CrowdStrike By The Numbers: Profitability, Growth, And Valuation

From a quantitative and data-driven perspective, CrowdStrike Holdings, Inc. (Nasdaq: CRWD) is a very clear case. The company's fundamental performance is truly outstanding, with vigorous sales growth, elevated profitability, and earnings exceeding expectations by a large margin. CrowdStrike is also a cash-generating machine. In terms of financial performance, CrowdStrike is impeccable.

The main negative is valuation. I don't think the stock is overvalued, but the price tag is demanding and it does not leave any room for error. CrowdStrike is an excellent business for the long term, and it is priced as such.

Excellent Fundamentals

Before going into the numbers, it makes sense to consider a key qualitative insight that explains why CrowdStrike is materially different from traditional cybersecurity stocks in terms of the quality of the business model.

Before artificial intelligence ("AI"), a cybersecurity company used to be the victim of its own success. If you were a traditional cybersecurity company before AI, then you built the product "by hand" and you were very successful, so you became the dominant cybersecurity solution.

After that, bad actors would focus on building the tools and strategies to vulnerate that particular solution that everyone was using, so you started being breached and you lost customers to younger and more up-to-date cybersecurity competitors.

CrowdStrike, on the other hand, is cloud-native and driven by Artificial Intelligence. When one customer is attacked, the company can learn from this attack and build better solutions for all of its customers right away.

Scale and data are crucial sources of competitive advantage for CrowdStrike, allowing the company to permanently learn and innovate. CrowdStrike gets more effective and competitively stronger as it gets bigger over time.

This business model is clearly superior to the old model for cybersecurity companies, and it has allowed CrowdStrike to thrive and outperform the competition over time.

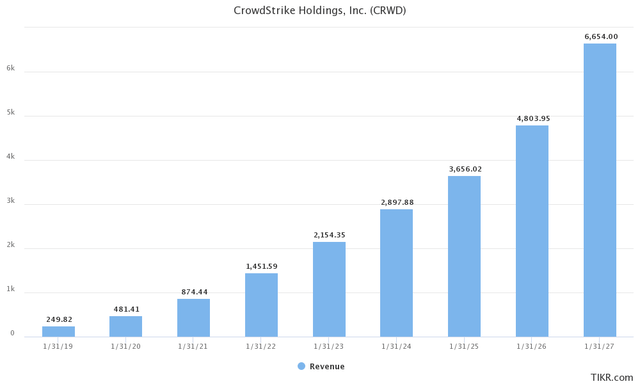

Revenue growth has been truly amazing over the past several years. The table below shows actual reported numbers in combination with future sales estimates to provide a more complete picture of the trend.

CrowdStrike was making $250 million in sales during fiscal 2019. Then we get to $1.4 billion in fiscal 2022, and Wall Street is expecting $6.6 billion in 2027.

(Click on image to enlarge)

TIKR

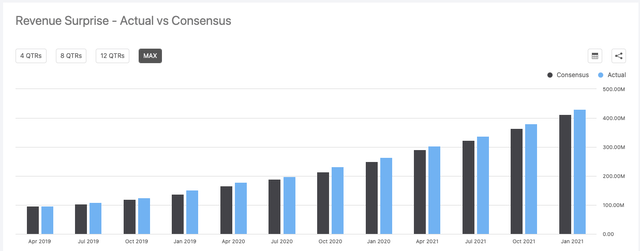

It is not easy to find companies that can produce this kind of growth on such a large scale. The numbers are impressive on their own merits, and CrowdStrike has outperformed revenue expectations in every quarter since becoming a public business.

