Sea Limited: Obliterating Expectations And Cheaply Valued

Image Source: Pixabay

Sea Limited (NYSE: SE) delivered an excellent quarter in Q4, surpassing expectations by a wide margin and making money in e-commerce for the first time. Management is doing an excellent job of cutting expenses across the board and making the business profitable at an unprecedented speed.

The gaming division is still showing weakness, and we don't have much visibility regarding the future balance between growth and profitability that management intends to maintain in the future, so the numbers could remain uncertain in 2023. Needless to say, the macro outlook is increasingly challenging on a global scale, and Sea Limited will not be immune.

Nevertheless, it was an extraordinary quarter for Sea Limited, and achieving profitability at the whole company level provides a major validation for the investment thesis in the company.

A High-Speed Transformation

Sea Limited is a three-headed monster with operations in gaming, e-commerce, and fintech. Over the past several years the company has been highly profitable in gaming, and management allocated the cash flows from the gaming business to building growth opportunities in e-commerce and fintech.

But gaming has been declining since the post-covid reopening, and this was a problem for Sea Limited because fintech and e-commerce were still burning cash. With the stock price under heavy selling pressure, management promised to obtain operational profitability in e-commerce for 2023.

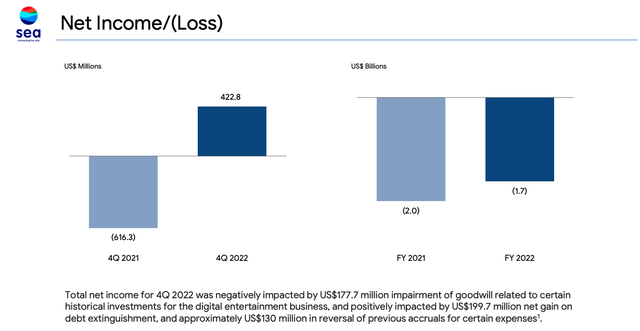

The big news is that Sea Limited delivered GAAP profitability in Q4 of 2022, not only in e-commerce alone but also at the whole company level. Management delivered sooner than expected and to a higher degree than anticipated by the market.

The company is cutting expenses and boosting margins at an amazing speed, and it is also using cash to repurchase debt at attractive prices. The balance sheet is quite healthy, especially if Sea Limited can sustain positive cash flows in 2023 and beyond.

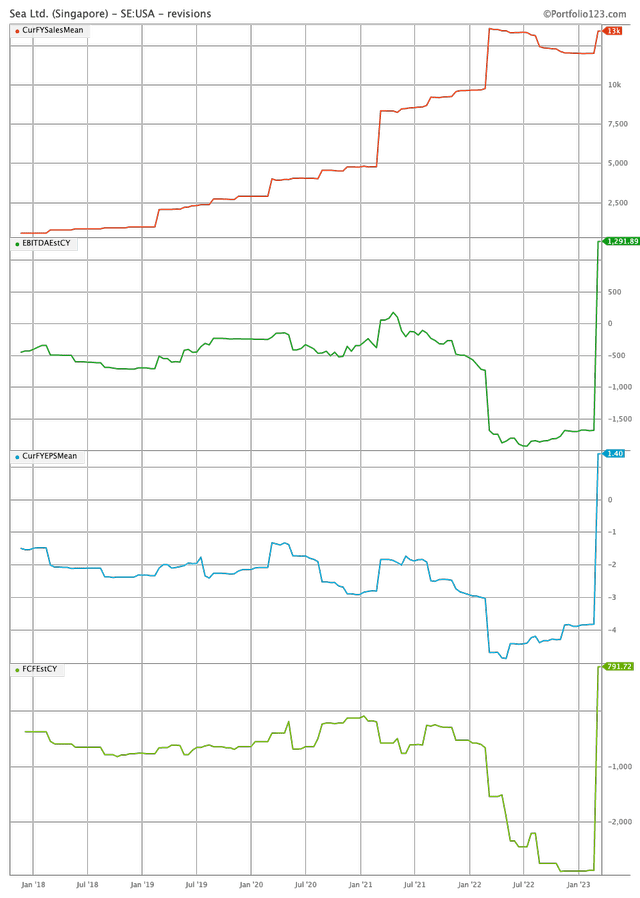

In the chart below we can see Wall Street estimates for Sea Limited's revenue, EBITDA, earnings per share, and free cash flow in 2023. There is a massive increase in earnings and cash flow estimates, which is clearly reflecting that Sea Limited delivered an expectation-breaking quarter on the positive side.

Portfolio123

The Numbers

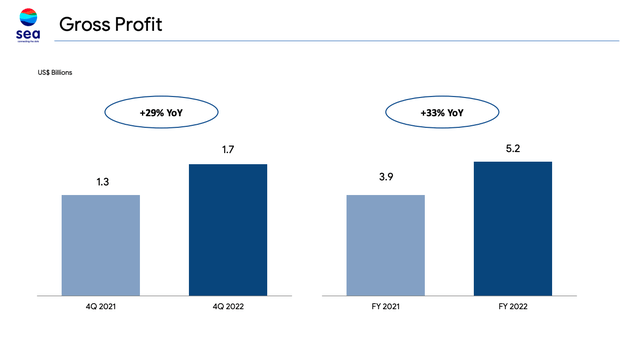

Total revenue growth was only 7% year over year, which is above market expectations but still quite modest for Sea Limited. On the other hand, gross profit increased by a much stronger 29% year over year. Sales growth is underwhelming, but gross profit growth is exponentially better.

