Selloff Accelerates After Consumer Sentiment Drops Near Record Lows

Image Source: Pexels

The selloff in stocks accelerated this morning after UMich reported that consumer sentiment plunged to a 41-month low, nearing its worst level ever. Prior to the 10:00 AM print, risk-off winds dominated Wall Street as participants remained worried about decelerating employment conditions, lofty valuations, margin compression and reports of cost cutting on earnings calls amidst political gridlock in Washington. Indeed, the record-long government shutdown is the primary factor worsening household confidence, which is limiting personal pocketbooks at a time when price pressures and softening labor demand are weighing on consumption prospects. The news is generating jitters related to the health of the cycle. Investors are responding by scooping up safe-haven assets, including Treasuries across the curve, shares in the defensive staples and utilities sectors, gold and silver futures and volatility protection instruments in case turbulence intensifies. Forecast contracts as well as energy commodities and equities are catching bids, too. Conversely, traders are reducing bitcoin and greenback exposure. A lack of speculative enthusiasm is dinging interest for the former while cheaper domestic borrowing costs, narrowing rate differentials and weaker growth expectations are motivating selling of the latter.

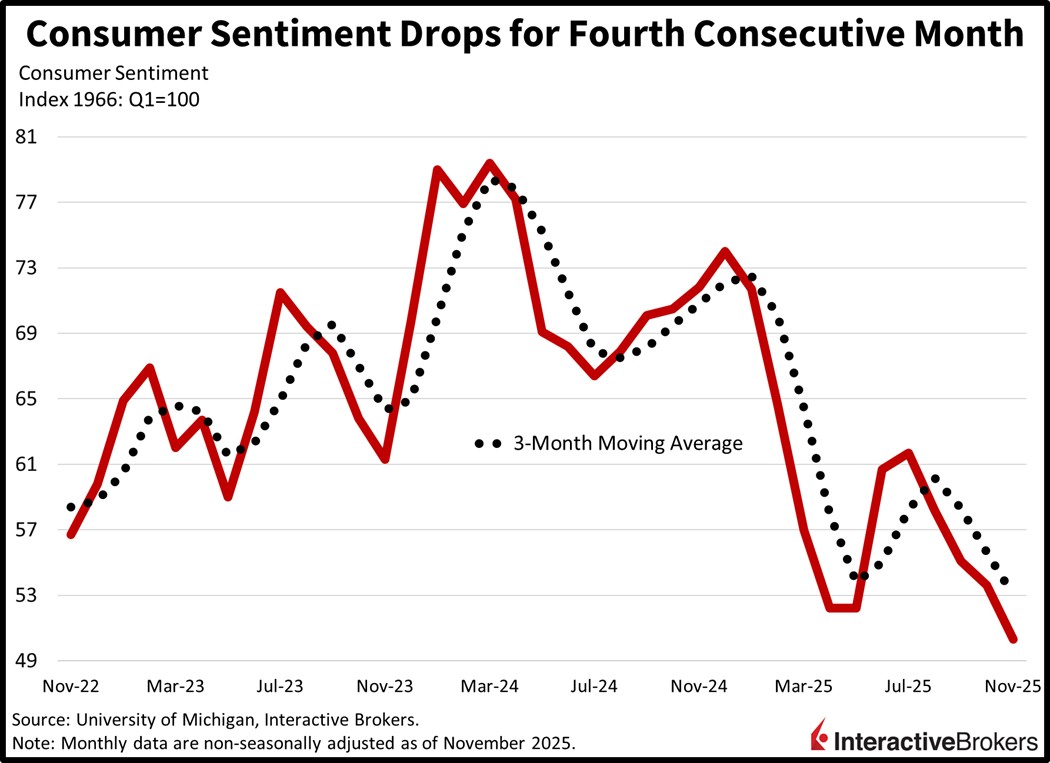

Consumer Sentiment Drops for Fourth Consecutive Months

Consumer Sentiment fell to its lowest level since June 2022 this month, with folks believing that the extended government shutdown could worsen economic prospects. Additionally, households reported deteriorating personal finances, as the headline November figure of 50.3 marked the fourth consecutive decline. The result missed the median estimate of 53.2 and was beneath October’s 53.6. Indices for current conditions and expectations dropped from 58.6 and 50.3 to 52.3 and 49. Some individuals expressed enthusiasm about the stock market, but that paled in comparison to the heightened concerns described amongst survey respondents.

The Reopening of Washington Could Reverse Market Decline

Pressure to strike a deal in Washington is mounting ahead of the pivotal holiday shopping season while turbulent markets and packed airports are frustrating the constituency. Indeed, the augmented standoff is weighing on earnings expectations, which is a problem for sustaining pricey equity valuations. Furthermore, the lack of revenues for individuals and firms dependent on the public sector via jobs, financial assistance, contracts and purchases is threatening to hamper the pace of economic growth and limit corporate profitability. However, seasonals are positive on Wall Street and investors are poised to rejoice in response to favorable news related to Capitol Hill, employment conditions, or another AI announcement. With the S&P 500 down just 4% from its record peak, a reopening of the government by next Friday the 14th, which had a possibility as high as 67% according to our predictive market this morning, could push the index back toward 7k.

International Roundup

China’s Exports Decline

China’s exports declined in October for the first time since April 2024 with shipments to the US descending for the seventh-consecutive month. Orders fulfilled for foreign customers sank 1.1% year over year (y/y), missing the economist consensus estimate for a 3% hike and weakening significantly from the 8.3% expansion in the preceding month. Even as China’s economic woes persisted last month, imports expanded 1%, but it was a deceleration from 7.4% in September and it missed the 3.2% estimate. Meanwhile, the country’s trade surplus fell from $90.4 billion in September to $90 billion. Non-US demand for Chinese products, however, was strong, climbing 3.1% y/y, but the gain didn’t offset the 25% contraction in orders sent to the world’s largest economy. Overcapacity of Chinese factories, furthermore, contributed to price declines. For example, the volume of cars shipped to other countries increased at a faster pace than the value of the products.

China recently announced it will suspend retaliatory tariffs of 15% on certain US farm goods, although it will keep a 13% tariff on soybeans. Separately, it will maintain a 10% tariff it introduced following President Trump’s “Liberation Day” announcement of taxes on imports. The US, for its part, reduced a fentanyl tariff by 10% that was intended to encourage China to crackdown on the production of ingredients used to illegally manufacturer the drug.

Canada’s Labor Market Strengthens

Canada’s unemployment rate unexpectedly fell last month while wage growth and payroll expansion surpassed estimates. Economists anticipated that the unemployment rate would be unchanged from September’s 7.1% print, but it improved to 6.9%. At the same time, the number of working individuals jumped by 66.6k, considerably strong than 60.4k in September and the economist consensus estimate for a 5k decline. The total payroll expansion, however, was driven by the addition of 85.1k part-timers with the number of full-time workers slipping by 18.5k after a 106.1k September expansion. The participation rate, or the portion of working-age individuals seeking work or working, ticked up modestly, increasing from 65.2% to 65.3%. Hourly wages, meanwhile, were 4% higher than in the year-ago period compared to the 3.6% y/y jump in the preceding month.

More By This Author:

Weak Challenger And Revelio Data Pour Cold Water On ADP’s Strength

ADP And ISM Signal Economic Acceleration, Reigniting Animal Spirits

Tech Shares Rally On Amazon, OpenAI, But Participation Is Narrow

Disclosure: The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the ...

more