“Big” Winners

Whenever you see a list of best-performing stocks, it’s inevitably loaded with many small stocks that most investors have never heard of. This year, though, it’s practically been the opposite trend as the two top-performing stocks in the S&P 500 on a YTD basis – Meta Platforms META (+96%) and Nvidia NVDA (+88%) – are not only household names, but they also have market caps of more than $500 billion. We’d also note that both stocks are more than 30 percentage points ahead of the next closest stocks in terms of top YTD returns!

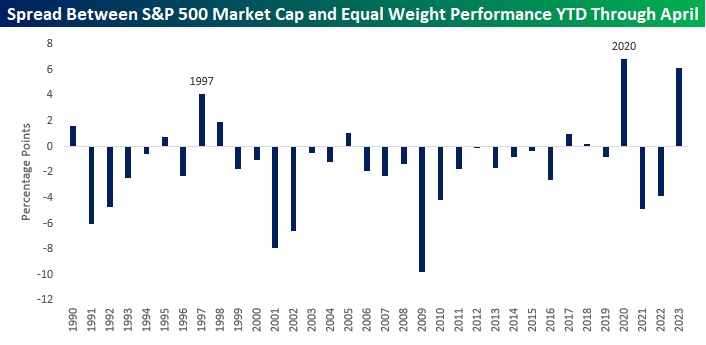

With such strong returns among the largest stocks in the S&P 500, the YTD performance spread between the market-cap-weighted S&P 500 and its equal-weighted counterpart is among the widest ever seen on a YTD basis through the end of April. Through Friday afternoon, the market-cap-weighted S&P 500 was up 8.26% YTD, while the equal-weighted index was up just 2.13%. At 6.14 percentage points, the YTD performance gap between the two indices is the second widest since 1990, trailing only the 6.8% percentage point gap in 2020.Besides 2020, the only other year where the gap was wider than two percentage points was in 1997. While it’s a small sample size and history doesn’t always repeat itself, we’d note that the S&P 500’s rest-of-year performance was a gain of over 20% in both of those years. Just saying.

Besides the two other years where the performance gap was significantly wide like this year, what stands out about the chart below is how common it has historically been for the market cap-weighted index to underperform the equal weight index in the first four months of the year. Including this year, the cap-weighted index has only outperformed nine times in the last 34 years.

More By This Author:

“Facebook” Becomes “Meta” Becomes “Efficiency AI”

10 Weeks Of Bearish Sentiment

Some Improvement In Claims

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more