This Could Boost The Housing Market, Stock Market, And U.S. Economy - All At Once

Image Source: Unsplash

The Godfather… Indiana Jones… Back to the Future — some of the greatest film franchises in history have come in threes.

Today, we’re wrapping up a trilogy of our own…

With a look at the third reason 2024 is poised to be “The Year of the Bull.”

This Could Boost the Housing Market, Stock Market, and U.S. Economy — All at Once

Welcome back to our look at why 2024 is set to be a banner year in the stock market.

So far, I’ve detailed the upcoming election, and the fact that the economy is in better shape than the “experts” would have you believe. Both of those elements will play a major role in the stock market’s performance this year.

Now it’s time to look at the third reason I’m convinced the market will deliver double-digit returns…

Rate Cuts Are Coming

That reason relates to interest rates — more specifically, interest-rate cuts.

You’ve probably heard a lot of chatter about pending interest-rate cuts. And I’d wager they’re coming down the pipeline.

But before we look toward the future, let’s recap how we got here.

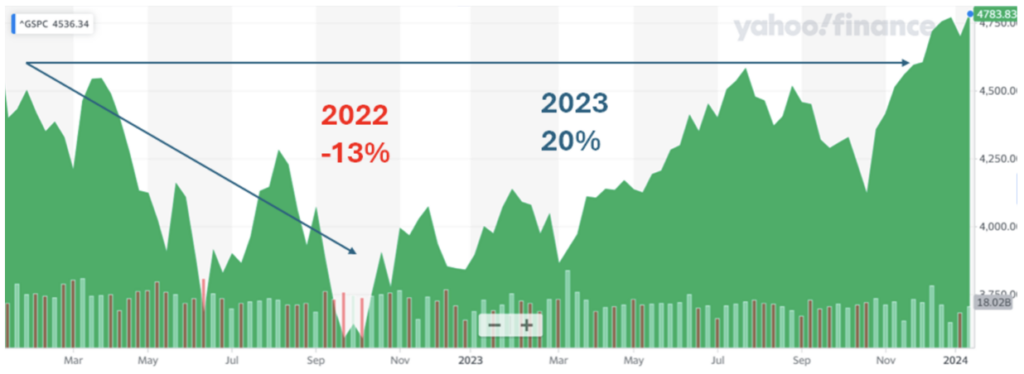

In March 2022, interest rates went from near zero all the way to 5.5%. How did the stock market respond? In a word: poorly. Take a look:

This is a two-year snapshot of the S&P 500. When interest rates started going up, the stock market immediately started to crash. It ended up falling 13% in 2022. And it took much of 2023 to recover those losses.

If you were a stock-market investor during 2022 and 2023 — and you didn’t have the benefit of Moneyball Economics stock-picking — your total returns were a measly 5%.

Now let’s focus on where we’re at today…

Investors Have a Few Choices

If you’re an investor, you have a few choices when it comes to where to put your money. For example:

- You can put it into a money-market account, most of which are still paying out around 5% interest.

- You can put it into the stock market, which has historically returned about 8% a year (though it’s been annoyingly volatile the past few years).

- Or you could hand your money off to a private equity fund and hope the fund can deliver on its promise of double-digit returns.

During times of economic uncertainty like we’ve been in, the option most investors have gone with is the money-market account — a virtually zero-risk way to keep your money and earn solid returns. In fact, last year, a trillion dollars flowed into money-market funds.

But that’s about to change. Not only are interest rates expected to stop climbing, but they’re expected to drop in 2024. And as those rates drop, so will the interest offered through investments like money-market accounts.

That means more investors will be flocking back to the stock market and trying to capture the higher returns the market has historically doled out.

That’s the potential impact interest rates will have on money-market funds and the stock market. But what about the economy itself?

These Sectors Are About to Boom

Housing represents one-third of our nation’s economy. And as interest rates drop, so will mortgage rates. That’ll make buying a home more affordable (at least somewhat) and will jolt the economy.

But the effects of the jolt won’t stop there. As housing becomes more affordable, more buyers will turn to sectors like furniture, appliances, and electronics. Simply put, the economy is about to experience a major boost when interest rates fall, led by a surging housing market.

There’s also a benefit to lower interest rates that seems to be flying under the radar. I’m referring to private-equity deals and mergers and acquisitions (M&A) activity.

You see, 2023 was a terrible year for private equity and M&A deals. The value of private-equity deals dropped 55%, while the value of M&A activity dropped 41%. Total capital spending in these areas went from around $4 trillion in 2019 to $3 trillion last year.

A key reason we saw such a drop was that high-interest rates meant that borrowing costs for a deal outweighed any potential value. But with lower interest rates, suddenly those borrowing costs will start to fall, and that’ll send M&A and private-equity deals surging. That missing trillion dollars could be back into play.

Stick With Me

The positive impact of interest-rate cuts can't be overstated. Everything from the housing industry to the economy to the stock market will surge as a result of these cuts.

It's just another reason I'm convinced 2024 will deliver double-digit returns to those who know when and where to invest. That's the insight I'll provide you with at Moneyball Economics, so stick around.

In the meantime, we're in it to win it. Zatlin out.

More By This Author:

Sell Your Stocks In This Sector NowChina Is Coming After U.S. Companies - Is Your Portfolio Exposed?

Is The US Economy Slowing Down?

If you want to get access to my best and most accurate research and forecasts so you can profit off my expertise, then consider trying out my advisory more