Something Unusual Is Happening With American Express Stock… Are Investors Overlooking It?

Image Source: Unsplash

American Express is one of the biggest credit card and payments companies in the world. It runs on a closed-loop network, meaning it acts as both the card issuer and the payment network.

This helps Amex capture more fees and control the customer experience. It’s known for premium cards like the Platinum and Centurion, big travel perks, and strong brand loyalty.

But lately, something unusual is happening with American Express stock (AXP). Beyond the surface of card fees and travel perks, Amex is quietly making moves in crypto, restaurant tech, and business software.

It’s building an ecosystem that looks more like a lifestyle and data company than just a credit card player. These shifts aren’t in every headline, but they could shape where the stock goes next.

The IDDA Analysis framework is used to analyze companies and determine which are right for you. There are five steps to the process:

- Capital Analysis – Your personal risk tolerance.

- Intentional Analysis – Your unique financial goals and timelines based on your age, health, and lifestyle.

- Fundamental Analysis – The viability of the asset based on company performance, financial health, and market position.

- Sentimental Analysis – The current emotions of Wall Street and other market participants.

- Technical Analysis – Historical price action to identify key psychological levels and market patterns.

Let’s dive into the IDDA analysis to assess American Express stock (AXP)’s fundamental, sentimental, and technical outlook.

IDDA Point 1&2: Capital & Intentional

The capital and intentional analysis need to be conducted by you.

Select your assets in alignment with your financial goals. Listen to your intuition about each asset, but remember to invest based on your own values, not just because of recommendations from others.

IDDA Point 3: Fundamental

Record revenue growth

Amex reported Q2 2025 revenue of 17.9 billion, up 9 percent year over year. Earnings per share hit 4.08. The company kept its full year guidance for 8 to 10 percent revenue growth and 15 to 15.50 EPS. The core engine is still strong.

Sticky fee income

Card fees keep climbing as customers stick with premium products. People are willing to pay for lounges, dining perks, and travel experiences. This keeps Amex less dependent on just lending and interest income.

Ecosystem expansion

Amex is not only a card company. It bought Tock for restaurant reservations, Center for expense management software, and Rooam for contactless bar payments. It also struck a partnership with Toast, linking Amex offers to restaurant point of sale systems. These moves make Amex part of lifestyle and business workflows, not just payments.

Crypto on Amex rails

The Coinbase One Card will run on the American Express network and give up to 4 percent back in Bitcoin. This brings crypto users into Amex’s system and shows it wants to stay relevant in new payment trends.

Travel and co-brand strength

The Delta partnership runs through 2029 and hotel co-brands keep expanding, like the Hilton launch in South Korea. Amex also plans new lounges in Newark, Salt Lake City, and Tokyo as part of its Platinum refresh, its biggest refresh yet. Travel and lifestyle remain strong drivers.

Digital leadership

Amex ranked number one in JD Power credit card mobile app and online satisfaction in 2025. A happy user base means higher spending and loyalty.

Valuation and market reaction

Even with strong numbers, the stock dipped after Q2 results. Wall Street set a high bar and investors worried about profit mix. Some see limited upside in the short term at current valuation.

Credit normalization

Charge-offs rose to about 2 percent in Q2. Loss provisions are increasing as consumer credit trends normalize. While Amex’s customer base is stronger than peers, rising delinquencies are still a risk.

Stress test strength

The Fed’s 2025 stress test gave Amex the lowest projected credit card loss rate and the highest projected return on assets among major banks. Its Stress Capital Buffer stays at the minimum 2.5 percent. This confirms a strong balance sheet.

Fundamental risk: Medium

IDDA Point 4: Sentimental

Overall sentiment is bullish for American Express stock (AXP). Investors and analysts see a strong brand, premium positioning, and solid fundamentals, even though short term valuation and credit trends create some caution.

Strengths

Analyst upgrades keep coming. JPMorgan and Morgan Stanley raised price targets in July, and Deutsche Bank has one of the highest targets on the Street. This signals confidence in the stock’s medium term outlook.

Wall Street likes Amex’s fee income model. While banks lean on lending, Amex makes more from card fees, lounges, and experiences. That makes revenue more stable and less exposed to interest rate swings.

The Platinum refresh and new lounges in major airports show commitment to keeping its premium edge. Investors like the moat around lifestyle and travel perks, which are harder for rivals to copy.

The Coinbase One Card running on Amex rails positions the company as a forward looking brand. This innovation appeals to growth minded investors and younger customers.

Stress test results boosted investor confidence. Amex had the lowest projected credit card losses among major banks and the strongest capital outlook. That reassures markets about stability.

Risks

Valuation concerns weigh on near term sentiment. Even after strong earnings, the stock dipped because the market had priced in high expectations. Some investors see limited upside in the short run.

Consumer credit normalization adds unease. Rising charge offs and provisions may spook investors even if Amex’s portfolio is stronger than peers.

Political noise is still a risk. The Credit Card Competition Act and fee cap debates hang over the industry. Even if Amex is less exposed than Visa or Mastercard, any new rules could shake sentiment.

