Penny Stock ARTW Has Doubled In Just The Last Month

TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

Image Source: Unsplash

- Art’s Way Manufacturing shows strong technical momentum, hitting a new 52-week high on Aug. 11.

- Shares are up 188% over the past year and have a Trend Seeker “Buy” signal.

- The company has posted positive revenue and earnings for four consecutive years, supporting its fundamental strength.

- Despite momentum, ARTW is highly volatile and speculative. I recommend strict risk management and stop-loss strategies for any potential investor.

Author’s Note: I normally do not feature penny stocks, but since this one had both positive revenue and earnings in all four of the last years, I am making an exception.

Today’s Featured Stock

Valued at only $21 million, Art’s Way Manufacturing (ARTW) manufactures and sells specialized farm and industrial machinery. The major products include portable grinder-mixers, silage mixing wagons, forage blowers, beet and potato harvesters, and a line of land management equipment.

What I’m Watching

I found today’s Chart of the Day by usng Barchart’s powerful screening functions to sort for stocks with the highest technical buy signals; superior current momentum in both strength and direction; and a Trend Seeker “buy” signal. I then used Barchart’s Flipchairts feature to review the charts for consistent price appreciation. ARTW checks those boxes. Since the Trend Seeker signaled a buy on July 15, the stock has gained 79.66%.

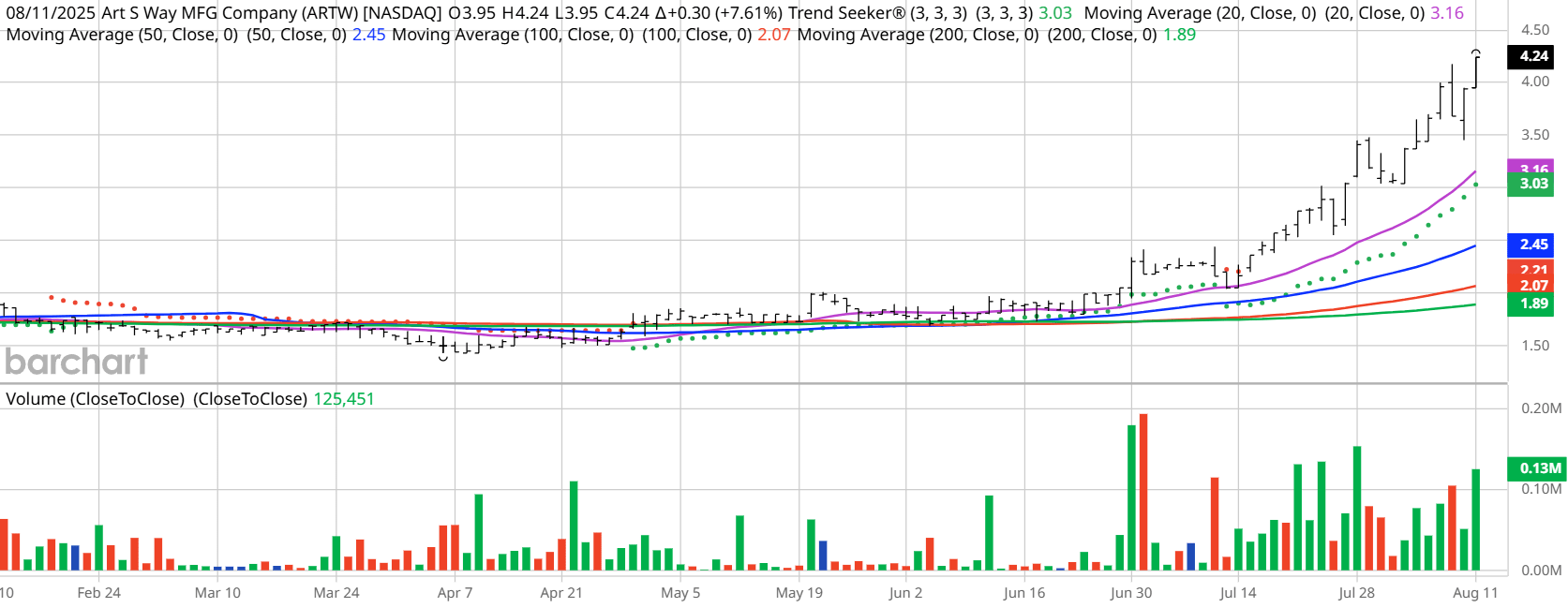

ARTW Price vs. Daily Moving Averages:

(Click on image to enlarge)

Barchart Technical Indicators for Art’s Way

Note: The technical indicators below are updated live during the session every 20 minutes and can therefore change each day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report. These technical indicators form the Barchart Opinion on a particular stock.

Art’s Way shares hit a new 52-week high on Aug. 11, touching $4.24 in intraday trading.

- Art's Way has a Weighted Alpha of +135.19.

- ARTW has an 100% “Buy” opinion from Barchart.

- The stock has gained 188.28% over the past year.

- ARTW has its Trend Seeker “Buy” signal intact.

- Art's Way is trading above its 20-, 50-, and 100-day moving averages.

- The stock made 16 new highs and gained 103.9% in the last month.

- Relative Strength Index (RSI) is at 74.42%.

- There’s a technical support level around $4.05.

Don’t Forget the Fundamentals

- $21.7 million market capitalization.

- Although the one analyst following the stock has not made revenue and earnings projections, it should be noted that ARTW posted revenue and earnings in all four of the previous years.

Analyst and Investor Sentiment on Art's Way

I don’t buy stocks because everyone else is buying, but I do realize that if major firms and investors are dumping a stock, it’s hard to make money swimming against the tide.

It looks like a Wall Street analyst is bullish on ARTW, and so is Morningstar.

- The Wall Street analyst tracked by Barchart has issued a “Strong Buy” opinion on the stock.

- Value Line gives the stock its average rating.

- CFRA’s MarketScope gives the stock a "Strong Buy" rating.

- Morningstar thinks the stock is undervalued by 23% with a fair value of $5.12.

- Only 834 investors monitor the stock on Seeking Alpha.

The Bottom Line on Art’s Way Manufacturing

ARTW currently has momentum and is hitting new highs. Investors seem to think the positive revenue and earnings will continue in the future.

I caution that ARTW is volatile and even speculative in the current environment, which means investors should use strict risk management and stop-loss strategies.

More By This Author:

This AI Stock Has Nearly Tripled In The Last Year

There's Nothing Soft About Microsoft Stock

This Data Center Stock Is Up 330% In The Past Year