S&P 500 Index In A Downswing On The Weekly Chart

I am often asked how I analyze stock price charts and what tools I use. Below I share with readers the short version of my approach by using the weekly chart of the S&P 500 index as an example.

I like old-school charting and mostly focus on reading the price itself, not derivatives of the price.

Since I want to stay close to the price, I stay away from fancy technical indicators. I may put one or two moving averages (MAs) on my charts, which are just a smoothing mechanism or curved trend lines, to determine their slopes and where the price is located related to the average(s). Although lagging, I consider MAs to be reasonably reliable measures of trends.

Back in the day, I tested most of the common and other mathematical indicators and found out they did not add value to my approach and what I was trying to accomplish with my price analysis. I have nothing against technical indicators, but always suggest their users know well how the indies are calculated, what they are supposed to measure, in what type of environment they work well and not at all, etc. And to be careful of overanalyzing, overoptimizing parameters and multicollinearity.

Even though I am trained in classical technical analysis, I do not blindly follow the so-called continuation and reversal patterns as taught by the early chartists, Schabacker and Edwards & Magee. However, I like to be aware of these patterns potentially forming or if they have already formed and I pay special attention when they fail to materialize according to the textbooks. In my view, the moving averages and trendlines are just guides to look to the left on the chart for possible support and resistance areas/zones. I am cautious of penetrations of MAs/trendlines and always treat horizontal lines, manually drawn between swing highs or swing lows, as much more important levels than any levels of diagonal or sloping/slanting lines.

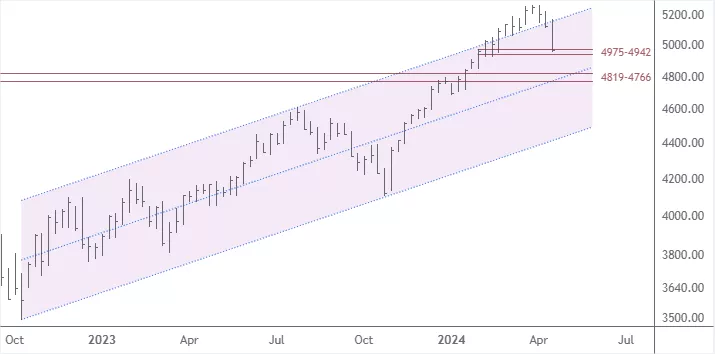

As can be seen on the chart below, I have drawn in an upward-sloping trend channel serving as a guideline but have marked with horizontal lines the levels I think are important in terms of possible support for the index in the coming days/weeks.

S&P 500 Index - Weekly Chart

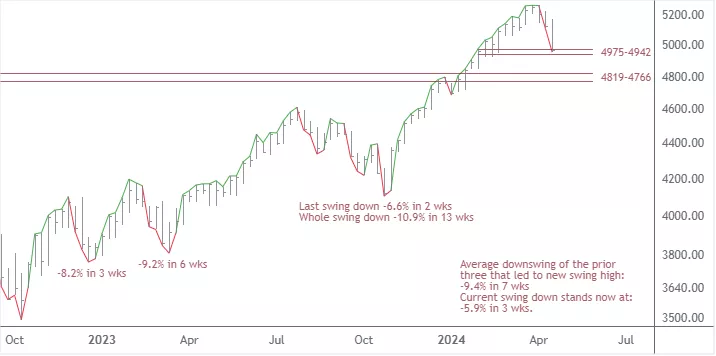

In 1998 I sat down with the task of designing a method to objectively define the up- and downswings in the price of any freely traded instrument or product in the financial markets, based solely on the high-low-close price bars. After some testing, I settled on a specific bar combination logic or rule that I have never tweaked since. First I plotted it by hand, later I coded it so it plots automatically in my charting software. I call it “The SwingPlotter”; it is purely price-bar based and I keep a few versions of it. For me, it is a simple yet highly effective visual tool that provides a lot of information from a chart. It serves as a road map for navigating price action, imposing structure to reduce noise, helping to visually identify and highlight formations, and locating potential inflection points. The SwingPlotter is universal in the sense that it can be used on all time frames and markets. I am not selling it, just introducing it as an important arsenal in my toolkit.

The SwingPlotter in Action

Here is the same S&P 500 chart, but this time with one color-coded version of my mechanical SwingPlotter. Green lines tracking the high prices of the bars are upswings and red lines tracking the low prices of the bars are downswings. The price bars form swings and the swings form trends. On the chart, I have marked the length of prior downswings, both in magnitude (%) and duration (weeks). The most recent downswing measures -5.9% in three weeks. Taking the average of the prior downswings that led to a new swing high, it stands at -9.4% over a seven week period. If the index falls further, then the 4819-4766 becomes the next area of possible support in my opinion, with the 4770 level representing a 9.4% drop from the March 28 peak. Based on the weekly chart, I still view the long-term trend to be up.

More By This Author:

Alvotech's Share Price At A Critical Juncture

Iceland's Stock Indices At Important Inflection Points

Value Line Geometric Average Still Ranging

Disclosure: The author of the analysis presented does not own shares or have a position or other direct or indirect monetary interests in the financial instrument or product discussed in his ...

more