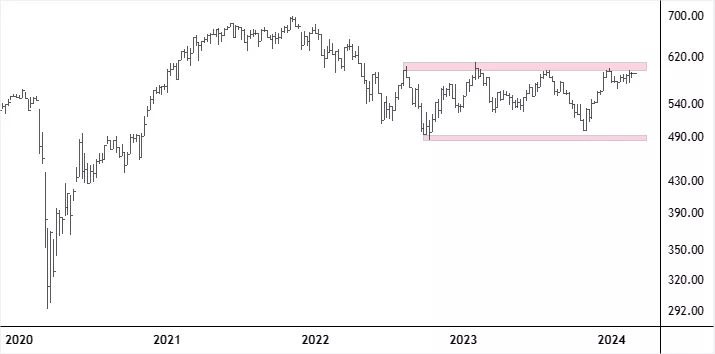

Value Line Geometric Average Still Ranging

I consider the Value Line Geometric Average (VLG) the best measure of the broad US stock market. The Average consists of stocks of about 1.700 companies of all types and sizes, from all major sectors/industry groups, and all have equal weight and thus the same impact on its performance.

Both the VLG and small-cap indices are still in ranges and need to break convincingly to the upside to support the advance of the S&P 500 Index and the other indices comprised of large-cap stocks. For VLG, the key level is roughly 610.

More By This Author:

Potential Cup & Handle Pattern In The S&P 500 Index

One Year Real Return Of Iceland's OMXIGI Is Currently -16%

Bullish Case For S&P 500 Index

Disclosure: The author of the analysis presented does not own shares or have a position or other monetary interests in the financial instrument or product discussed in his articles on ...

more