Nvidia: Strong Fundamentals And Reasonable Valuation

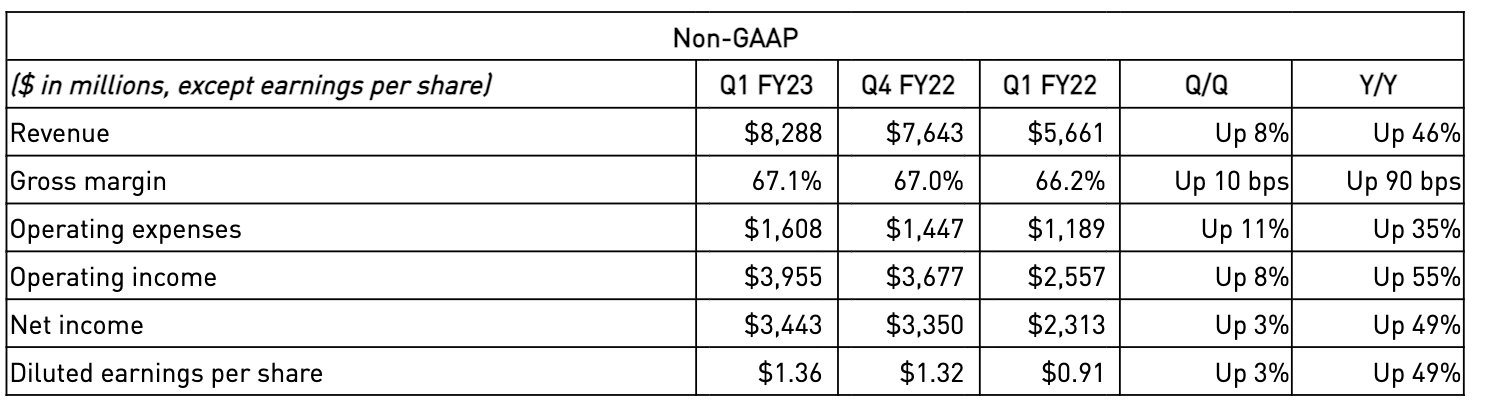

Nvidia (Nasdaq: NVDA) delivered a strong quarter for Q1 of the calendar year 2022, which is actually Q1 of the fiscal year 2023 for the company. Sales, margins, and earnings came in ahead of expectations for the period.

Guidance for the next quarter was below Wall Street forecasts. However, this is due to a $500 million cut due to not selling in Russia and the lockdowns in China. Without that cut, revenue guidance would have been above estimates.

