Cutting Carbon Without Changing Course: Net Zero Fixed Income Indices

S&P DJI recently expanded its range of S&P PACT™ Indices (S&P Paris-Aligned & Climate Transition Indices) to go beyond equity to now cover fixed income. Within these indices, the differences between the two asset classes in terms of the balance between cost (tracking error) and reward (sustainability profile) are material and highly thought-provoking.

As shown in S&P DJI’s Climate & ESG Index Dashboard, the equity S&P PACT Indices typically have an annualized tracking error ranging from 1.8% to 2.7% versus their market-cap-weighted benchmarks as of March 31, 2023. These levels of tracking error may be challenging for investors who are highly sensitive to any deviations in performance from a standard, market-cap-weighted benchmark.

Following on the path drawn by equity indices, the suite of S&P PACT Indices expanded into fixed income with the launch of the iBoxx EUR Corporates Net Zero 2050 Paris-Aligned ESG. This index uses the broad iBoxx € Corporates as its underlying benchmark and adopts similarly ambitious sustainability and climate targets as its equity counterpart—in particular, meeting the definition of a Paris-Aligned benchmark.

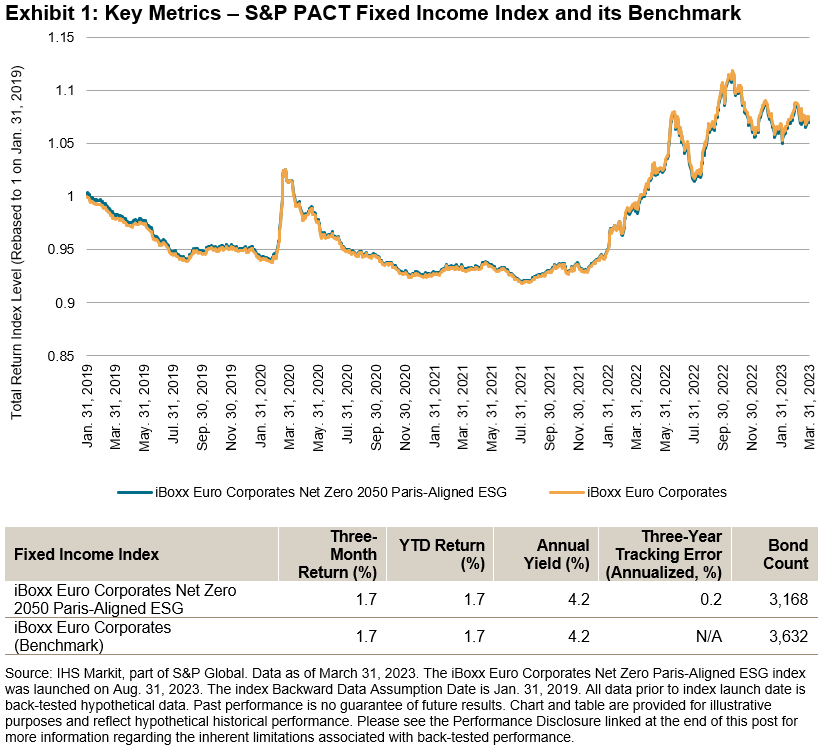

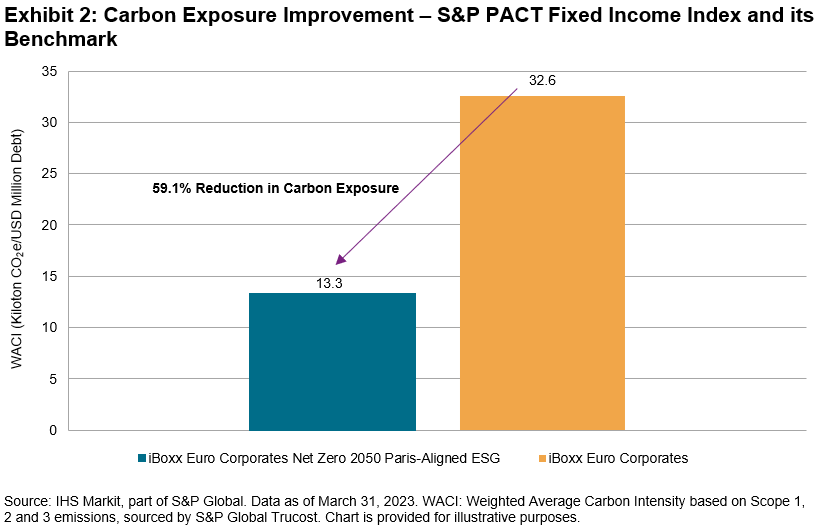

What is particularly remarkable about this fixed income S&P PACT Index is that it has had a (back-tested) annual tracking error of only 0.2% versus its underlying index; specifically, it has achieved a material benchmark-relative reduction in carbon exposure of 59.1% as of March 31, 2023. Exhibits 1 and 2 summarize the carbon exposure improvement and performance characteristics as compared to iBoxx € Corporates, using the same analytical engine driving S&P DJI’s Climate & ESG Index Dashboard.

(Click on image to enlarge)

Overall, these exhibits show that the fixed income S&P PACT Index maintained near benchmark-like performance while achieving a substantial improvement in carbon exposure.

The key to this result is that, while integrating sustainability and climate goals, the fixed income methodology for the S&P PACT Indices also includes steps to approximate the duration and credit quality of the benchmark. With a similar rating and maturity profile, even ambitious sustainability and climate goals can potentially be incorporated without generating materially distinct index performance. For this reason, the fixed income S&P PACT Index may be useful to those who are highly sensitive to tracking error, aligning with climate and sustainability goals at a marginal cost.

Key performance and sustainability metrics for the S&P PACT Index suite can be monitored in S&P DJI’s Quarterly Climate & ESG Index Dashboard.

1 https://www.spglobal.com/spdji/en/education/article/faq-esg-back-testing-backward-data-assumption-overview/

More By This Author:

Persistently Disappointing

A Quick Look At Key USD Indices And Fixed Income ETF Flows This Year

Combining Sectors And Sustainability

Disclaimer: See the full disclaimer for S&P Dow Jones Indices here.