Sentiment: Back To The 20s

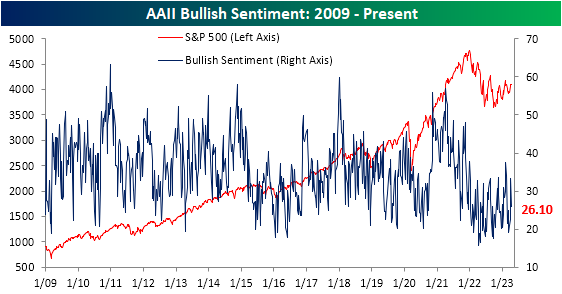

Whereas last week saw a huge rebound in bullish sentiment after the S&P 500’s breakout above March highs, the more listless price action of the past week resulted in a modest turnaround in sentiment. The latest AAII sentiment survey showed only 26.1% of respondents reported as bullish compared to the recent high of 33.3% last week. The 7.2 percentage point decline was the largest one-week drop in bulls since the last week of February when it declined by 12.5 percentage points. That leaves bullish sentiment right in the middle of the range since the start of 2022.

Although bullish sentiment fell, without any considerable push lower for the S&P 500, bearish sentiment went little changed falling just half of one percentage point down to 34.5%. Like last week, that remains the lowest reading since the week of February 16th.

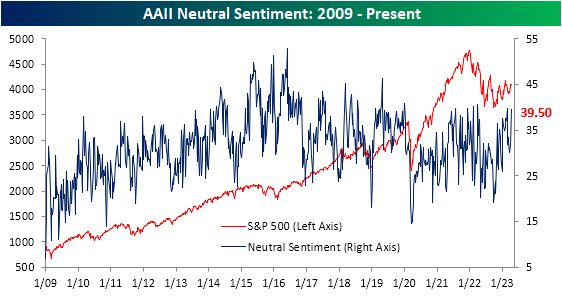

That means that all of the declines in bullish and bearish sentiment flowed to the neutral camp with a surge of 7.9 percentage points; the largest one-week increase since the first week of the year. At 39.5%, neutral sentiment is at the high end of the past few years’ range and only 0.3 percentage points below the late February high.

The AAII survey was not the only sentiment reading to take a more bearish tone this week. The NAAIM Exposure Index’s latest release today showed investment managers reduced equity exposure. Meanwhile, the Investors Intelligence survey’s bull-bear spread has actually continued to rise resulting in the highest reading since the first week of 2022. Additionally, as we noted in Monday’s Chart of the Day, the TD Ameritrade Investor Movement Index went unchanged in March after rebounding in the proceeding few months. In other words, across multiple readings, sentiment has improved but has yet to definitively shift to bullish.

More By This Author:

Claims Resume Their Trend Higher

10-Year 10-Baggers

Industry Performance And CPI

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more