(Click on image to enlarge)

Seeking Alpha

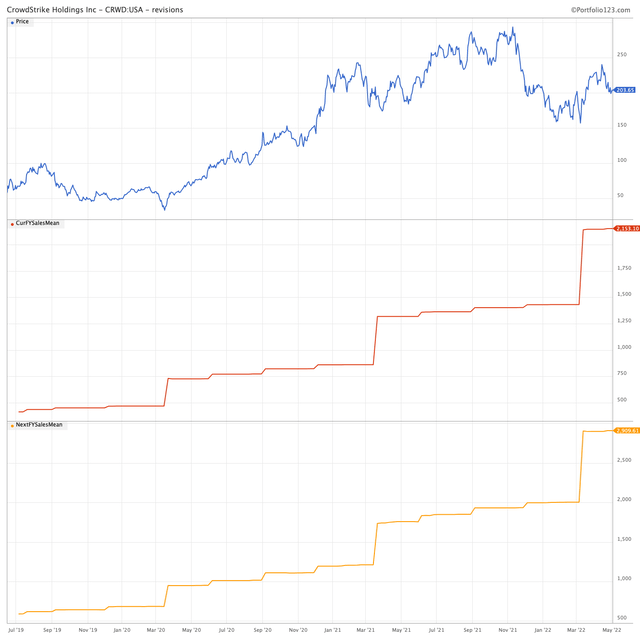

When we discuss valuations, especially for high-quality growth stocks, it is of utmost importance to understand that this is a dynamic concept.

A stock may seem expensive or even overvalued on the surface, however, if the company can consistently exceed sales and earnings expectations, then valuation is actually much more attractive than it seems to be.

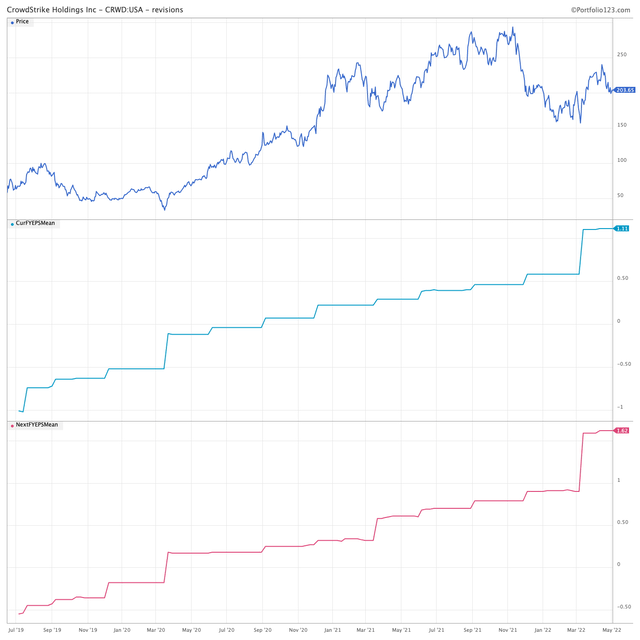

CrowdStrike has widely exceeded expectations, and analysts have been running from behind and increasing their estimates for the business.

The chart shows the stock price in blue plus revenue expectations for the current year and next year in red and yellow respectively. Just to be clear, the lines below show how much revenue Wall Street is expecting CrowdStrike to make in 2022 and 2023, and how those numbers have fluctuated.

In July of 2019, the market was expecting CrowdStrike to make $590 million in revenue for the year 2023, now they are expecting $2.9 billion for that same year. The image is worth a thousand words.

(Click on image to enlarge)

Portfolio 123

The cybersecurity industry is offering powerful tailwinds, and CrowdStrike is also gaining market share in that industry. In 2019, the company was 4th in endpoint security with a 7.9% market share, now it is in the first place and it has a 14.2% market share according to data from IDC. The size of the overall market is growing, and CrowdStrike is getting a bigger share of that growing market.

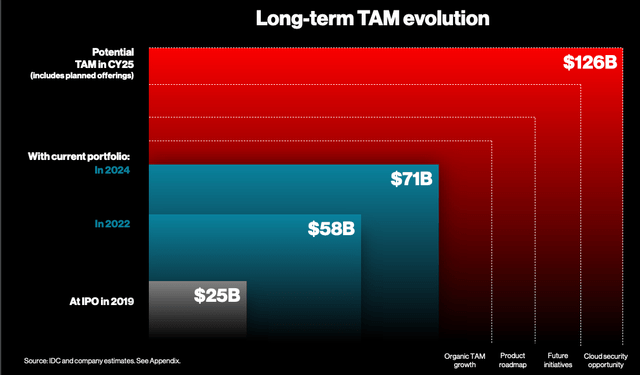

Innovation and product development are key growth engines for CrowdStrike. At the time of the IPO in 2019, the company had 10 modules and now it has 22 modules to offer.

