‘September Effect’ Explained: Why It’s A Tough Month For Stock Markets

Image Source: Unsplash

- CME Group data from last year says the S&P 500 has lost ground in 55% of Septembers over the last century.

- The index has dropped for the last four years, according to Deutsche Bank.

- The phenomenon is not restricted to the US alone but a trend that has affected stock markets worldwide.

As September rolls in, investors are bracing for what is often considered the most challenging month for stock markets.

Historically, September has earned a reputation for weak stock market performance, a phenomenon known as the “September Effect.”

Despite anticipation and speculation surrounding the Federal Reserve’s possible rate cuts and concerns about a potential recession, historical data suggests that September is frequently a tough period for global stock markets.

What is the September Effect?

The “September Effect” refers to the tendency for stock markets, particularly the S&P 500, to underperform during September.

Data from 1928 to 2023 shows that the S&P 500 has typically experienced a decline in this month.

According to CME Group, the S&P 500 has lost ground in 55% of Septembers over the last century, making it the only month with an average negative return of -0.78%.

September has also seen some of the most significant market declines, such as the 29.6% drop in 1931 during the Great Depression.

Although September is not the worst-performing month every year, it has been particularly challenging in recent years, with the S&P 500 dropping for the past four consecutive Septembers.

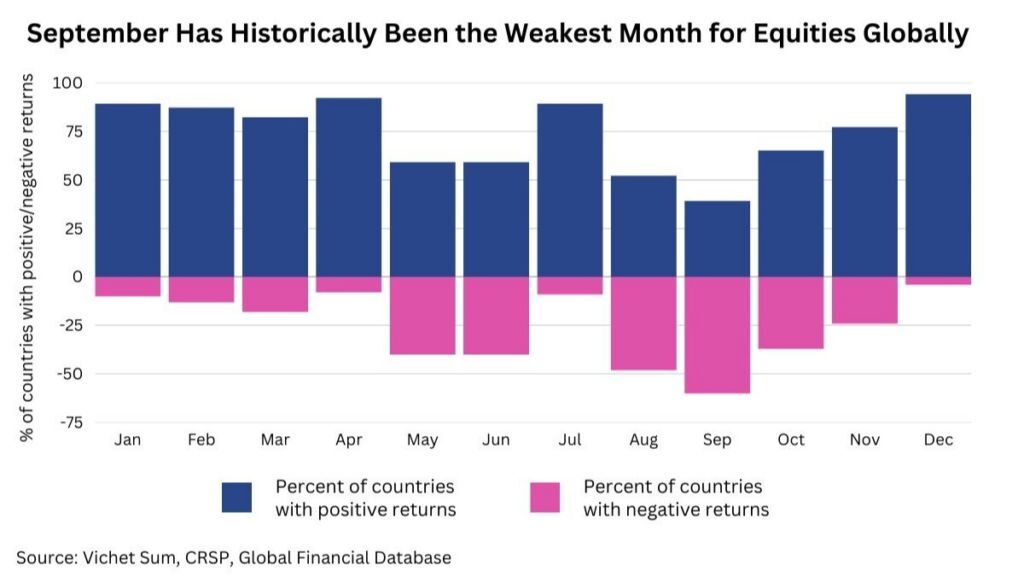

Notably, this trend is not limited to the US; it affects global markets as well.

What explains the September effect?

Several theories attempt to explain the September Effect, but none provide a definitive answer.

Tom Stevenson, Investment Director at Fidelity International, suggests that investors returning from summer vacations in August often reassess their portfolios, leading to the sale of underperforming stocks.

This “new school year” mentality could contribute to September’s weak performance.

Another theory posits that large mutual funds engage in “window dressing” ahead of their fiscal year-end, typically at the end of September.

Additionally, some believe that individual investors liquidate stocks to cover back-to-school expenses.

Market psychology also plays a role, as investors anticipate the September Effect, creating a self-fulfilling prophecy of negative sentiment.

Source: Summit Financial Solutions

Steve James, Managing Director of Summit Financial Solutions, points out that September usually marks the beginning of the US election cycle, prompting investors to reposition their portfolios in anticipation of potential political shifts.

This is particularly relevant this year, with the US presidential elections approaching in November.

Market triggers for this September and future outlook

This September, investors are closely watching the Federal Reserve’s policy meeting on September 18, with expectations that the Fed may cut interest rates, a move typically favorable for markets.

However, LPL Financial’s Adam Turnquist cautions that the upcoming August jobs report, due on September 6, could influence the Fed’s decision.

A weaker-than-expected labor report might prompt the Fed to pursue deeper rate cuts, signaling a weakening economy.

“If economic data improves next week, the ‘soft landing’ narrative could gain momentum, potentially breaking the losing streak we’ve seen in September,” Turnquist told Markets Insider.

However, he also warned that downside risk remains likely.

Should investors fear the ‘September effect’?

While seasonal anomaly has been observed over decades, it doesn’t necessarily mean that investors should fear September.

According to Fisher Investments,

“The belief in calendar-based stock strategies like the “September Effect,” “Sell in May,” or the “Santa Claus Rally” assumes that past performance can predict future returns. This assumption is flawed—the stock market efficiently incorporates widely known information, and seasonal trends cannot predict future market movements reliably. If a calendar-based forecasting tool has predictive power, efficient markets have already considered it, sapping any potential advantage.”

However, if one wishes to let conventional wisdom guide market moves, analysts say investors generally turn to dividend-yielding stocks in times of expected volatility and uncertainty.

Experts also suggested buying the seasonal dips to gain during the season.

More By This Author:

US Stocks Plunge As Tech Shares, Including Nvidia And AMD, Decline Amid Economic ConcernsJP Morgan Stock: Fortress Balance Sheet, One Way To Bet On The USA

Apple Stock Price Analysis: Can Its Valuation Be Justified?

Disclosure: Invezz is a place where people can find reliable, unbiased information about finance, trading, and investing – but we do not offer financial advice and users should always ...

more