Should Investors Buy JPMorgan Stock Ahead Of Q3 Earnings?

Image Source: Unsplash

JPMorgan Chase (JPM - Free Report) will kickstart third-quarter results from big banks this week as investors look for insight into the effect rate cuts will have on the broader banking industry.

To that point, banks can experience benefits and drawbacks from interest rate cuts with loan demands likely to rise although profit margins might decrease.

That said, let’s see if it’s time to buy JPMorgan’s stock ahead of its Q3 earnings report on Friday.

JPM Q3 Expectations

Based on Zacks estimates, JPMorgan’s Q3 sales are expected to be up 3% to $41.01 billion. However, Q3 earnings are thought to have decreased 7% to $4.02 per share versus EPS of $4.33 in the prior-year quarter.

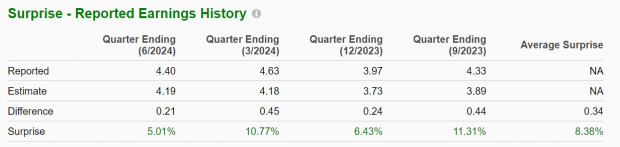

Notably, JPMorgan has surpassed the Zacks EPS Consensus for eight consecutive quarters posting an average earnings surprise of 8.38% in its last four quarterly reports.

Image Source: Zacks Investment Research

JPM’s Earnings Estimate Outlook

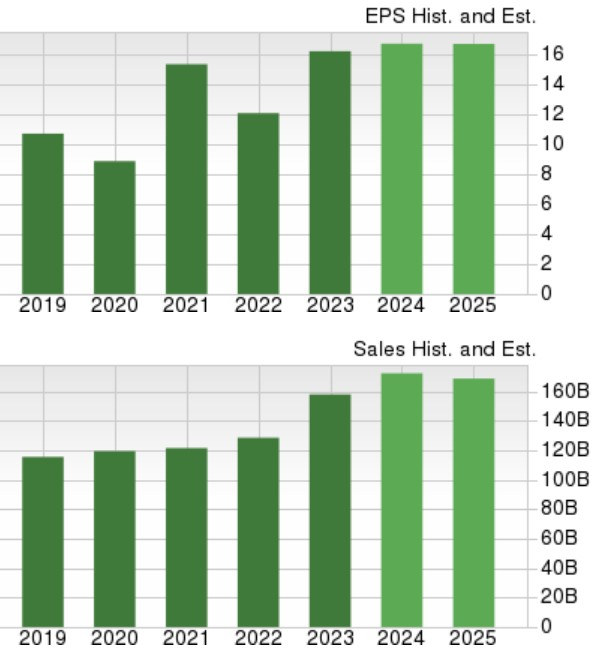

Looking forward, JPMorgan’s top line is now projected to expand 9% in fiscal 2024 to $172.47 billion although FY25 sales are expected to dip -2%.

On the bottom line, 3% EPS growth is expected in FY24 with annual earnings forecasted to be virtually flat next year at $16.72 per share.

Image Source: Zacks Investment Research

JPM’s Stock Performance & Valuation

Attributed to its strong market position and financial performance, JPMorgan’s stock has risen over +20% year to date which has edged the benchmark S&P 500 and big bank peers Bank of America (BAC - Free Report), Citigroup (C - Free Report), and Wells Fargo (WFC - Free Report).

Image Source: Zacks Investment Research

Despite soaring over +100% in the last two years, JPM still trades at 12.6X forward earnings and roughly on par with Bank of America, and their Zacks Banks-Major Regional Industry average. JPM does trade at a slight earnings premium to Wells Fargo and Citigroup but is at a significant discount to the benchmark’s 24.1X forward P/E multiple.

Image Source: Zacks Investment Research

Bottom Line

Ahead of its Q3 report, JPMorgan’s stock lands a Zacks Rank #3 (Hold). While it will be important to monitor JPMorgan’s profit margins amid a deflationary environment, holding on to JPM at current levels could certainly be rewarding.

Furthermore, there could be more upside in JPM if the banking giant can reach or exceed Q3 expectations and quite any probability fears while giving a positive outlook especially as it pertains to higher loan volumes.

More By This Author:

Top Analyst Reports For Meta Platforms, Cisco & Philip MorrisBlackRock Stock Drops Despite Market Gains: Important Facts to Note

Garmin Gains But Lags Market: What You Should Know

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more