Broader macro trends like job market weakness or slower travel recovery could hurt spending volumes, which investors watch closely.

Sentimental risk: Medium

IDDA Point 5 – Technical

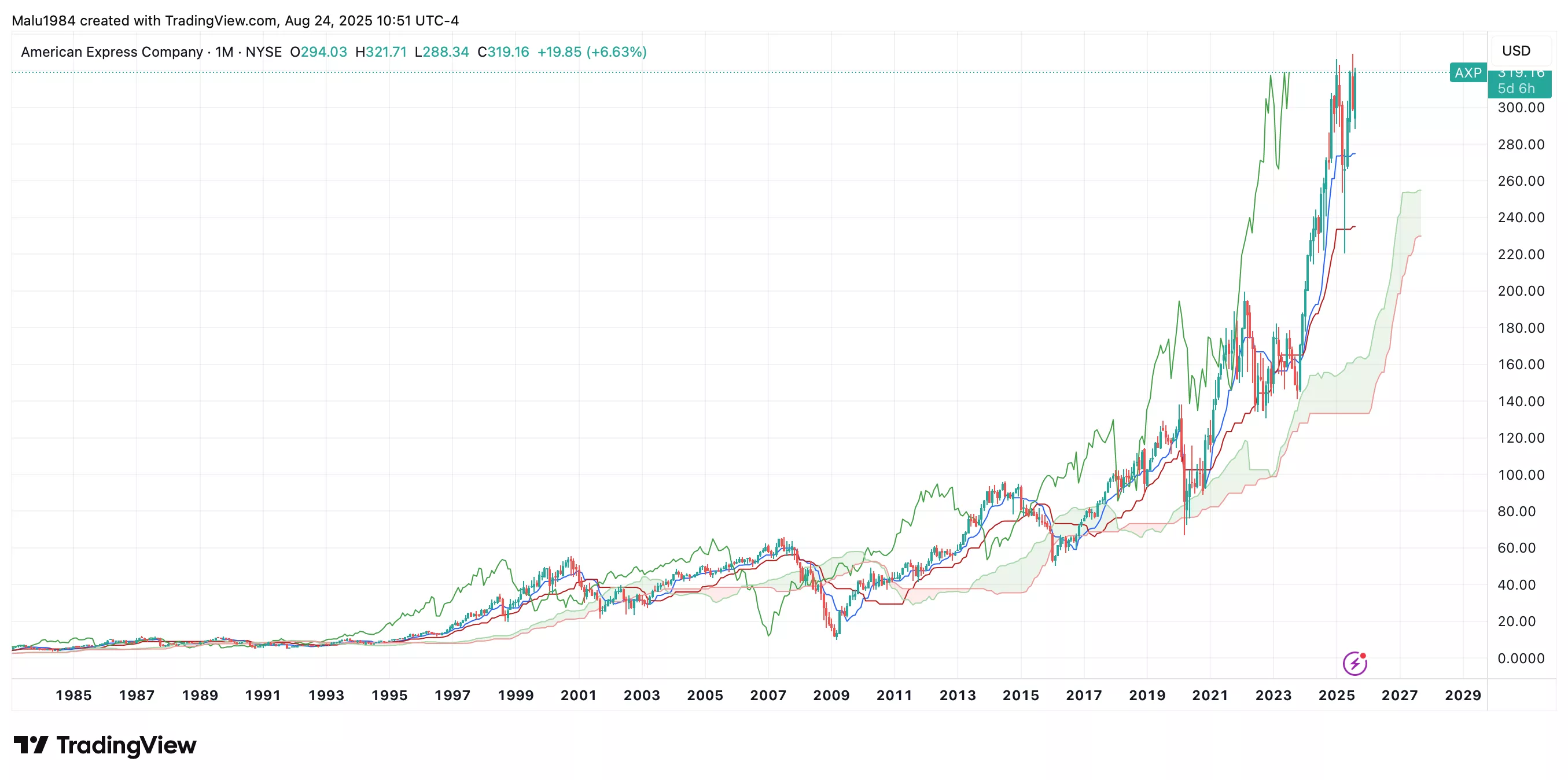

Monthly Chart

Candles are trading above the Ichimoku Cloud, showing long term bullish momentum.

The conversion line (Tenkan) is above the baseline (Kijun), confirming strength in the trend.

The overall structure shows higher highs and higher lows, with no major reversal patterns in sight.

(Click on image to enlarge)

