ADP And ISM Signal Economic Acceleration, Reigniting Animal Spirits

Image Source: Pexels

Hotter-than-expected economic figures signaling cyclical momentum are countering valuation concerns that pushed stocks lower in the past several days. Indeed, equities are advancing strongly this session, even as interest rates rise in response to firmer growth projections and data that are quelling slowdown fears. More specifically, ADP reported the fastest pace of private sector hiring in three months, which eased worries about potential labor market deterioration. Additionally, ISM-services beat expectations, a result of robust consumer spending that is improving businesses’ pricing power amidst accelerating inflation as detailed in the same print. Buoyant activity that is strengthening price pressures, furthermore, is sending the yield curve north in bear-steepening fashion led by duration, while the odds of a December Fed rate cut are drifting further south and are at 62%. Anticipation of the awaited economic updates that have been reduced in frequency by the extended government shutdown are also supporting the greenback’s climb. Risk assets are rallying, too, with broad participation across most equity sectors and commodities, excluding the defensive categories in stocks as well as real estate shares and lumber, which are suffering because of pricier mortgages, which correlate with rising long-end borrowing expenses. Volatility protection instruments are being neglected due to the recovery in investor sentiment and lessening hedging demand. Meanwhile, returning animal spirits are propelling bitcoin after the cryptocurrency sank below the pivotal 100k level for the first time since June. Forecast contracts reached another year-to-date volume peak of 12.68 million yesterday and are catching heavy bids again today after successfully predicting commanding victories by Democrats in the three major elections as well as the passage of California’s Proposition 50.

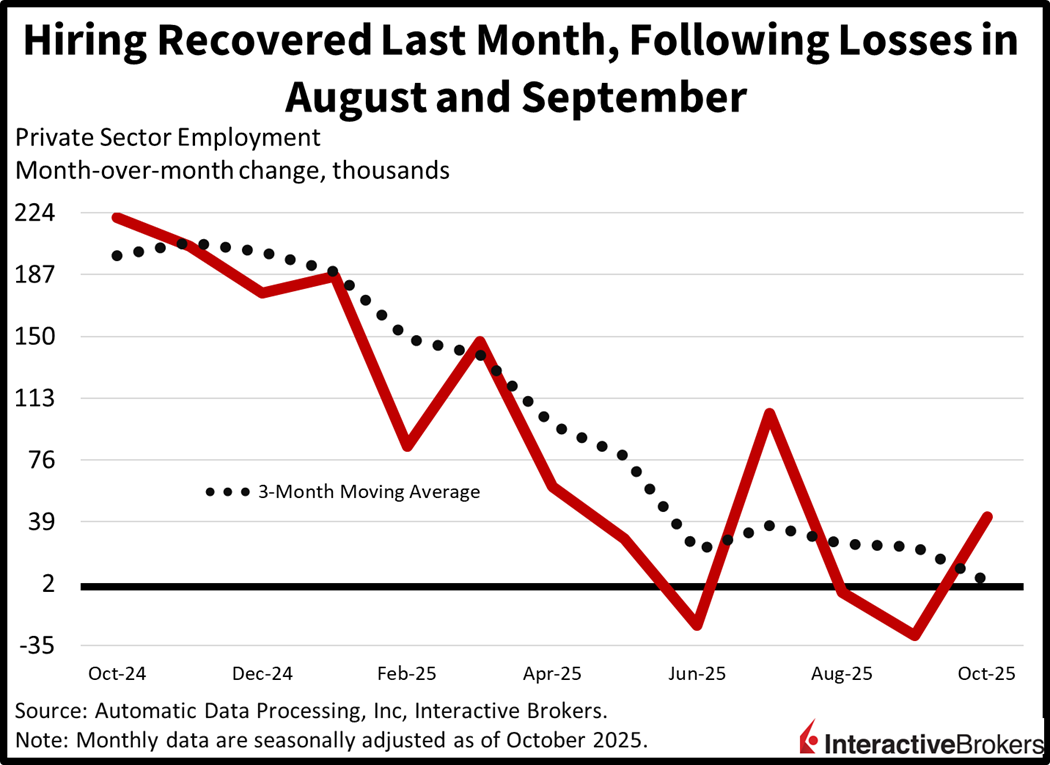

Employers Roll Out the Welcome Mat

The US private sector added jobs for the first time in three months in October, although the pace of expansion remains well below the momentum experienced earlier this year, according to payroll firm ADP. Immigration restrictiveness, AI adoption and hiring caution in the rate sensitive real estate, goods producing and small business categories are hampering labor conditions. Still, the 42k headline gain beat the projected 25k and recovered from September’s loss of 29k. The following categories and the amount of their staffing changes expanded payrolls:

- Trade/transportation/utilities, 47k

- Education/health services, 25k

- Financial activities, 11k

- Natural resources/mining, 7k

- Construction, 5k

Sectors with contracting headcounts and the scope of the changes included the following:

- Information, 17k,

- Professional/business services, 15k

- Other services, 14k

- Leisure/hospitality, 5k

- Manufacturing, 3k

Establishments with 499 employees or fewer reduced headcounts by 32k, but larger firms countered the weakness, boosting rosters by 74k. Compensation trends were steady, however, as the median year-over-year (y/y) pay hikes remained at 6.7% and 4.5% for job stayers and changers, respectively.

