Something Major Happened In The Markets Yesterday

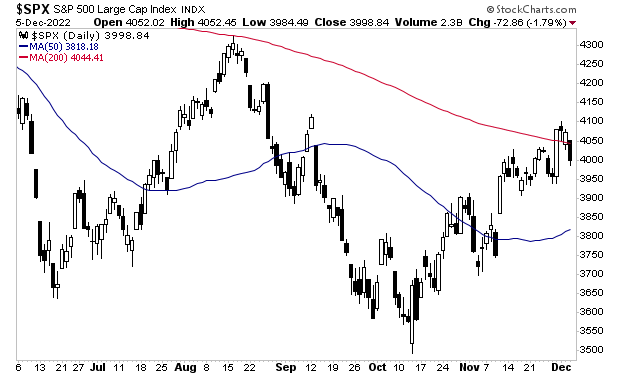

Stocks lost their 200-day moving average (DMA) yesterday.

This is a major development because it indicates that the bulls could not get the S&P 500 to break above its 200-DMA and stay there, despite numerous interventions, manipulations, and performance gaming.

Why does this matter?

The 200-DMA is like a “line in the sand” for long term trends in the market. During bull markets, stocks rarely break below it. And during bear markets, stocks rarely break above it. You can see this relationship clearly in the below chart. The 200-DMA is the red line.

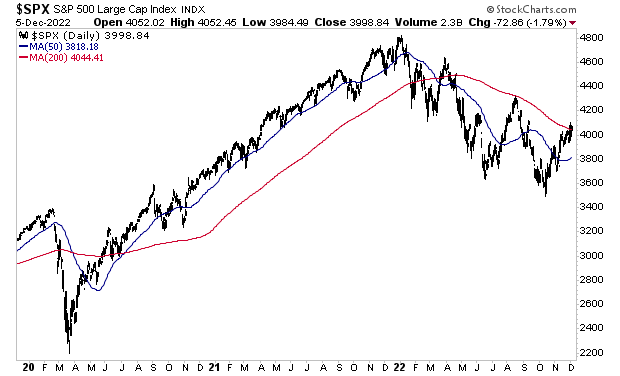

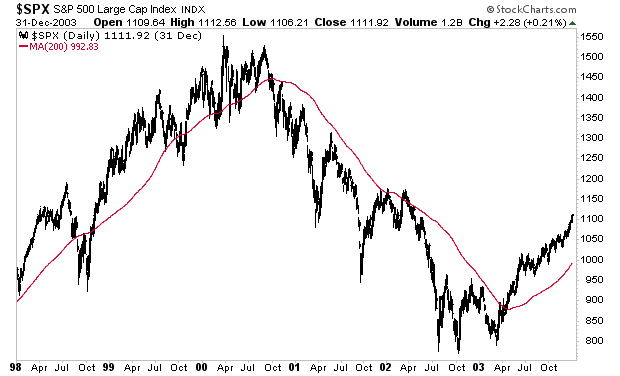

With this latest failure, it’s a clear sign that the bear market is nowhere near over. Take a look at the bear market of 2000-2003 to see what I mean.

Here’s the bear market of 2007-2009.

So again, the bear market is not over. The trend remains down. And it likely won’t end anytime soon (think months, possibly years). Many investors will lose another 50% of their portfoios… if not more as it unfolds.

More By This Author:

This Is Why Stocks Are Holding Up… But Will Soon Crash

This Is Why We Opened Our Crash Trades

Forget Stocks, The Bond Market Is Signaling Something Major