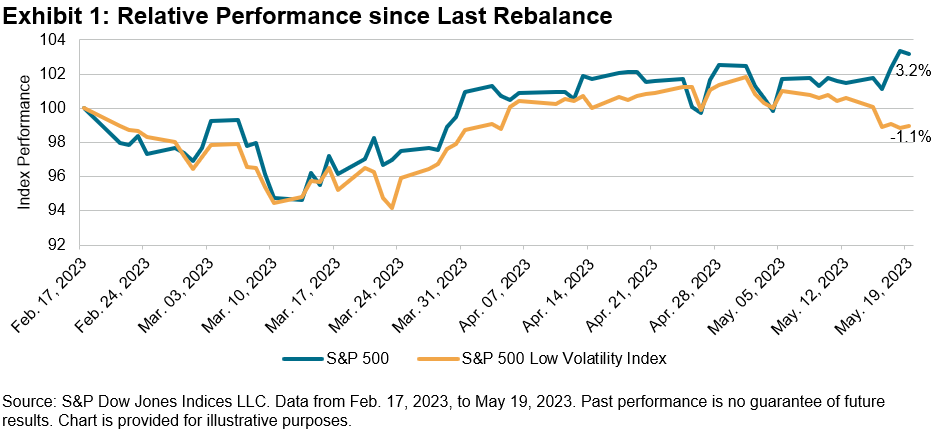

Since the last rebalance for the S&P 500® Low Volatility Index on Feb. 17, 2023, the S&P 500 finished up 3.2% despite briefly dropping in mid-March during the collapse of Silicon Valley Bank. Exhibit 1 shows that during this period, the S&P 500 Low Volatility Index underperformed the S&P 500 by 4.3%. This divergence is mainly due to the significant performance contributions from the mega-cap tech stocks as a result of their strong performance and large weights in the S&P 500.

Exhibit 2 shows that the overall trailing one-year volatility decreased slightly since the end of January. Measured in absolute terms, volatility decreased the most for the Information Technology and Consumer Discretionary sectors, falling 2.4% and 2.2%, respectively. Out of the 11 GICS® sectors, 9 had their trailing one-year volatility reduced during the period, with the exceptions being the Real Estate and Utilities sectors, which increased just 0.3% and 0.4%, respectively. As of April 28, 2023, Energy, Consumer Discretionary, Communication Services, Information Technology and Real Estate were the top five most volatile sectors in the S&P 500.

As a result of the overall decrease in volatility, the low volatility index’s latest rebalance brought some changes to the sector weights.

The latest rebalance for the S&P 500 Low Volatility Index shifted an additional 4% weight to the Consumer Staples sector. Similarly, Communication Services and Real Estate each gained ground and added 1% weight to their sectors. Despite minor changes in volatility at the sector level for Utilities and Financials, these two sectors lost the most weight in the index at 3% and 1%, respectively.

Communication Services, Information Technology and Real Estate were the most underweighted sectors in the latest rebalance of the low volatility index (effective after the market close on May 19, 2023).

More By This Author:

Active Or Agnostic?

Hedging Debt Ceiling Drama With The S&P GSCI SOFR And S&P GSCI Gold

Cutting Carbon Without Changing Course: Net Zero Fixed Income Indices

Disclaimer: See the full disclaimer for S&P Dow Jones Indices here.