ISM Services Gauge Surpasses Expectations

The Institute for Supply Management (ISM) also posted a beat, as accelerating consumer demand bolstered pricing power amongst businesses. The headline reading of 52.4 for the Services Purchasing Managers’ Index (PMI) flew past estimates of 50.8 and improved from September’s 50 print, which is the contraction-expansion threshold. New orders and prices climbed from 50.4 and 69.4 to 56.2 and 70, as heavy transaction volumes supported loftier costs. But the employment score signaled that firms continue shedding headcounts and stands in contrast to ADP, even as the 48.4 result rose from the prior period’s 47.2.

IBKR Predictive Market Cuts Through Election Noise

As voters flocked to the polls in the New York City mayoral race yesterday, election commentators began to opine alongside anecdotal evidence that former governor Andrew Cuomo’s chances of a surprise victory over frontrunner Zohran Mamdani were improving, a result of a strong early turnout by elderly democrats that tend to have a much more moderate profile. The IBKR ForecastTrader prediction market, however, continued to show that Mamdani, a democratic socialist, was strongly favored to win, with his chances dropping to a low of 87% yesterday. The results, along with the accurate ForecastTrader predictions of gubernatorial victories in New Jersey and Virginia by Democrats Mikie Sherrill and Abigall Spanberger illustrate how the IBKR ForecastTrader platform can be a powerful tool for assessing election outcomes. As of yesterday, ForecastTrader had placed 82% and 97% chances that Sherrill and Spanberger would succeed, alongside a 98% chance that Proposition 50 would pass in California.

The power of the IBKR ForecastTrader as a predictive market isn’t limited to elections. Since the platform’s launch in August 2024, it has frequently priced the possibilities of outcomes of economic data, capital market performance, fiscal policy decisions, Federal Reserve actions and environmental developments accurately.

International Roundup

China’s Services Sector Growth Slows

China’s services industry expanded during October at the slowest pace in three months with the sector’s RatingDog China PMI from S&P Global slipping from 52.9 in September to 52.6 but narrowly surpassing the economist consensus estimate of 52.5. While new business grew, the uptick was limited to the domestic market. Export sales, staffing levels and gate prices all descended. Services providers also faced the fastest rate of input inflation in a year with wage pressures and raw materials accounting for much of the trend. Unfilled backorders, meanwhile, declined despite the higher flow of new business with services providers’ efficiency improving. Looking ahead, business confidence was still positive despite declining slightly with some managers expressing concerns about global trade.

Wholesale Prices Fall Again in Europe

Euro area wholesale prices dropped 0.1% month over month (m/m) in September, a slower pace than the 0.4% drop in the preceding month, according to the Producer Price Index. Economists anticipated no change.

Relative to September 2025, the gauge was down 0.2%, which matched the economist consensus estimate and moderated from the 0.6% descent in August. Energy costs fell 0.2% while capital goods were unchanged. Durable consumer and non-durable consumer goods were 0.3% and 0.1% more expensive.

Hong Kong Business Activity Grows for Third Month

Hong Kong’s overall private sector activity moved further above the S&P Global PMI contraction-expansion threshold of 50 with the gauge climbing from 50.4 in September to 51.2 last month. It was the third-consecutive monthly improvement in business conditions. October featured the steepest climb in output and new business in the past 12 months. In response, businesses added employees and increased their purchasing volumes. Input cost increases eased, but firms passed the higher costs onto customers. Local Asian markets supported the increased demand with orders from Mainland China growing for the first time in a year. Conversely, businesses had a downbeat view of conditions during the coming year, primarily a result of US import taxes and the shift toward online consumption. Nevertheless, sentiment is still better than it has been for most of 2025.

More By This Author:

Tech Shares Rally On Amazon, OpenAI, But Participation Is NarrowStocks Post An Outstanding October

Buy Rumor, Sell News, Buy Dip

Disclosure: Digital Assets

Trading in digital assets, including cryptocurrencies, is especially risky and is only for individuals with a high risk tolerance and the financial ability to ...

more