Seadrill Kicks The Can Down The Road

Highly-indebted Seadrill (SDRL) has been skating on thin ice ever since oil prices diverged to the downside nearly three years ago. Earlier this month it finally succumbed to its $10 billion debt load, announcing a comprehensive restructuring plan:

Seadrill Limited (“Seadrill” or the “Company”) has entered into a restructuring agreement with more than 97 percent of its secured bank lenders, approximately 40 percent of its bondholders and a consortium of investors led by its largest shareholder, Hemen Holding Ltd.

The agreement delivers $1.06 billion of new capital comprised of $860 million of secured notes and $200 million of equity. The Company’s secured lending banks have agreed to defer maturities of all secured credit facilities, totaling $5.7 billion, by approximately five years with no amortization payments until 2020 and significant covenant relief. Additionally, assuming unsecured creditors support the plan, the Company’s $2.3 billion of unsecured bonds and other unsecured claims will be converted into approximately 15% of the post-restructured equity with participation rights in both the new secured notes and equity, and holders of Seadrill common stock will receive approximately 2% of the post-restructured equity.

The company believes the plan is a comprehensive solution to Seadrill’s liabilities and debts. However, I believe Seadrill is simply kicking the can down the road.

Seadrill's Debt/EBITDA Would Still Be At Junk Levels

The company believes the agreed upon plan addresses Seadrill’s liabilities, including funded debt and other obligations. I beg to differ. The current plan entails $1.06 billion of fresh capital, but only $200 million of new equity. The additional $860 million would comprise new debt that would not come due until later. An additional $2.3 billion of debt would be swapped into equity.

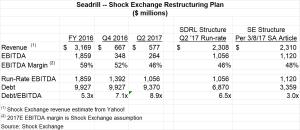

The following chart illustrates the $2.5 billion reduction in debt (debt swap and equity infusion), which brings total debt to 6.5x run-rate EBITDA (Q2 2017 results annualized).

Seadrill’s debt/EBITDA has been at junk levels since year-end 2016. Debt/EBITDA was 5.3x at year-end 2016. Debt/run-rate EBITDA at Q2 2017 had deteriorated to 8.9x. The current structure would reduce the metric to 6.5x – still junk levels. In my opinion, the optimal structure would be one that would provide the company with sufficient working capital and bring debt/EBITDA down to investment grade levels.

A March 8, 2017 article highlighted how a $6.6 billion debt for equity

I estimate a debt-for-equity swap of $6.57 billion could relieve Seadrill’s liquidity strain and help rightsize its capital structure. Its debt of $3.36 billion would be less than Transocean’s (RIG) Q4 2016 debt of $8.26 billion. Its 2017E 3.0x debt/EBITDA multiple would be less than Transocean’s which is now around 3.9x EBITDA.

With a $6.6 billion debt-for-equity (or some other type of equity infusion) Seadrill’s debt/EBITDA would have declined to 3.0x. It would have also given the company breathing room to maintain its investment grade rating even if its EBITDA continued to slide amid a slump in deepwater E&P.

Seadrill Might Have To Return To The Trough

In my opinion, Seadrill’s current capital structure appears to be a stopgap measure. It pushes some of its debt obligations out into the future and provides some amount of debt reduction. However, debt/run-rate EBITDA of 6.5x would be higher than it was at year-end 2016 (5.3x). Secondly, it likely does not give the company much breathing room if its EBITDA continues to slide. Any hiccups in its operations or if the deepwater E&P continues to slump and Seadrill’s credit metrics could deteriorate further into junk territory.

That is a long-winded way of saying the company might have to return to the trough for more money. I believe management has better negotiating power now than it would at a later date. It would behoove the company to negotiate a deal that could keep the company out of bankruptcy. Having to re-negotiate with creditors at a later date could create an additional distraction for management and negative sentiment for all stakeholders involved.

These oil companies and oil equipment companies need to come to an end in order for a proper correction in the oil arena. The fact they keep on going and keep on overproducing at losses is a insult to capitalism and is a product of an overly insulated banking system that feels that it can loan until it gets so bad taxpayers end up footing the bill. Sadly, the way Washington works, they may be right.

Well said. Oil companies are in hoc to banks by the hundreds of billions. If banks take a loss then it's an act of treason. The banks have to be propped up so the oil companies also have to be propped up.