Iceland's Stock Indices At Important Inflection Points

OMXIPI

I am closely watching if the OMX Iceland All-Share Price Index (OMXIPI) is in the process of reversing its long-term trend from down to up. If so, holding the 2.015 level and rising above the purple smoothing line in the next few days is important in my opinion.

(Click on image to enlarge)

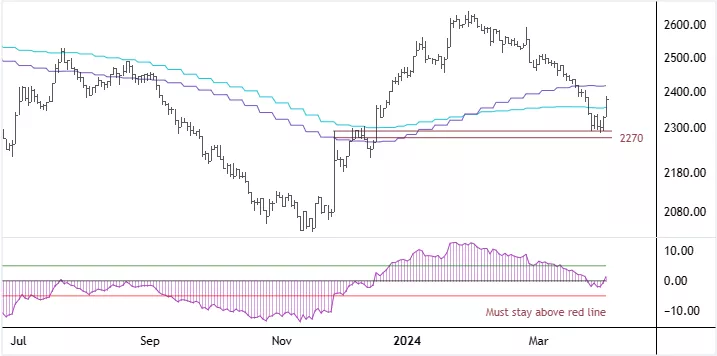

OMXI15

If the OMX Iceland 15 Index (OMXI15) is turning its long-term direction to the upside, it needs to stay above the 2.270 level.

(Click on image to enlarge)

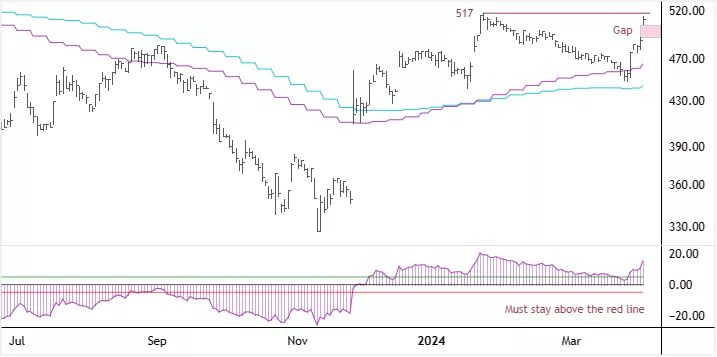

Stock Price of Marel

Marel is the second-largest company in the Icelandic stock market in terms of market capitalization. As a member of both indices, its stock price weighs heavily on the performance of OMXIPI and OMXI15. On Friday, Marel´s stock price gapped up on positive news. It would be a very promising signal for the general market if the price manages to push convincingly through the 517 ISK per share level, whether filling the gap underneath first or not.

(Click on image to enlarge)

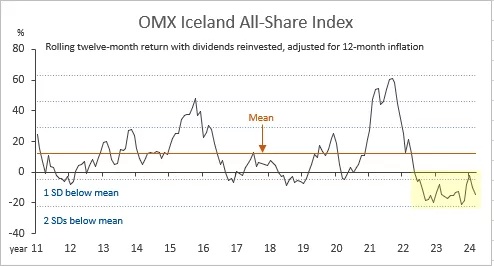

OMXI All-Share Index Real Total Return

The final chart shows the rolling one-year, real total return of the OMX Iceland All-Share Index. Since June 2022 the rate of return has been negative and has for the most part oscillated between one and two standard deviations below its +12-year average. Its current standing is -14.5%.

(Click on image to enlarge)

More By This Author:

Value Line Geometric Average Still Ranging

Potential Cup & Handle Pattern In The S&P 500 Index

One Year Real Return Of Iceland's OMXIGI Is Currently -16%

Disclosure:

The author of the analysis presented does not own shares or have a position or other monetary interests in the financial instrument or product discussed in his articles on ...

more

Very useful charts, thanks.