Sea Limited

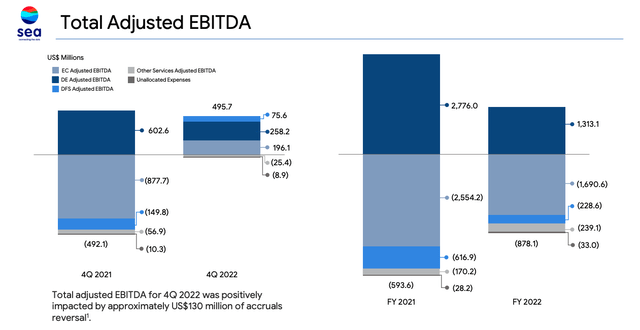

Not only did the company deliver positive numbers on an Adjusted EBITDA basis, but also at the Net Income level, which includes all kinds of expenses both cash and non-cash.

Sea Limited

Sea Limited

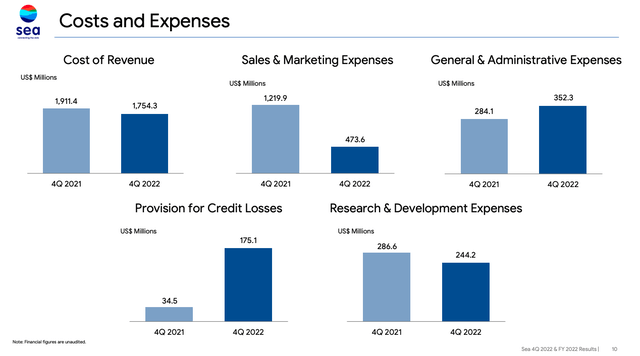

The big driver behind such a strong expansion in margins is cost-cutting across all areas, this was exceptionally notable in sales and marketing expenses, declining by more than 60% year over year.

Sea Limited

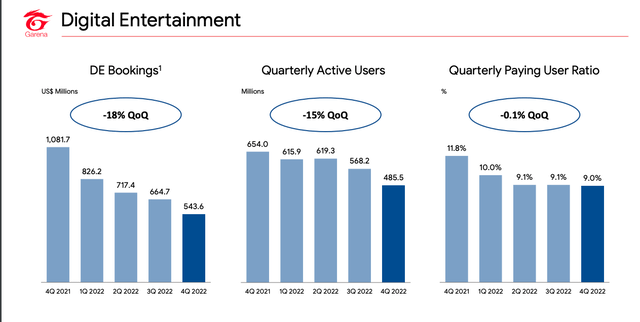

Looking at the different business segments, gaming is still declining and this is the main negative in the report. Adjusted EBITDA in this segment was $258 million, so profitability is still strong, but users and bookings keep moving in the wrong direction.

Sea Limited

The reopening and the economic environment are hurting the gaming industry on a global scale. Garena's Free Fire is a massively popular game, but the industry is always dynamic and competitive, and it won't be easy to deliver new titles that are big enough to have a considerable financial impact.

With Sea Limited being focused on profitability, management's new approach to game development and publishing is "doing less but doing it better". The company does not comment much on new launches, so we will have to wait and see how this segment evolves over time.

Sea Limited

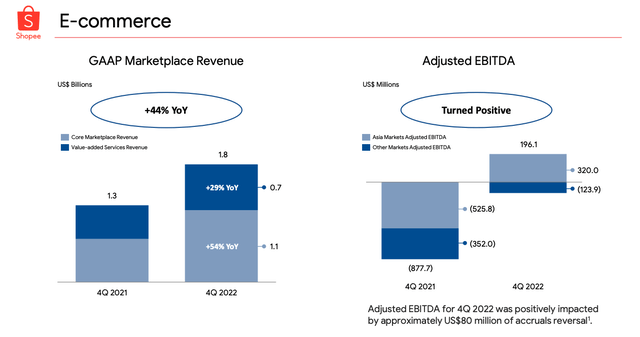

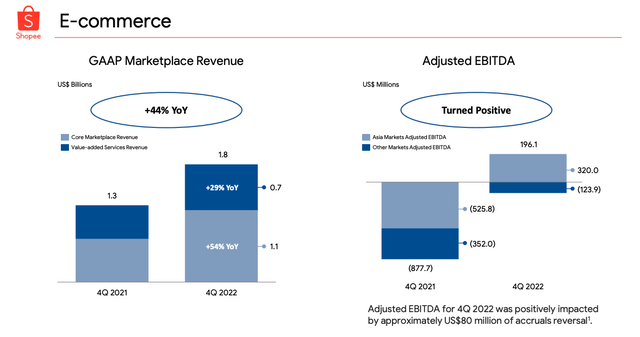

The biggest positive in the report is the spectacular improvement in e-commerce. Gross Merchandise Value was down 1% in local currency and up by a modest 8% in constant currency. On the other hand, marketplace revenue jumped by a healthy 44% driven by increases in both advertising and transaction-based fees.