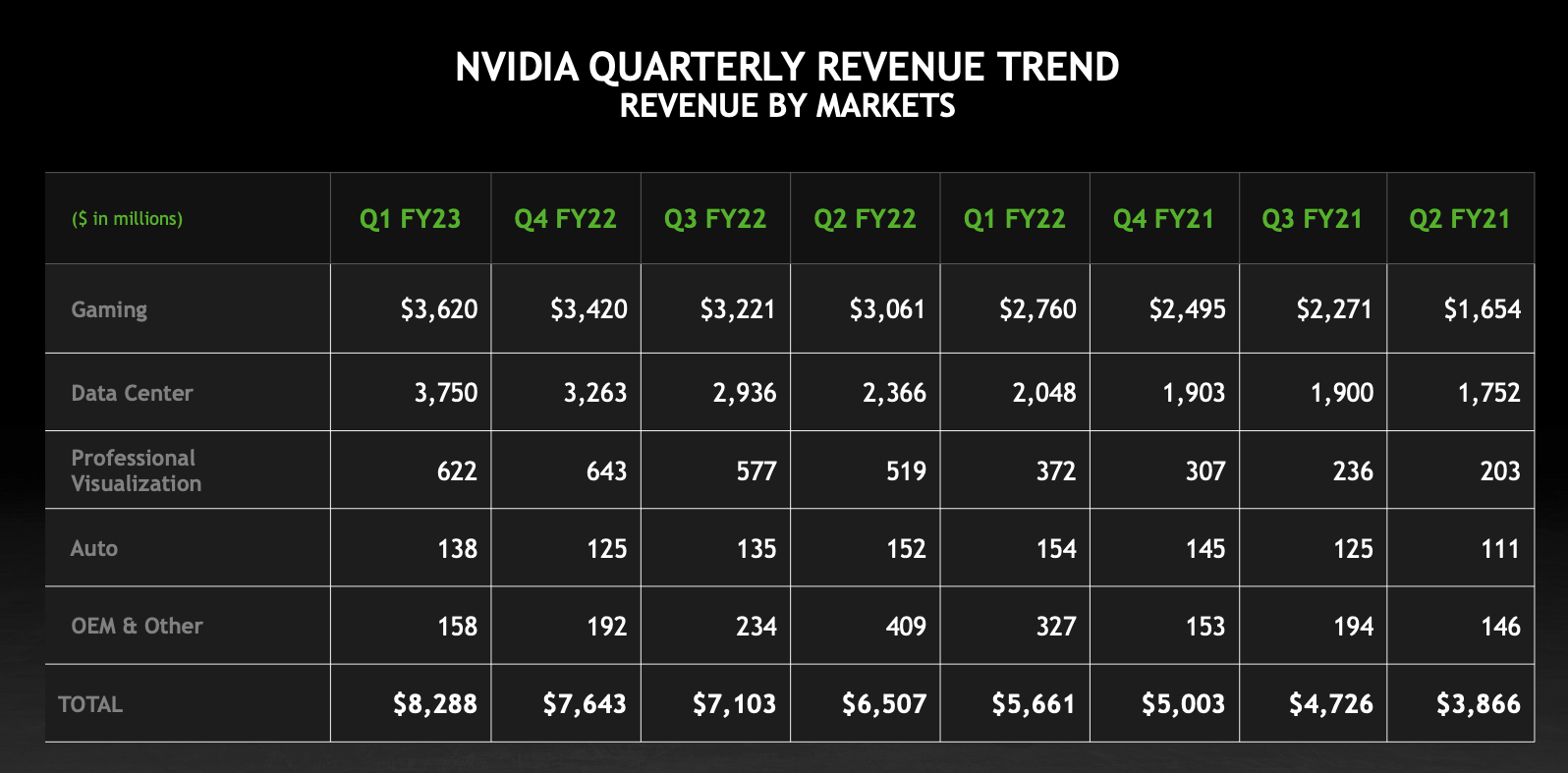

The company is signaling a slowdown in gaming - which includes crypto mining demand too. On the other hand, demand in the data centers segment remains spectacularly strong, and this is Nvidia's largest business nowadays.

Expectations have been reset due to macro headwinds, and Nvidia stock is fairly reasonably valued. The company has consistently exceeded expectations in the past and it could easily continue doing so in the future.

Macroeconomic risk and supply chain problems are always important risk factors for Nvidia. Nevertheless, the fundamentals are stronger than ever and the long-term thesis remains intact.

Fundamental Strength

Revenue during the quarter increased 46% year over year to $8.3 billion. Gross profit margin increased by 90 bps to 67.1%, and adjusted earnings per share grew 49% year over year. In a sign of confidence, Nvidia enlarged the share buyback program to up to $15 billion through December 2023.

(Click on image to enlarge)

Nvidia

Data Center is now the biggest segment for the company, and it's firing on all cylinders. This segment delivered $3.8 billion in revenue, growing 15% sequentially and accelerating to 83% growth year on year.

(Click on image to enlarge)

Nvidia

According to management in the conference call:

Revenue from hyperscale and cloud computing customers more than doubled year-on-year, driven by strong demand for both external and internal workloads. Customers remain supply constrained in their infrastructure needs and continue to add capacity as they try to keep pace with demand.

Nvidia is at the core of many of the most important trends in technology going forward: Gaming, Omniverse, Artificial Intelligence, Cloud Computing, Data Analytics, and self-driving vehicles, to name a few notable examples. The company has superior technologies and a large R&D budget allowing it to stay ahead of the competition in that regard.

Nvidia is increasingly expanding into software, which should drive not only revenue growth but also higher margins. Because the industry has superior economics, software companies trade at premium valuations versus hardware companies, so this expansion into software could have a positive impact on earnings visibility and perhaps even on valuation over the long term.

Nvidia is entering the second half of the year with the largest wave of new products in its history. Leaving aside the macro uncertainty, Nvidia has a lot of operational momentum behind it.

In the words of Jensen Huang, founder, and CEO of Nvidia:

We are gearing up for the largest wave of new products in our history with new GPU, CPU, DPU and robotics processors ramping in the second half. Our new chips and systems will greatly advance AI, graphics, Omniverse, self-driving cars and robotics, as well as the many industries these technologies impact.

