SOBRSafe: A Disruptive Stock Worth The Risk

Photo by Scott Graham on Unsplash

A couple of months ago (Sept. 20, to be precise), the NTSB recommended passive alcohol detection for all new vehicles. If you googled "passive alcohol detection" at that time, the top result -- actually the only result -- was a company called SOBRsafe, trading as SOBR on the Nasdaq.

Anyone who's read me before probably knows I am no kind of risk-taker, but I'm really interested in disruptive technology. So, when I took a fast look at SOBR's chart and saw a lot of volatility, I put it on my pile of things to research further. I set my goal to revisit after Q3 earnings. But then two things happened that moved up my timeline. The first was the opportunity to interview SOBRsafe's CEO, David Gandini. And the second was author MN Gordon's reminder of the spirit of Hunter S Thompson about finding fun in risk.

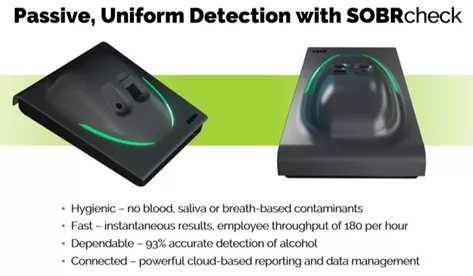

So first, a quick overview of SOBRsafe’s "unique selling proposition" - how its passive alcohol detection works. Like me, you may have thought of those relatively new devices that stop a car from starting if you blow into a tube interface and it shows the presence of alcohol. Those are called interlock devices, and they are not passive - the driver has to do something, i.e. blow. There are also devices called passive for police to use on the side of the road - passive for the driver in that the police can just hold them close to the suspected inebriated person, but still require an operator to engage them.

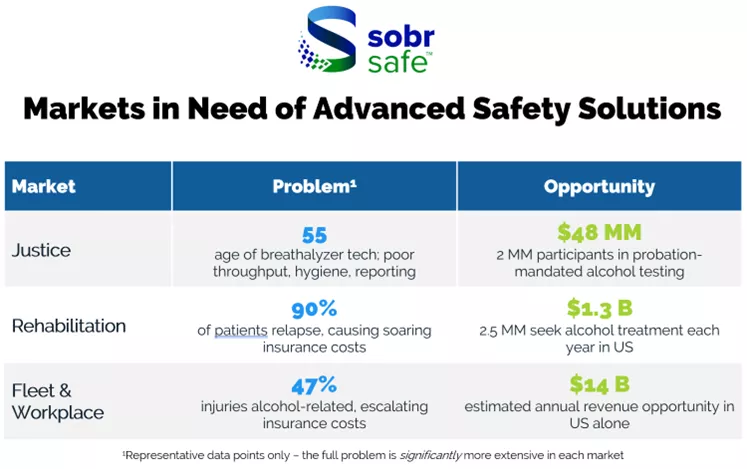

SOBRsafe is actually a SaaS solution, and as such initially, it's aimed more at fleets of vehicles and other industrial contexts than at individuals. A touchpad provided through its supplier to client subscribers can provide identification and alcohol detection simply by requiring touch at the entry to a workplace, commercial garage, etc. The software can then be used by the subscribing company to make sure an employee who has alcohol in their system is not in a position to endanger anyone, including themselves.

Other large categories of potential users are institutional and judicial, probation agencies, and work release programs. Subscription pricing is per individual, typically $30 per person; each device costs $500. One SOBRcheck device can handle biometric information for up to 1,000 people.

Also in development are wearables, called SOBRsure, which could interface with GPS, vehicle telematics, and/or tracking. One of the company's mantras is "We are creating a culture of prevention and support."

