SNAP Craters 25% After Reporting Weakest-Ever Growth, Removes Q3 Guidance, Drags Down All "Socials"

Image Source: Unsplash

For the third quarter in the past four, SNAP stock has cratered after reporting catastrophic earnings.

Having plunged three months ago after slashing already dismal guidance, SNAP stock tumbled a whopping 25% moments ago when we learned that not only had it not cut enough, and reported revenue that missed, but was also the lowest growth on record.

Here is how the company did in yet another catastrophic quarter:

- Revenue $1.11 billion, missing the estimate $1.14 billion, and growing just +13% y/y, the lowest on record.

- Adjusted loss per share 2.0c vs. EPS 10c y/y, estimate loss/shr 4.6c

- Adjusted Ebitda $7.19 million, -94% y/y, estimate loss $1.24 million

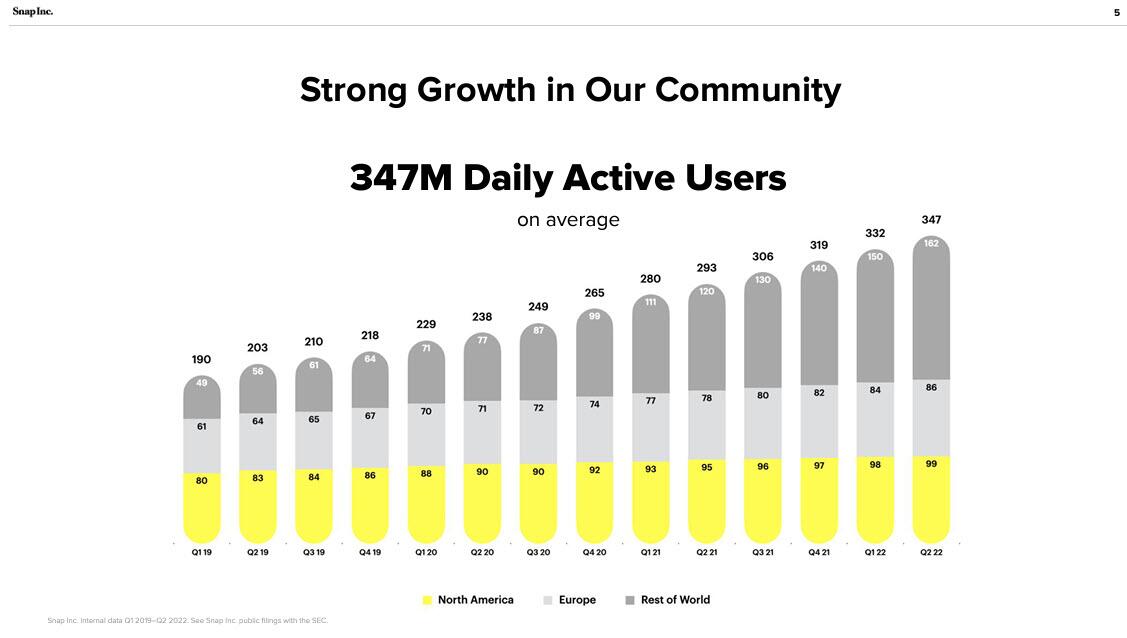

- There was some good news in the daily active users which at 347 million, actually beat estimates of 343.2 million

- North America daily active users 99 million, +4.2% y/y, estimate 99.1 million

- Europe daily active users 86 million, +10% y/y, estimate 85 million

- Rest of world daily active users 162 million, +35% y/y, estimate 157.9 million

Tragically, in a time when tech companies are firing everyone, SNAP still has the same colorblind in house graphic designer.

Of course, with more users than expected and less revenue, it meant just one thing: the monetization disappointed and sure enough, ARPU of $3.20, not only was lower vs 2021, down 4.5% y/y, but missed estimates of $3.37

- North America average revenue per user $7.93, +7.6% y/y, estimate $8.16

- Europe average revenue per user $1.98, +1.5% y/y, estimate $2.11

- Rest of world average revenue per user 96c, -10% y/y, estimate $1.05

And yes, unlike Tesla, SNAP did not have any bitcoin to sell: Negative free cash flow $147.5 million, +27% y/y, estimate negative $52.3 million.

The commentary was also ungood: "We are also seeing increasing competition for advertising dollars that are now growing more slowly. Our revenue growth has substantially slowed", to wit:

From 2018 — our first full year as a public company — through the end of 2021, our revenue grew at an average compound annual rate of more than 50%. The rapid growth of our top line has been fueled by our fast-growing community, deep engagement with our platform, and a robust advertising business that has driven measurable returns for our advertising partners. However, over the past year, a series of significant headwinds have emerged that have disrupted this momentum.

Platform policy changes have upended more than a decade of advertising industry standards, and macroeconomic challenges have disrupted many of the industry segments that have been most critical to the growing demand for our advertising solutions. We are also seeing increasing competition for advertising dollars that are now growing more slowly. Our revenue growth has substantially slowed, and we are evolving our business and strategy to adapt. We are working to reaccelerate growth and take share, but we believe it will likely take some time before we see significant improvements.

Translation: advertisers finally figured out that 12-year-olds don't have credit cards.

So yes, earnings were terrible, but it's what the company said elsewhere that was even worse, starting with the decision not to provide any Q3 financial guidance whatsoever, and only tentatively predicting 360 million in DAUs, but with the Twitter-Musk fiasco in the background, we all know these are all just fake bots and what not.

Worse, the company said that "thus far in Q3, revenue is approximately flat on a year-over-year basis", which means that "growth" is about to go into reverse... which is not a good thing for a "growth" company.

And now that SNAP is a "value" company, it means it's time for "streamlining" - sure enough, SNAP said it would slow the rate of hiring and rate of operating expense growth.

SNAP also announced that co-founders Bobby Murphy and Evan Spiegel signed new long-term employment pacts through at least Jan. 1, 2027, for $1 per year and no equity compensation. The Board agreed to stock split in form of a dividend of one Class A share for each outstanding Class A share if the Class A share price reaches $40 within the next 10 years; would allow co-founders to donate or sell additional Class A shares instead of donating or selling Class B or Class C shares

And most remarkably, even though the company authorized a new $500 million stock repurchase program over the next 12 months to offset a portion of dilution related to the issuance of restricted stock units to employees, the stock still cratered over 25% after hours following these absolutely catastrophic numbers.

(Click on image to enlarge)

The results were so horrific they dragged down all social peers: Facebook META -2.3% and Pinterest PINS -3.1%, and Twitter TWTR, which is mired in a legal battle with Elon Musk, is down 1.7% (ahead of its results tomorrow). Even Google, which also derives revenue from online advertising, is down 1.8%.

And cure the return of the "recession is coming" panic which stocks so gingerly managed to tapdance around for the past three days...

More By This Author:

The Number Of Americans Filing For First-Time Unemployment Claims Soared To 8-Month-Highs Last Week

Tesla Pumps And Dumps After Earnings Beat; Sells 75% Of All Bitcoins

China Spent 72% More On Russian Oil In June As Moscow Remains Top Chinese Supplier; Saudi Volumes Tumble

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more