RGTI: This Quantum Computing Stock Is Up 4,024% In A Year; What Comes Next?

Image Source: Unsplash

Summary

Rigetti Computing (RGTI) stands out for its quantum-classical computing infrastructure and has surged 4,012% over the past year.

RGTI receives strong technical buy signals, trading above key moving averages, with a Trend Seeker 'Buy' and high momentum indicators.

Fundamentals show projected revenue growth of 160% next year and earnings increases, but analyst opinions are mixed and valuations are stretched.

RGTI remains highly volatile and speculative; strict risk management and stop-loss strategies are recommended for any investment consideration.

Today’s Featured Stock

Valued at $9.20 billion, Rigetti Computing RGTI is a pioneer in full-stack quantum-classical computing. The Company's proprietary quantum-classical infrastructure provides high performance integration with public and private clouds for practical quantum computing.

What I’m Watching

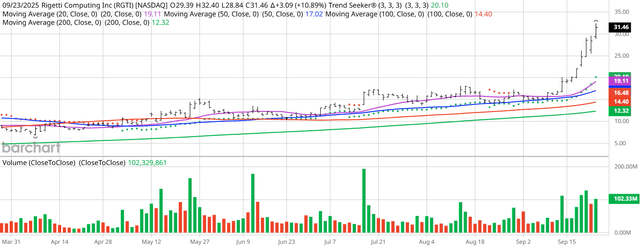

I found today’s Chart of the Day by using Barchart’s powerful screening functions to sort for stocks with the highest technical buy signals; superior current momentum in both strength and direction; and a Trend Seeker “buy” signal. I then used Barchart’s Flipcharts feature to review the charts for consistent price appreciation. RGTI checks those boxes. Since the Trend Seeker signaled a buy on August 28, the stock gained 89.75%.

RGTI Price vs Daily Moving Averages:

(Click on image to enlarge)

RGTI (Barchart)

Barchart Technical Indicators for Rigetti Computing

Rigetti hit an All Time high of $31.46 in intraday trading on Sept. 23.

- Rigetti has a Weighted Alpha of +601.19.

- RGTI has an 100% “Buy” opinion from Barchart.

- The stock gained 4,012.42% over the past year.

- RGTI has its Trend Seeker “Buy” signal intact.

- Rigetti is trading above its 20-, 50-, and 100-day moving averages.

- The stock made 11 new highs and gained 112.28% in the last month.

- Relative Strength Index (RSI) is at 88.47%.

- There’s a technical support level around $26.05.

Don’t Forget the Fundamentals

- $9.20 billion market capitalization.

- Revenue projected to grow 160.52% next year

- Earnings are estimated to increase by 37.97% this year and an additional 13.89% next year.

Analyst and Investor Sentiment on Rigetti

I don’t buy stocks because everyone else is buying, but I do realize that if major firms and investors are dumping stock, it’s hard to make money swimming against the tide.

It looks like Wall Street analysts are high on Rigetti and so are individual investors.

- The Wall Street analysts tracked by Barchart have issued 5 "Strong Buys", 1 “Moderate Buy” and 1 “Hold” opinion on the stock.

- Their price targets are between $14-$20.

- Value Line gives the stock its "Lowest” rating but with price target of $10-$49 and comments:" For those who believe in Quantum's eventual commercial viability, Rigetti offers investors with a way to tap into the long-term potential.".

- CFRA’s MarketScope Advisor rates it a “Strong Sell.”

- Morningstar thinks the stock is 41% overvalued with a fair value of $20.04

- 42 investors following the stock on Motley Fool think the stock will beat the market while 11 think it won’t.

- 32,480 investors monitor the stock on Seeking Alpha, which rates the stock a “Hold” and comments: “ The company's roadmap to achieve a 100+ qubit system by the end of 2025 and a 1,000+ qubit system within four years highlights its potential to capture a significant market share in the quantum computing industry. ”

The Bottom Line on Rigetti

I caution that RGTI has skyrocketed but could go higher if Revenue and Earnings catch up to the price. RGTI is volatile and even speculative in the current environment, which means investors should use strict risk management and stop-loss strategies.

More By This Author:

EBAY Stock Keeps Hitting New Highs. Is More Growth Ahead?

Penny Stock ARTW Has Doubled In Just The Last Month

This AI Stock Has Nearly Tripled In The Last Year

Read previous editions of the daily newsletter here.

The technical indicators below are updated live during the session every 20 ...

more