This Is Why Stocks Are Holding Up… But Will Soon Crash

Over the last few days, I’ve illustrated how several major indicators are flashing “RECESSION!”

By quick way of review:

- The 10y-3m yield curve has predicted every recession in the last 50 years. It’s telling us that a new, severe recession is just around the corner.

- Oil has collapsed from $130 per barrel to ~$75 per barrel, indicating demand destruction is underway. This only happens during a recession.

All of these data points are BAD news for stocks.

Why?

During the typical recession Earnings Per Share (EPS) decline by 25%.

Based on what bonds are doing, stocks are priced between 16 and 18 times forward EPS. And Wall Street is currently forecasting EPS growth of 5% next year to $230.

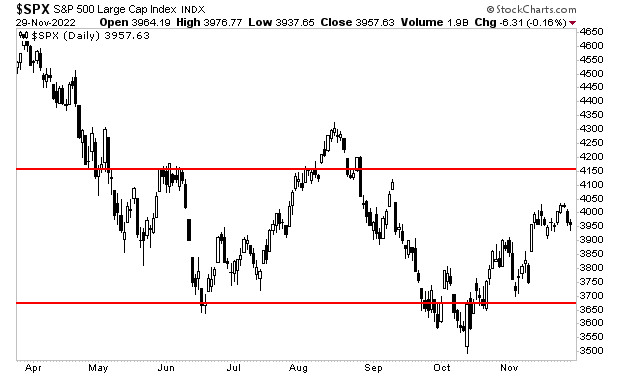

$230 X 16 (or 18)= 3,680 to 4,410.

Incidentally, that is the trading range that stocks have been in for most of the last six months.

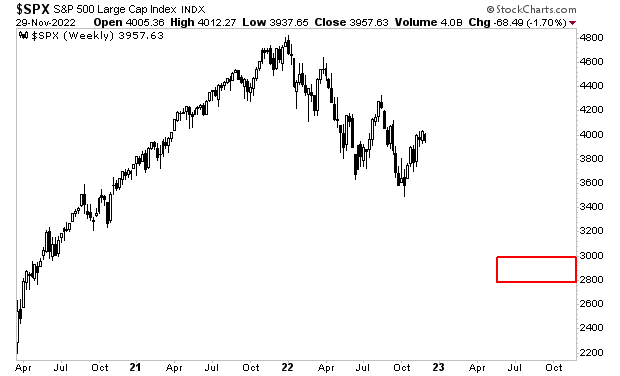

However, a recession would mean that EPS for 2023 is closer to $172.

$172 X 16 (or 18)= 2,752 to 3,096

That’s the red box in the chart below.

Put simply, a recession will erase trillions of dollars in wealth…and Wall Street is once again asleep at the wheel, driving its clients off a cliff.

More By This Author:

This Is Why We Opened Our Crash Trades

Forget Stocks, The Bond Market Is Signaling Something Major

The Fed Didn’t Pivot… And It Won’t For Months