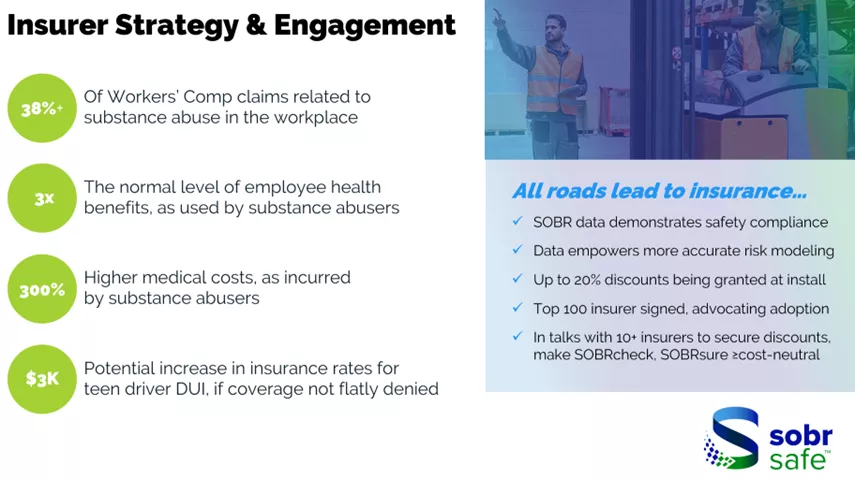

The company is also beginning to make inroads with insurance companies - something that is appealing to corporate clients. CEO Dave Gandini stated that, "With inflation, supply chain and personnel costs on the rise, helping customers materially reduce overhead is a significant selling point. Each of our early customers is getting a 10-20% discount on their insurance premiums, as our technology has been acknowledged as a safety solution by multiple insurers. One of our immediate goals is to build out our Sales team so that we can ultimately embed our solutions into standard commercial insurance policies."

As we all know, goals take money. Gandini gave me an overview of what their public stock charts show, how they got here and what the near future holds.

"We developed our transdermal (touch-based) technology from 2020 to 2021. When we assumed control of the company it was on the Pink Sheets, and we quickly upgraded to the OTC QB. We raised approximately $8 million prior to 2022, and in May we completed a $10 million uplist to Nasdaq Capital Markets. We subsequently closed on a $6 million follow-on Offering and are now fully capitalized into 2024. We initiated commercial sales in June and now have six customers and nine distributors, the latter bringing to SOBRsafe 29 sales professionals, over 525 potential customers, and a combined 126 years in business.”

When the May IPO was lowered from $15M to $10M and raised a bit less, the company slowed its roll just a bit to adjust, delaying some hiring of sales staff. In August, OHSA gave SOBRsafe its award for New Product of the Year in the Safety Monitoring Devices category. And then, in September, the NTSB announcement happened and "brought great visibility," in Gandini's words.

This is when the volatility you see on the SOBR chart begins. It had just done a 3-for-1 reverse split to move up to Nasdaq. In less than three months the stock has been bouncing between just under $1 and just under $4.This seems to have primarily reflected early investors and warrant holders cashing out, which angel investors in startup tech tend to do. The company was looking to do a second rise sometime this year to make up the shortfall in the first raise, but to capitalize on the increased market interest it raised $6M via a PIPE in late September. In November it received the Child Safety Network Safe Family Seal of Approval, which recommends SOBRsafe for school bus safety.

In the latest Cash on Hand statement, SOBR "announced that its cash on hand as of October 25, 2022, has now exceeded $10 million, through a combination of existing reserves, it's recent $6 million financing, and over $3 million in proceeds from warrants exercised. SOBRsafe's public float as of October 14, 2022 (the most current reporting date) was approximately 7 million shares."

The latest quarterly report, for Q3 2022, was filed on Nov. 14; see the whole 49-page 10-K here.

Rather than regurgitate more numbers and more research, I suggest that you read a recent article from one of my fellow contributors at TalkMarkets, Shareholders Unite, here. They do such a thorough job I don't feel a need to duplicate them.

Look, as SOBRsafe says in their Safe Harbor statement, "Our prospects here at SOBRsafe are subject to uncertainties and risks." And there are a lot of warrants eligible for sale right away that might make this feel a bit riskier than most. On the other hand, they have some disruptive technology, enough cash to carry them for a year or two, and even the moral high ground if you like feeling good about the products you invest in.

The frequent updates - new hires, new distributors, new clients, new developments - give you that ground-floor feeling, like you're in on the beginning of something.

My two cents: If something is cheap enough, and interesting enough, and has some concrete indications of holding higher prices - and you are clear-eyed about it - 'risk' is not intrinsically bad. As Hunter S. Thompson said, "Buy the ticket, take the ride."

Related Article:

SOBRSafe: A Very Favorable Risk/Reward Play

More By This Author:

Making A Splash: Small Portfolio Company With Big Potential

Gain Therapeutics: Reasons For Optimism

Why Protalix Is Back On The Radar

Disclosure: This article is part of TM's' “UnderCovered” series of exclusive articles featuring companies with limited coverage. Authors are compensated by TalkMarkets ...

more

Sounds good.

Thanks for sharing. $SOBR sounds very intriguing.