Markets Weigh Breakout Risk As Inside-Day Structure Sets Key Levels

Image Source: Pixabay

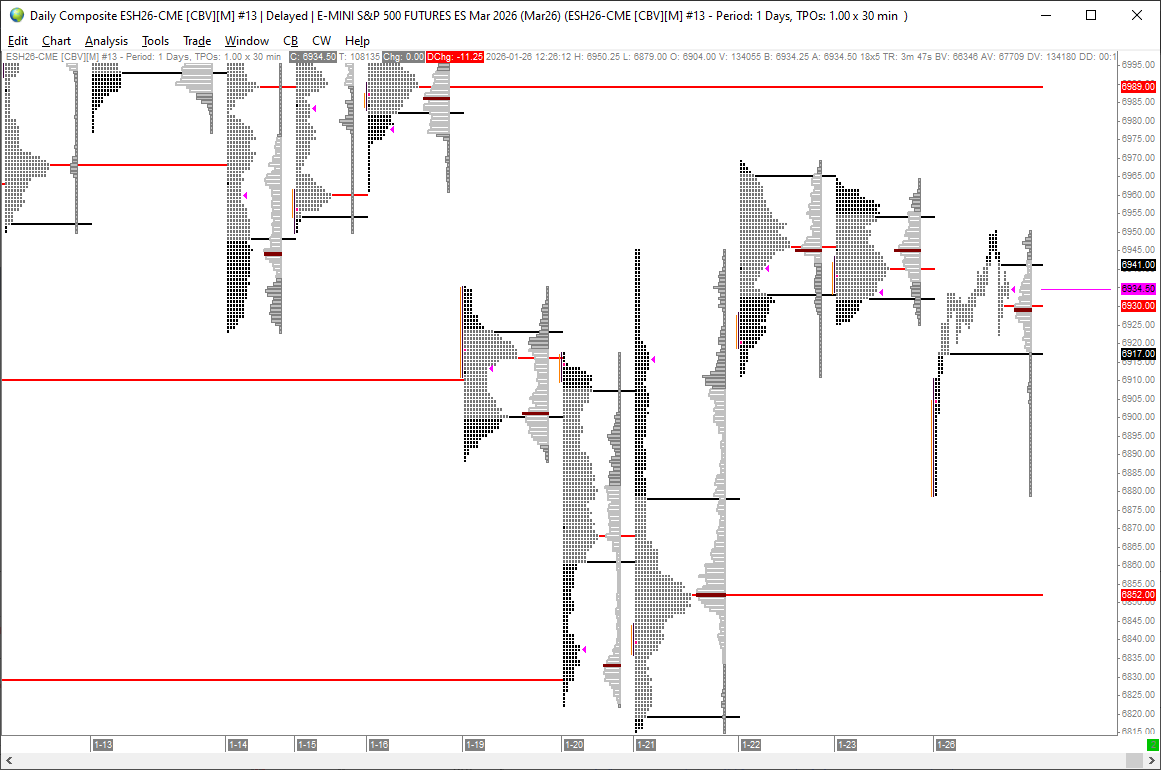

Friday closed with a balanced, inside-day profile structure on both a TPO and volume basis. From a technical perspective, this sets up a straightforward framework: either an inside-day failure or a breakout will define the directional bias for the next session. Today’s session opened with a gap down, suggesting traders should initially lean on the developing value extremes. However, with the gap already filled, attention can shift back to the distribution extremes of Friday’s profile as the primary reference levels.

The broader regime this year continues to support a risk-on environment, with clear capital flows into the Russell 2000 and emerging markets confirming that stance. Bitcoin remains slightly positive, reinforcing the appetite for risk. Gold, however, signals some underlying caution through its safe-haven demand, while Dr. Copper continues to act as a positive economic barometer. Crude oil adds an inflationary component, and a softer dollar should be supportive for sentiment overall.

That said, the VIX suggests some risk remains in play, and interest-rate futures increasingly point toward a rate hold, which could require a larger pullback to fully price in this scenario alongside other risk factors. The yield curve reflects a similar tone. Credit markets remain constructive, keeping dip-buying opportunities on the table, while elevated TIPS continue to highlight persistent inflation risk. Overall, the probability of the equity bull case currently sits around 65%.

There are several risk factors the market still needs to price in. While the tariff threat toward Canada appears to be resolved for now—given the country’s stance against pursuing a free trade deal with China—other pressures remain. Rising Japanese yields stand out as a key risk, as they could weigh on global markets, especially with the likelihood of yen intervention increasing. Coordination between U.S. and Japanese authorities is becoming more plausible, as the New York Fed has reportedly notified several banks on the matter. Government shutdown risk is another factor worth monitoring, although past instances suggest that an actual shutdown may not exert significant pressure on markets.

More By This Author:

Markets Mark Time Below Key Volume Node As Risk-On Signals Clash With Rate-Hold Fears

Markets Tilt Risk-On As Overnight Breakout Offsets Rate-Cut Uncertainty

Rare Earths: Volatility, Geopolitics And The Global Race To Secure Supply

Enjoyed this article? Invest in a subscription to expand your horizon towards advanced wealth creation.

Visit our more