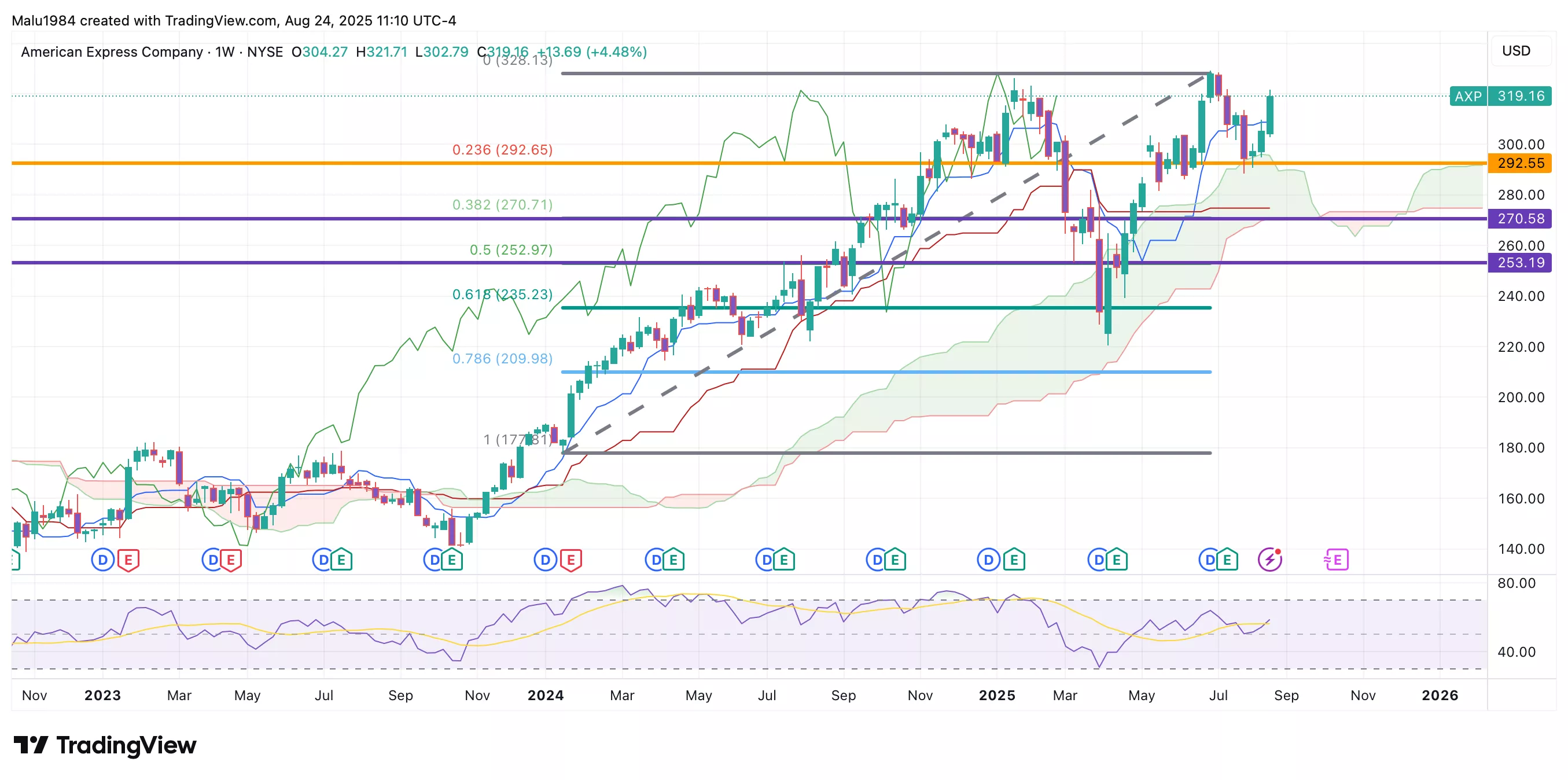

Weekly Chart

Price is also above the Ichimoku Cloud, confirming bullish momentum in the medium term.

The Tenkan (conversion) and Kijun (baseline) lines are aligned for strength, signaling buyers remain in control.

RSI is at 58, showing room to move higher before reaching overbought levels.

(Click on image to enlarge)

Overall, the technical outlook is bullish. Both monthly and weekly charts point to sustained growth, supported by Ichimoku signals and a healthy RSI. While the stock is not oversold, it still has room to climb before hitting stronger resistance levels.

Buy Limit (BL) levels:

$292.55 – High Risk

$270.58 – Moderate Risk

$253.19 – Low Risk

Hold long term.

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical risk: Low to Medium

Summary: Final Thoughts

American Express continues to show why it stands out in the payments world. Fundamentals are strong with record revenue, steady recurring card fees, and new moves in dining, software, and even crypto rewards. Its premium travel and co-brand partnerships add another layer of resilience. Stress tests confirmed its balance sheet strength, keeping investors confident in the long term.

On the sentiment side, Wall Street is leaning bullish thanks to analyst upgrades, fee-driven revenue, and brand power. Risks remain around valuation, rising credit losses, and potential regulatory changes. Political chatter about competition or fee caps could always spark short term jitters.

Technicals back up the story. Both monthly and weekly charts show bullish signals with Ichimoku strength and RSI still below overbought. The trend points up, though investors should watch resistance levels as the stock keeps climbing.

Overall, American Express stock (AXP) looks solid with long term growth drivers in place. The main watchpoints are consumer credit quality and regulatory developments.

Overall risk: Medium

More By This Author:

Is Zoom Stock Still Worth Buying In 2025? The AI Growth Story Investors Are Missing

PayPal Stock Turnaround Is Gaining Momentum – But One Big Risk Could Undo It

Palantir Stock Growth Looks Unstoppable – But This One Risk Could Change Everything