Sentiment Slouches

The S&P 500 has firmly turned lower in the past few days and is nearing the lows from last Wednesday. In spite of that turn lower, bullish sentiment was unchanged at 24.1% per the latest AAII sentiment survey. Although less than a quarter of respondents reported as bullish, that reading is only in the middle of the past year’s range of readings as bullish sentiment has consistently been hard to come by.

With no change to bullish sentiment, all of the moves occurred for neutral and bearish sentiment. Neutral sentiment has declined for three weeks in a row, coming in at a six-week low of 31% this week.

All of those declines to neutral sentiment were picked up by bears as that reading rose 6.4 percentage points to 44.9%. That is the highest reading since the end of March and right in line with the average reading of bearish sentiment since the beginning of 2022.

With bearish sentiment moving higher, the bull-bear spread moved more firmly into negative territory. This week, bears outnumbered bulls by 20.8 percentage points; the widest spread in five weeks. That indicates the predominant share of respondents continue to expect the S&P 500 to head lower over the next six months.

That negative outlook by individual investors is nothing new. Following the record streak of 44 straight weeks of a negative bull-bear spread that ended in February, the spread has resumed another lengthy streak of negative readings. This week marked the eleventh straight negative reading in the bull-bear spread. Even in the more recent context of the aforementioned record streak and another double-digit streak in the first quarter of last year, the AAII survey has seldom seen bears outnumber bulls on such a consistent basis.

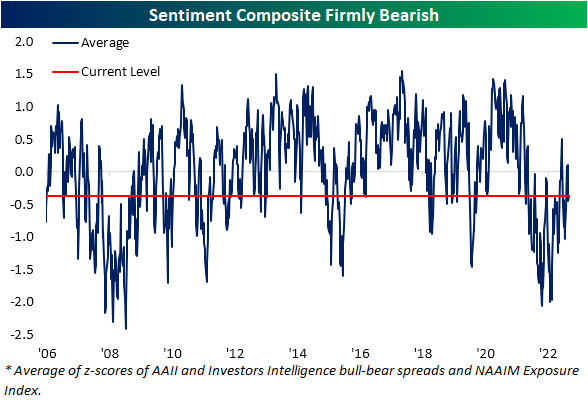

Factoring in other sentiment surveys like those from Investors Intelligence and NAAIM reaffirms the bearish tones of sentiment. With all three surveys combined, our sentiment composite remains firmly negative meaning sentiment is more bearish than average. We would also note that due to the timing of the collection of these surveys, they would have mostly missed any reaction to the FOMC’s rate decision and market response yesterday. As such, next week’s surveys will be the first to fully reflect the latest 25 bps hike and subsequent market declines.

More By This Author:

“Big” Winners

“Facebook” Becomes “Meta” Becomes “Efficiency AI”

10 Weeks Of Bearish Sentiment

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more