Sales Are Down, But Stocks Are Up - What’s Going On Here?

Image Source: Unsplash

Something strange is happening in the semiconductor market.

Sales are down. But stocks of these companies are up.

What’s going on here? And how can we make money from it?

I’ve got the answers…

Sales are Down, But Stocks are Up — What’s Going on Here?

Semiconductor stocks are on fire!

- Micron Technology (MU) is up 50% in the past year.

- Shares of Intel (INTL) have doubled over the past year.

- And shares of Nvidia (NVDA) have tripled during that stretch.

Admittedly, increases like these aren’t too jaw-dropping. After all, these are three of the most prominent tech companies in the world. And we’re living in a tech-driven economy.

What’s fascinating is this:

These companies’ stock prices are rising, but their sales are falling — big time.

What’s happening here?

Demand Takes a Hit

As I’ll explain, the answer relates to the time-honored relationship between supply and demand. Let’s start with the demand side of things.

Semiconductors are an integral part of many things, from medical devices to communications tools. But they’re overwhelmingly used in today’s electronics, including personal computers (PCs).

The thing is, for the past two years, PC sales have collapsed. During 2023, sales of PCs fell 14%, meaning demand for the semiconductors used to make them fell, too.

But now, the future is bright for PCs. In fact, in the most recent quarter, PC sales increased. And I expect they’ll continue rising for the foreseeable future. Here’s why…

The Replacement Cycle

When COVID hit in 2020, the work-from-home phenomenon began. And consumers rushed out to buy a computer.

This was notable for a couple of reasons. First, a lot of buyers purchased a computer before they were ready. That meant the demand for computers that should’ve taken place in 2021 and 2022 was bumped up to 2020.

Second, by the end of 2020, many consumers had their new computers, meaning they weren’t going to need one for at least the next few years.

But as 2024 gets underway, computers purchased during the height of COVID-19 are almost four years old. In technology years, that’s old — borderline ancient. Consumers are going to start to explore replacing their computers. And that’s why we’re seeing sales start to climb.

The thing is, replacing an aging computer is only part of the story here…

AI’s Role in Semiconductor Demand

You see, the real trigger for this replacement cycle is Artificial Intelligence (AI) — more specifically, the introduction of this technology into upcoming PCs.

Microsoft (MSFT), for example, has Copilot, an AI “chatbot” that’ll be available through Windows 11. Microsoft is even creating a dedicated key on its keyboards for AI.

And keep in mind: AI isn’t just boosting the capabilities of PCs. It’s also being used to enhance data centers. And everyone from Meta (formerly Facebook) to Google to Microsoft is ramping up their data-server businesses.

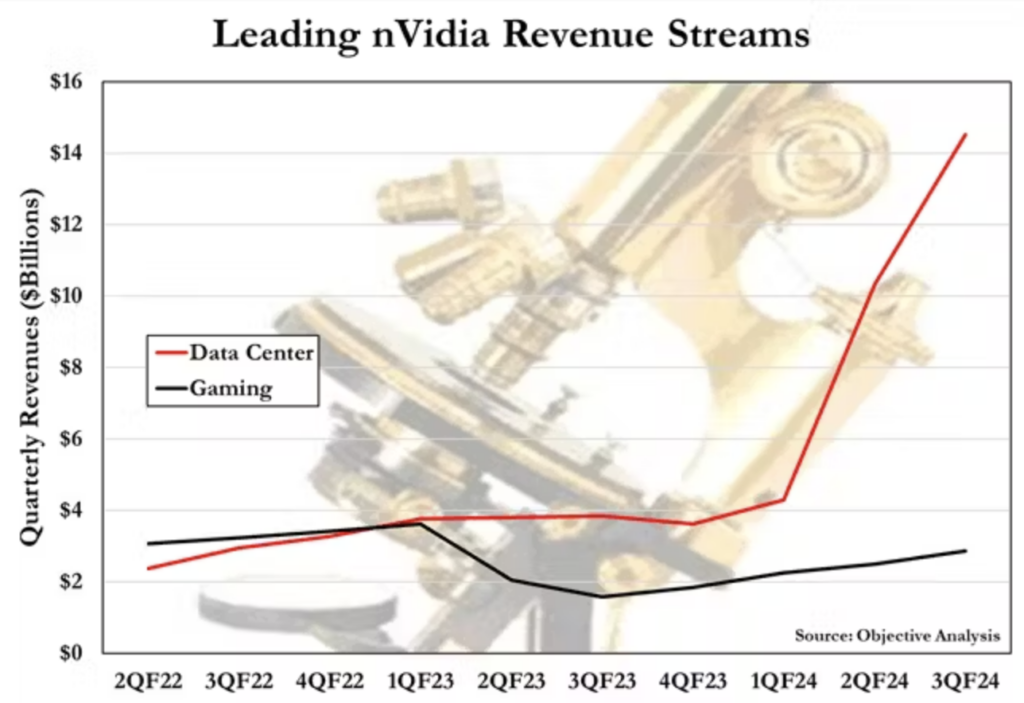

That’s good news for companies like Nvidia, which used to make its bread and butter on chips for the gaming sector. Now, as you can see by this chart, the bulk of its growth is due to increased involvement in data centers:

Now let’s look at the other side of the equation…

Where’s The Supply?

When PC sales fell in 2021 and 2022, semiconductor makers trimmed production.

In 2022, Micron shut off one of its factories. A year later, Samsung did the same, both to reduce the excess supply of chips.

By the end of 2023, the supply of semiconductors was low. In fact, the amount of silicon being ordered — silicon is used to make silicon wafers, which are the building blocks of semiconductors — was down 20% from the start of the year:

Can you tell me where I’m going with this?

An Industry Worth Monitoring

Today, the supply of semiconductors is low. Yet demand for them is starting to rise.

That’s evident in this chart, which tracks global semiconductor billings:

Notice the sharp uptick in demand to close out 2023.

What happens when supply is low, but demand is high? High prices! That’s why companies like Intel and Nvidia are seeing their stock prices soar despite sluggish sales. They’re making more money by selling fewer chips — at least for the time being.

This is a market that’s worth investing in for the long haul. And I’ll be tracking this situation over the next several weeks to let you know when and how to invest.

In the meantime, we’re in it to win it. Zatlin out.

More By This Author:

This Could Boost The Housing Market, Stock Market, And U.S. Economy - All At Once

Sell Your Stocks In This Sector Now

China Is Coming After U.S. Companies - Is Your Portfolio Exposed?

If you want to get access to my best and most accurate research and forecasts so you can profit off my expertise, then consider trying out my advisory more