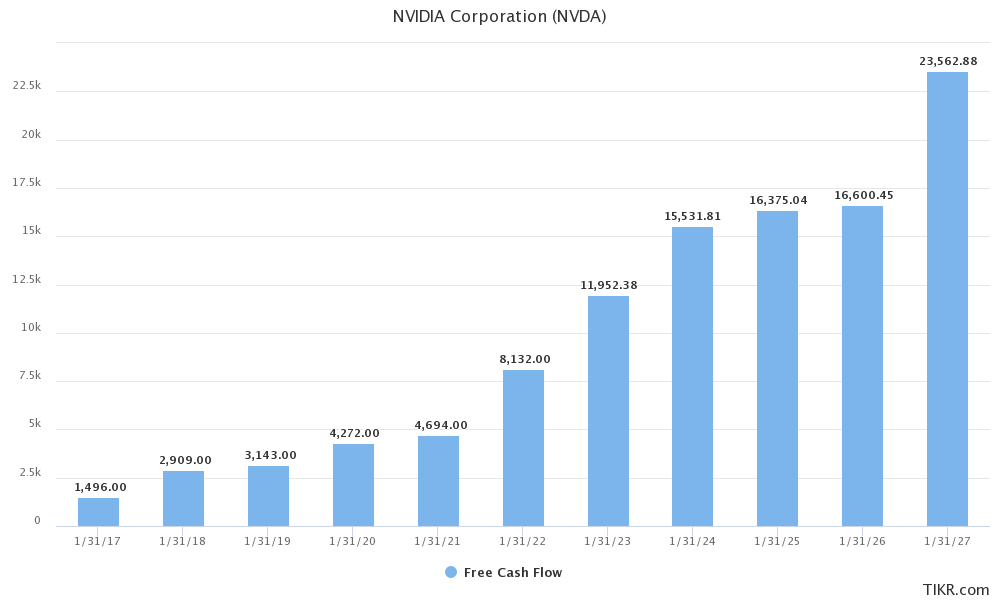

It can be useful to take a step back and look at the long-term trends in cash flow generation. The chart shows historical free cash flow data in combination with forward-looking analyst estimates to assess the main trend. Wall Street is forecasting free cash flow to grow from $8.1 billion for the year ending in January 2022 to $23.6 billion for the year ending in January of 2027.

(Click on image to enlarge)

TIKR

When looking at growth projections, investors should always ask if the company has the ability to meet or ideally exceed these expectations.