Here is a key insight from management based on growth opportunities considering current customers and current product offerings alone (emphasis added):

If our FY '21 customers adopted the entire platform that was available to them at the time with the same number of endpoints and consistent ASPs, the full platform opportunity would be equal to more than 2.5x FY '21 ending ARR - Annual Recurrent Revenue - showing a significant runway to add net new ARR from within our existing accounts.

With the addition of new Falcon modules in new adjacencies, such as identity and log management, this methodology would value the full FY '22 platform opportunity of the customer base at approximately $7 billion, more than 4x our FY '22 ending ARR and approximately 150% growth in opportunity from the prior year.

While we don't assume that every customer will adopt the full Falcon platform, the magnitude of expansion in the total opportunity speaks to the extent to which we are increasing the value we can provide to our customers and the rate at which we are expanding the capabilities of the platform.

Management calculates that the total addressable market has increased from $25 billion at the time of the IPO to $126 billion when considering future offerings. These kinds of projections should always be taken with a big grain of salt. However, there are valid reasons to think that CrowdStrike still has abundant room for sustained growth in the years ahead.

CrowdStrike

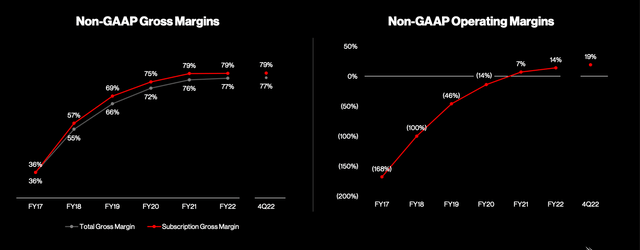

Another exceptional trait is that CrowdStrike is delivering explosive revenue growth in combination with rapidly expanding profitability.

(Click on image to enlarge)

CrowdStrike

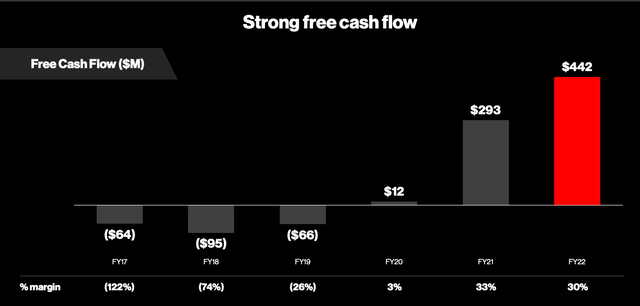

Hypergrowth companies often burn lots of cash because they need to invest in R&D and marketing to generate that growth. But CrowdStrike has a remarkably profitable business model, and the company is making both positive earnings and cash flows.

The free cash flow margin is remarkably high and growing. When excluding a one-time IP transfer tax payment related to the Humio acquisition, the free cash flow margin would have been 35% of revenue last year.

CrowdStrike

The increase in earnings expectations for CrowdStrike is something to behold. Earnings per share estimates for next year were for a negative -$0.55 in 2019, and now the market is expecting a positive $1.62 per share.

(Click on image to enlarge)

CrowdStrike

Demanding Valuation

CrowdStrike is one of the strongest growth stocks in the market when considering revenue growth, profitability, and future opportunities for sustained growth in combination with generous cash flow generation.

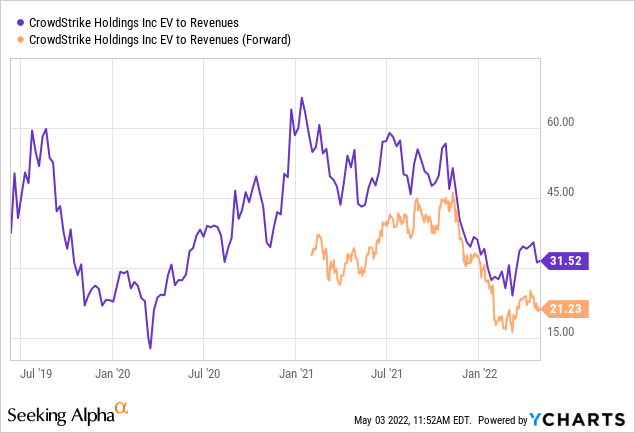

The bad part is that the stock is aggressively valued. The EV to Revenue ratio is above 21 on a forward basis, which is a valuation currently assigned to only a select group of hypergrowth companies in the market.

