Risk Assets Rebound As Markets Regain Bullish Footing

Image Source: Pexels

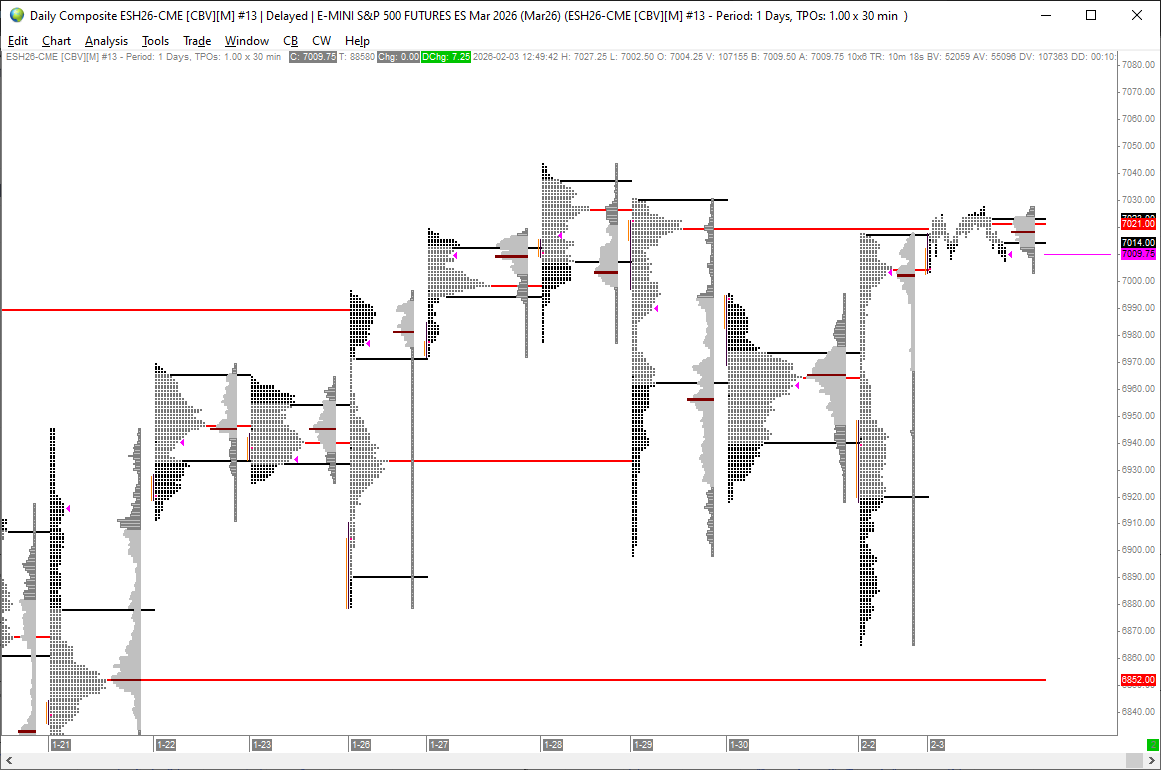

The market closed with an elongated price structure, recovering much of the previous week’s decline with strong bullish momentum. For bias, it makes sense to focus on the volume profile, with the POC around 7002 acting as the key reference level. As long as price holds above it, the level can be treated as support and a potential buying area. A break below would shift the bias to bearish, turning that same level into resistance.

(Click on image to enlarge)

Looking at the current regime, we can observe capital inflows into the Russell 2000 and emerging markets, supporting a broader risk-on tone. Higher-risk assets like Bitcoin are also up roughly 1.6% for the week. Copper is higher as well, reinforcing a constructive economic signal, despite last week’s pullback in gold and silver that was triggered by rumors around potential bank stress.

Crude oil is trading lower, down about 3.9% since Monday, pointing to near-term deflationary pressure. Volatility dynamics also suggest an improved risk appetite. Interest-rate futures continue to price in rate cuts through 2027, which remains supportive for dip-buying and melt-up scenarios. That said, sentiment has been somewhat pressured by recent hawkish signals following the rate hold. Yields are telling a similar story, reflecting short-term hawkish tendencies that have weighed on price action.

Credit markets are mixed on the week but remain supportive overall, keeping the bullish backdrop intact. While there are some short-term deflationary signals, the growth impulse could reintroduce inflation risks further down the road.

In summary, the broader setup still favors a bullish scenario, with near-term risks centered around the rate-hold narrative. Our current framework points to roughly a 90% bullish probability from a short-term perspective.

More By This Author:

Three Value Area Frameworks That Define Risk With Precision

Markets Weigh Breakout Risk As Inside-Day Structure Sets Key Levels

Markets Mark Time Below Key Volume Node As Risk-On Signals Clash With Rate-Hold Fears

Enjoyed this article? Invest in a subscription to expand your horizon towards advanced wealth creation.

Visit our more