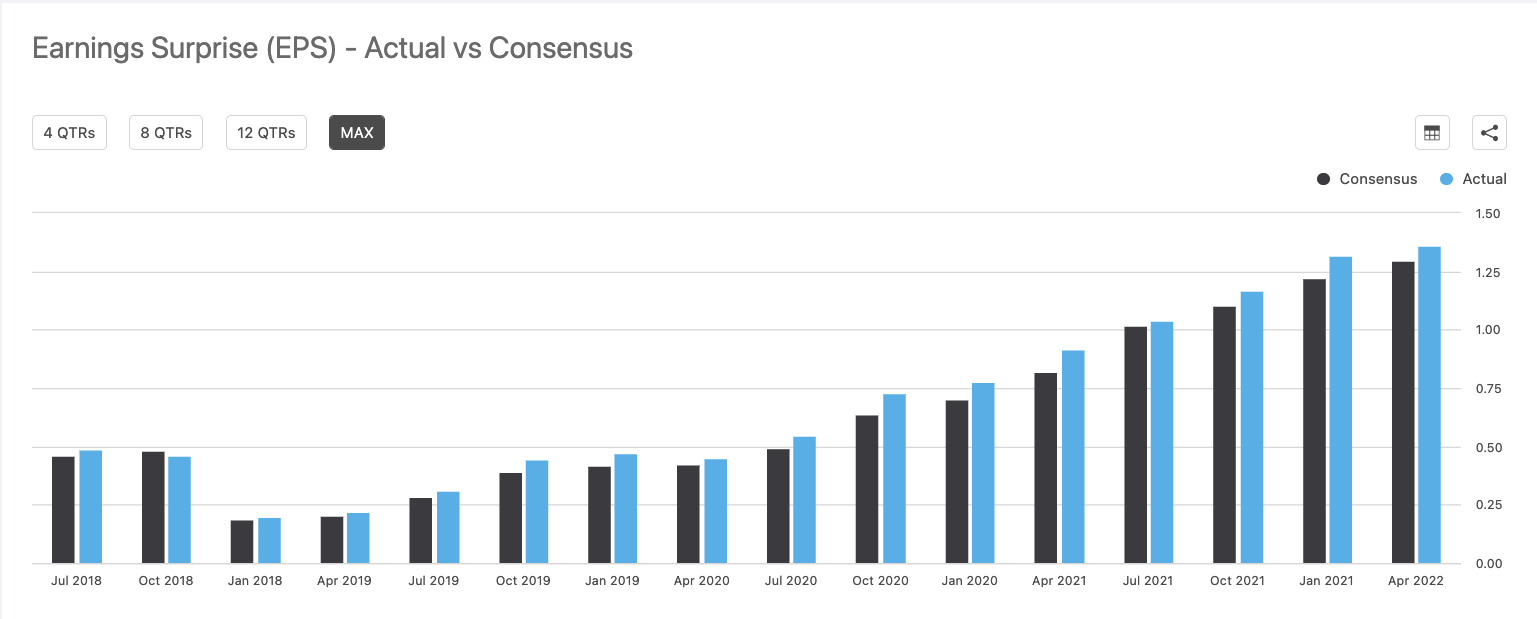

In the particular case of Nvidia, the company has widely surpassed expectations in the past, and the business looks as strong as ever from a long-term perspective.

(Click on image to enlarge)

Seeking Alpha

The Valuation

Nvidia has always been an excellent business, and the most recent report confirms that the fundamental quality of the company remains intact, regardless of the natural volatility that comes with macroeconomic jitters.

The main negative factor affecting the stock has always been valuation as Nvidia has traditionally traded at aggressive multiples.

In the current environment, however, valuation is actually quite reasonable, and it's not hard to make a case that Nvidia is actually looking cheap if the company can exceed expectations in the years ahead.

The table below shows quarterly earnings for Nvidia and the average and median surprise versus estimates. The company has roughly exceeded estimates by 8% across time.

| Earnings Date | EPS Estimate | EPS Actual | Surprise | Surprise % |

| FQ1 2023 (Apr 2022) | 1.29 | 1.36 | 0.07 | 5.04% |

| FQ4 2022 (Jan 2021) | 1.22 | 1.32 | 0.1 | 7.96% |

| FQ3 2022 (Oct 2021) | 1.11 | 1.17 | 0.06 | 5.81% |

| FQ2 2022 (Jul 2021) | 1.02 | 1.04 | 0.02 | 2.27% |

| FQ1 2022 (Apr 2021) | 0.82 | 0.92 | 0.09 | 11.43% |

| FQ4 2021 (Jan 2020) | 0.7 | 0.78 | 0.07 | 10.36% |

| FQ3 2021 (Oct 2020) | 0.64 | 0.73 | 0.09 | 14.20% |

| FQ2 2021 (Jul 2020) | 0.49 | 0.55 | 0.05 | 10.67% |

| FQ1 2021 (Apr 2020) | 0.42 | 0.45 | 0.03 | 6.87% |

| FQ4 2020 (Jan 2019) | 0.42 | 0.47 | 0.05 | 12.87% |

| FQ3 2020 (Oct 2019) | 0.39 | 0.45 | 0.05 | 13.18% |

| FQ2 2020 (Jul 2019) | 0.29 | 0.31 | 0.02 | 8.24% |

| FQ1 2020 (Apr 2019) | 0.2 | 0.22 | 0.02 | 8.73% |

| FQ4 2019 (Jan 2018) | 0.19 | 0.2 | 0.01 | 6.48% |

| FQ3 2019 (Oct 2018) | 0.48 | 0.46 | -0.02 | -4.08% |

| FQ2 2019 (Jul 2018) | 0.46 | 0.49 | 0.02 | 5.10% |

| Average Surprise | 7.82% | |||

| Median Surprise | 8.10% |

Wall Street analysts are expecting Nvidia to make $5.45 in earnings per share during the fiscal year ending in January 2023 and $6.52 during the fiscal year ending in January 2024. Based on different assumptions for earnings surprise in the near term, the stock is trading in a PE ratio in the low 30s for the current year.