Data by YCharts

This is not too expensive at all based on the company's past history, but it is a substantial premium versus other growth stocks. In a market environment in which valuations have been under pressure and many growth stocks are exceptionally cheap, CrowdStrike is priced at demanding levels.

It is interesting to note that CrowdStrike had an EV to Revenue ratio above 60 both in July 2019 and in January 2021, which is a very aggressive valuation by all standards.

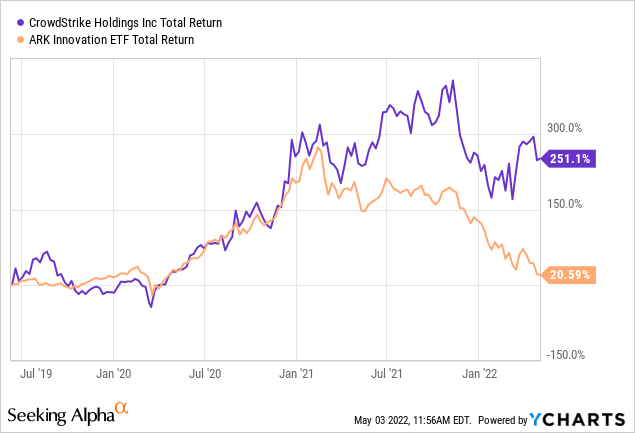

If we look at July of 2019, CrowdStrike has gained 251% since then. Using ARKK as a benchmark for high-beta growth stocks, the benchmark has gained a much smaller 20.6% since that period.

Data by YCharts

Please note that ARKK does not own CrowdStrike stock, I am just using it for comparison purposes to illustrate the relative performance versus other high-octane growth stocks.

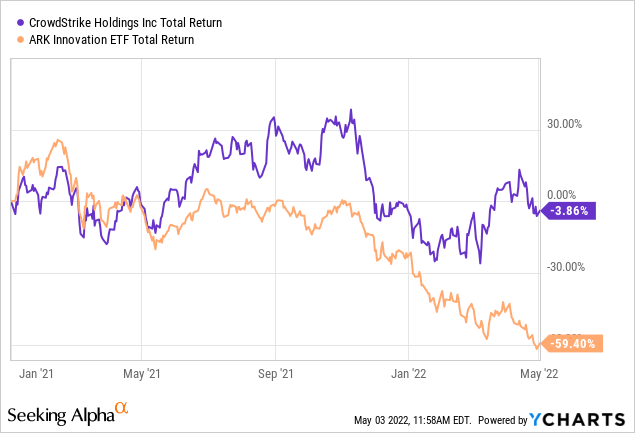

Since January of 2021, when the stock was also trading at a remarkably expensive EV to revenue ratio above 60, CrowdStrike is down 3.9%. This is nothing to write home about in absolute terms, but still much better than the 59.4% decline suffered by ARKK in that period.

Data by YCharts

In a brutal bear market for growth stocks, CrowdStrike has performed much better than other names in the sector in spite of its demanding valuation levels. This is perhaps because the market is willing to prioritize a high-quality business in an economically resilient area like cybersecurity.

Valuation is always relevant and should never be ignored in decision-making. However, the quality of the business is far more important, especially if you have a long-term horizon in your investments. When a company has the strength to widely exceed expectations, then this means that current valuation ratios are misleading and the stock is actually much cheaper than it looks.

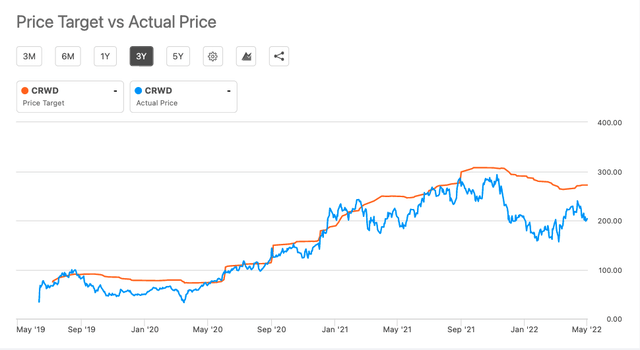

The average price target among the analysts following the stock is currently $272.07. This is not an unreasonable valuation level when you project cash flow growth potential, but it is also a valuation target that doesn't leave much room for error.

