Forget Stocks, The Bond Market Is Signaling Something Major

It’s all trader games today.

The stock market is closed tomorrow for Thanksgiving. It will also close early on Friday, November 25th at 1 PM. As one can imagine, most of Wall Street has already left for the holidays.

This means that trading volume will be extremely light. And that means that those few traders/funds who are active will have an easier time moving the market.

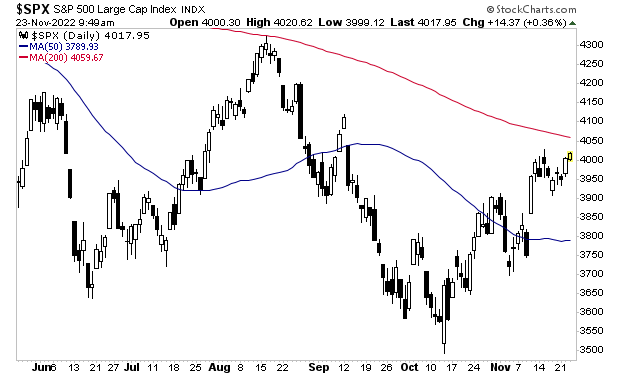

As I write this, the S&P 500 is within spitting distance of its 200-day moving average. There’s little doubt in my mind that stocks will make a run for that line sometime over the holiday.

However, that is a short-term issue. The longer-term issue is that the Treasury market is telling us a severe recession is coming.

The Treasury is comprised of numerous bonds with different maturation periods. They are:

Treasury Bill Maturation Periods:

4 Weeks

13 Weeks

26 Weeks

52 Weeks

Treasury Note Maturation Periods

2 Years

3 Years

5 Years

7 Years

10 Years

Treasury Bond Maturation Periods

20 Years

30 Years

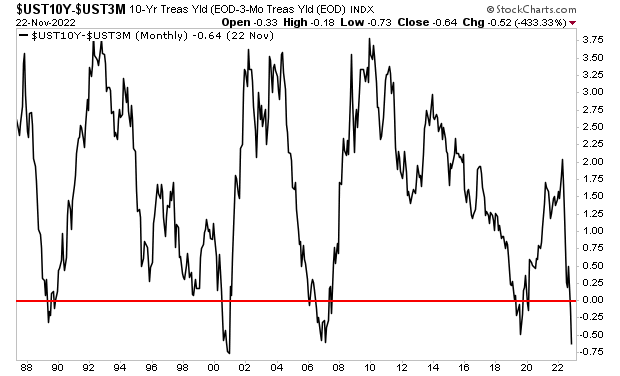

When you plot the yield on all of these bonds, you get the “yield curve”. And the difference in yield between various bonds on this curve is one of the most accurate predictors of a recession.

Specifically, the difference between the yield on the 10-Year U.S. Treasury and the yield on the 3-month U.S. Treasury. Anytime this difference becomes negative (meaning the 3-month yield is actually higher than the 10-year yield) this indicates a recession is about to hit.

I’ve illustrated this in the chart below. Anytime the black line falls below the red line, the 10-year 3-month yield curve is “inverted.” This was the case in 1989, 2001, 2007, and 2019: all of those preceded recessions.

It is happening again now. And as you can see, this metric is MORE negative today than it was before the COVID-19 crash as well as the Great Financial Crisis.

Put simply, the yield curve of the Treasury market is predicting a severe recession in the near future, likely at the start of 2023.

This is going to force stocks to new lows. I’ll explain why in Friday’s article. Until then… know this: it is highly likely that a recession is going to trigger a major crash in stocks. It’s not a question of “if,” it’s a question of “when.”

More By This Author:

The Fed Didn’t Pivot… And It Won’t For MonthsWarning: None Of The “Jobs” Created Last Month Were Real

A Fed Pivot Won’t Fix Anything… Stocks Will Fall Another 30%