Should Investors Buy Delta Air Lines Stock After Mixed Q3 Results?

Image: Bigstock

Delta Air Lines (DAL - Free Report) gave a glimpse at how the large domestic airliners have been faring after reporting third quarter results on Thursday, with United Airlines (UAL - Free Report) and American Airlines (AAL - Free Report) set to release their Q3 reports in the coming weeks.

Although Delta’s Q3 financial metrics were mixed, the company’s valuation and post-pandemic recovery have still been enticing.

Delta’s Q3 Results

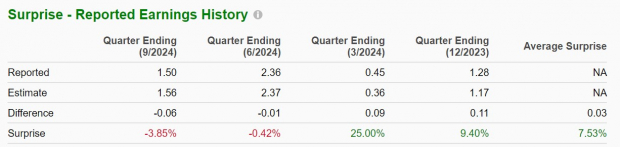

Delta posted Q3 EPS of $1.50 on operating income of $971 million, which decreased 26% from $2.03 per share in the prior year quarter on earnings of $1.31 billion. This also missed Q3 EPS estimates of $1.56 by -4%.

Notably, the year-over-year decline in Delta’s bottom line was attributed to a global technology outage earlier in the quarter after a malfunction in a software update by security vendor CrowdStrike (CRWD - Free Report) led to thousands of flight cancellations.

Still, Delta’s Q3 sales of $15.67 billion beat expectations of $15.37 billion by 2%, and Delta was up 1% from a year ago despite incurring a $500 million loss from the faulty software update.

Image Source: Zacks Investment Research

Tracking Delta’s Outlook

Optimistically, Delta expects improved trends to continue in regards to post-pandemic travel demand, stating bookings for the Q4 holiday season are strong. Delta anticipates record Q4 revenue of $14.5-$14.8 billion, which came in above the current Zacks Consensus of $14.52 billion, or 2% growth.

Delta’s full-year revenue projections for fiscal 2024 call for 2%-4% growth, which fell in line with Zacks estimates of 3% growth, or $59.85 billion in sales. Based on Zacks estimates, Delta’s total sales are forecasted to rise another 5% in FY25 to $62.91 billion.

Image Source: Zacks Investment Research

Fourth quarter EPS projections of $1.60-$1.85 also came in range with the Zacks Consensus of $1.82 per share, which would be a 42% increase from $1.28 a share in Q4 2023.

Delta now expects full-year FY24 EPS of $6.00-$7.00 compared to previous guidance of over $7 a share, although this lines up with estimates of $6.17 per share, a decline of -1% from 2023.

That said, FY25 EPS is projected to rebound and soar 17% to $7.26 based on Zacks estimates.

Image Source: Zacks Investment Research

Delta's Stock Performance & Valuation

Trading at around $50 in recent days, Delta’s stock has moved up +25% in 2024. Also, shares were virtually flat during Friday's trading session. Year-to-date, the stock has trailed United Airlines' gains of +47%, but it has slightly edged over the benchmark S&P 500’s performance and American Airlines' +15%.

Image Source: Zacks Investment Research

Most intriguing is that Delta stock still has been trading at just 8.1X forward earnings and at a steep discount to the benchmark’s 24.5X. Delta’s stock has also been trading beneath its Zacks Transportation-Airline Industry average of 10.1X forward earnings, with American Airlines at 9.6X and United Airlines at 6.1X.

Image Source: Zacks Investment Research

Bottom Line

Delta’s stock currently maintains a Zacks Rank #3 (Hold) rating. While Delta’s Q3 results weren’t overwhelming, the company’s outlook remains attractive. Futhermrore, holding the stock may certainly be rewarding given Delta's upbeat guidance for the upcoming holiday season.

More By This Author:

Bear Of The Day: Altice USAShould Investors Buy JPMorgan Stock Ahead Of Q3 Earnings?

Top Analyst Reports For Meta Platforms, Cisco & Philip Morris

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more