(Click on image to enlarge)

Seeking Alpha

There are lots of good reasons to own CrowdStrike, including outstanding growth rates, exceptional profitability, abundant cash flow generation, and long-term potential for sustained growth ahead.

Valuation, on the other hand, is quite demanding. I am not saying that the stock should be avoided because of this. On the contrary, I showed some examples of how CrowdStrike delivered market-beating returns from record-high valuation levels in the past.

This being said, the valuation is clearly aggressive, and CrowdStrike will need to deliver impeccable numbers in order to justify this valuation in the years ahead.

Some Risks To Consider

Looking at the risks, valuation is clearly the main negative factor for CrowdStrike. A high bar is always hard to beat, and the bar is increasingly getting higher for the company.

Don't be surprised if the stock pulls back after delivering an excellent quarter in the near term. This happens very often when a company is so strong and everyone is already expecting world-class performance in each and every quarter.

If revenue growth slows more than expected, or if CrowdStrike suffers a breach, the stock price will be destroyed immediately.

Many analysts are highlighting competition as an increased risk for CrowdStrike, with SentinelOne (S) being usually mentioned in these conversations. However, I see no evidence of that being a problem so far.

In fact, CrowdStrike mentioned some wins versus the competition in the most recent earnings conference call. Management did not mention SentinelOne by name, but SentinelOne is most probably the "next-gen competitor" being referred to:

Among these many fantastic recent wins, let me take a moment to share some additional details about the expansion with a Fortune 50 financial institution that I think exemplifies our technology advantage in action and why scalability and trust matter. Mid-year, this particular customer had chosen CrowdStrike to protect its traditional endpoints and displace the legacy incumbent.

At approximately the same time, for relationship reasons, this organization had chosen a next-gen competitor to protect a server environment. But after six months, they were still struggling to deploy the other vendors' products in its server environment. They were plagued by forced reboots, significant memory usage and unmet product road map promises. While they struggle to get their service protected, Falcon was fully deployed across their hundreds of thousands of endpoints in a matter of weeks without requiring a reboot.

Side-by-side, we showcased our differentiation on a broad scale and a real production environment. This customer was able to see the rich telemetry Falcon provided in real time and the power of our security cloud, all resulting in better efficacy. This customer terminated the other vendors contract and is now deploying Falcon to protect their services globally.

This is just one of many customer stories that demonstrate the fundamental reason why we have earned our leadership with increased win rates and record displacement, efficacy, scalability, manageability, real-time versus batch mode and importantly, our ability to consolidate agents while solving a growing number of real-world business problem.

Competition is always a factor in such a dynamic industry, but I see no evidence of competition hurting CrowdStrike at this stage, so this is only a trend to monitor as opposed to a current headwind for CrowdStrike.

The Bottom Line

CrowdStrike is a notably clean investment case from a quantitative point of view. The quality of the business is outstanding, and it is fair to say that CrowdStrike is one of the best companies in the market when considering growth, profitability, and cash flow generation.

The point is that this is already known by the market and reflected in valuations. The stock is not too expensive by its own historical standards, in fact, it is close to the low end of the valuation range since 2019. However, CrowdStrike is still one of the most expensive stocks in the sector.

A demanding price tag is no reason to sell CrowdStrike. The most profitable long-term investments are often high-quality business trading at demanding valuations over multiple years while also consistently exceeding expectations.

We have, in fact, seen in the paragraphs above how CrowdStrike has delivered very solid returns from aggressive valuation levels in the past, even while other growth stocks with elevated valuations have been under pressure.

As far as the company keeps delivering at this level, CrowdStrike is an excellent business to own for the long term. Any price corrections due to macroeconomic fears or general market conditions can be buying opportunities for long-term investors in this powerful growth business.

Disclosure: I/we have a beneficial long position in the shares of CRWD either through stock ownership, options, or other derivatives.

Disclaimer: I wrote this article myself, and ...

more