The e-commerce segment reached profitability for the first time in Asia, as the company registered an adjusted EBITDA of $320 million. By comparison, the prior quarter showed a negative EBITDA of $217 million.

In other markets, management said that the adjusted EBITDA loss was reduced by more than 50% year over year. In Brazil, the contribution margin loss per order decreased by 54% from the previous quarter.

Sea Limited

Sea Limited will not be reporting GMV on a quarterly basis anymore. Competitors do not disclose such information, so the company could argue competitive strategy reasons behind this decision. However, it makes a lot of sense to expect GMV to remain weak as Sea Limited is focusing more on value-added revenue and profitability.

From the conference call:

The macro environment remains uncertain, and there are still headwinds on consumption in our markets. With our recent pivot, we are showing a positive bottom-line for the first time. As such, our focus this year will be to continue to solidify the efficiency gains and optimize the cost structure across our markets. In our Asia markets, we will work to further strengthen our leading position and profitability. In Brazil, we will focus on driving the business towards profitability to capture the significant opportunity in this new market. GMV will largely remain an output for us in the near term.

The fintech business is firing on all cylinders, with revenue growing at full speed and the segment generating profitability at an early stage. Revenue reached $380 million during the quarter, growing 92% year-on-year.

Adjusted EBITDA also turned positive for the first time at $76 million in the period. Management attributed these improvements to "both strong topline growth and optimization of sales and marketing spend".

The company explained the key synergies between fintech and e-commerce across the integrated ecosystem.

Our SeaMoney business is a highly synergistic part of our digital ecosystem. For example, our mobile wallet has resulted in lower transaction costs and a more seamless transaction experience on Shopee. Shopee in turn has allowed the mobile wallet to grow its user base and build user habits more efficiently.

With Shopee, our credit business is able to leverage a large captive user base, a highly relevant use case with significant scale, and a wealth of user insights for more effective underwriting.

At the same time, Shopee benefits as consumers enjoy more flexible payment options, access to credit, and greater affordability. We expect our digital insurance, wealth management and bank businesses to enjoy similar synergies with our e-commerce platform to serve the large, underserved communities in our markets.

We see SeaMoney as an important long-term growth engine for us. We will continue to prioritize the ecosystem strategy in pursuing this significant opportunity with efficiency and profitability.

Valuation And Timing

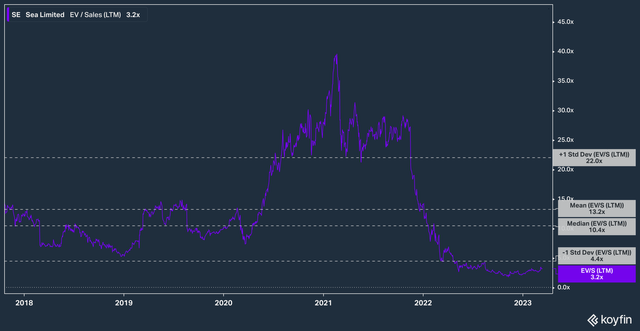

In terms of EV to Revenue, Sea Limited is still close to the low end of the valuation range over the company's history. The mean value is 13.2 and the median value is 10.4 times the revenue. The stock is currently quite cheap at 3.2 times forward revenue.

Koyfin

Sea Limited stock surged almost 20% after earnings, and then it pulled back in a highly convoluted market environment. In the short term, the stock price has been making a series of higher highs and higher lows, so the price action remains positive as long as this trend remains in place.

TradingView (TradingView)

The Bottom Line

It was an outstanding quarter for Sea Limited, with the company delivering on its promise to achieve profitability sooner than expected. The weakness in gaming is worth noting, but the massive improvements in e-commerce and fintech override the negative data from gaming.

It will be important to monitor Sea Limited's competitive position going forward, as cutting marketing investments can always be risky. However, most competitors are weaker than Sea Limited both financially and strategically speaking. Besides, the company can always accelerate spending again from a much stronger financial position when economic conditions improve.

None of this means that the path going forward is going to be easy for Sea Limited. We still don't know what kind of impact the company will suffer on revenue growth in this increasingly challenging economy. Management explicitly said that they plan to be flexible when managing the growth versus profitability trade-off, so I expect both financial performance and the stock price to remain volatile in the next few quarters.

That being acknowledged, Sea Limited is the leading player in e-commerce, fintech, and gaming in Southeast Asia. This market offers tremendous opportunities for growth, with favorable demographics and superior economic fundamentals versus other regions of the world.

Now that the company is proving that to investors that it can be profitable, the investment thesis in Sea Limited looks stronger than ever.

More By This Author:

Airbnb Down On Great Earnings: Buying Opportunity

Nvidia: Strong Fundamentals And Reasonable Valuation

CrowdStrike By The Numbers: Profitability, Growth, And Valuation

Disclosure: I/we have a beneficial long position in the shares of SE either through stock ownership, options, or other derivatives.

Disclaimer: I wrote this article myself, and it ...

more