This is not too cheap, but not excessive either for such a high-quality growth company that has always traded at demanding valuations vs. the rest of the market.

| AVG Estimate | 5% Surprise | 8% Surprise | |

| PE Jan 2023 | 34.3 | 32.7 | 31.8 |

| PE Jan 2024 | 28.7 | 27.3 | 26.6 |

Not only is the stock reasonably priced based on current estimates, but Nvidia has proven an exceptional ability to consistently surpass expectations over the long term, and this is the main reason why the stock has created so much value for shareholders over the years.

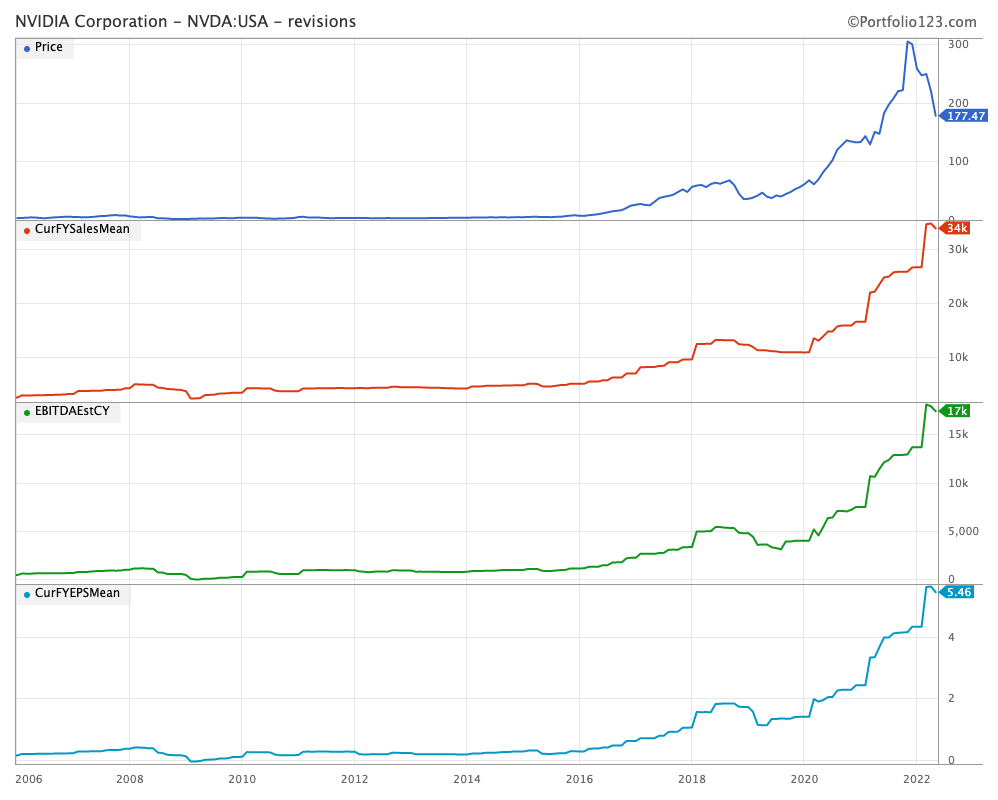

The chart shows the stock price in blue, with revenue expectations for the current year in red, EBITDA estimates in green, and earnings per share expectations in light blue.

Five years ago, the market was expecting Nvidia to make $8.25 billion in revenue during the current year, now they're forecasting almost $34.5 billion.

Earnings estimates have increased from $0.78 to $5.6 per share over this period.

(Click on image to enlarge)

Portfolio123

Risk And Reward Going Forward

Nvidia has direct exposure to cyclical areas like autos, gaming, and all kinds of industrial applications. The semiconductor industry also is globally integrated and vulnerable to supply chain disruptions. For these reasons, the macroeconomic risk is substantial in Nvidia.

That aside, Nvidia is a unique company due to its leading presence across several of the most important trends in technology, offering exponential growth opportunities over the years ahead. The business is widely profitable and it enjoys robust cash flow generation.

Besides, the management team is one of the best in the technology sector. Consistent innovation combined with superior technology is what has allowed Nvidia to expand and win in multiple sectors, and there's no reason to believe that this trend is going to change, with or without macroeconomic headwinds.

The stock is not too cheap, but it's reasonably valued considering the quality of the business and its proven ability to consistently outperform expectations over the long term.

Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives.

Disclaimer: I wrote this article myself, and it ...

more