EBAY Stock Keeps Hitting New Highs. Is More Growth Ahead?

Image Source: Pixabay

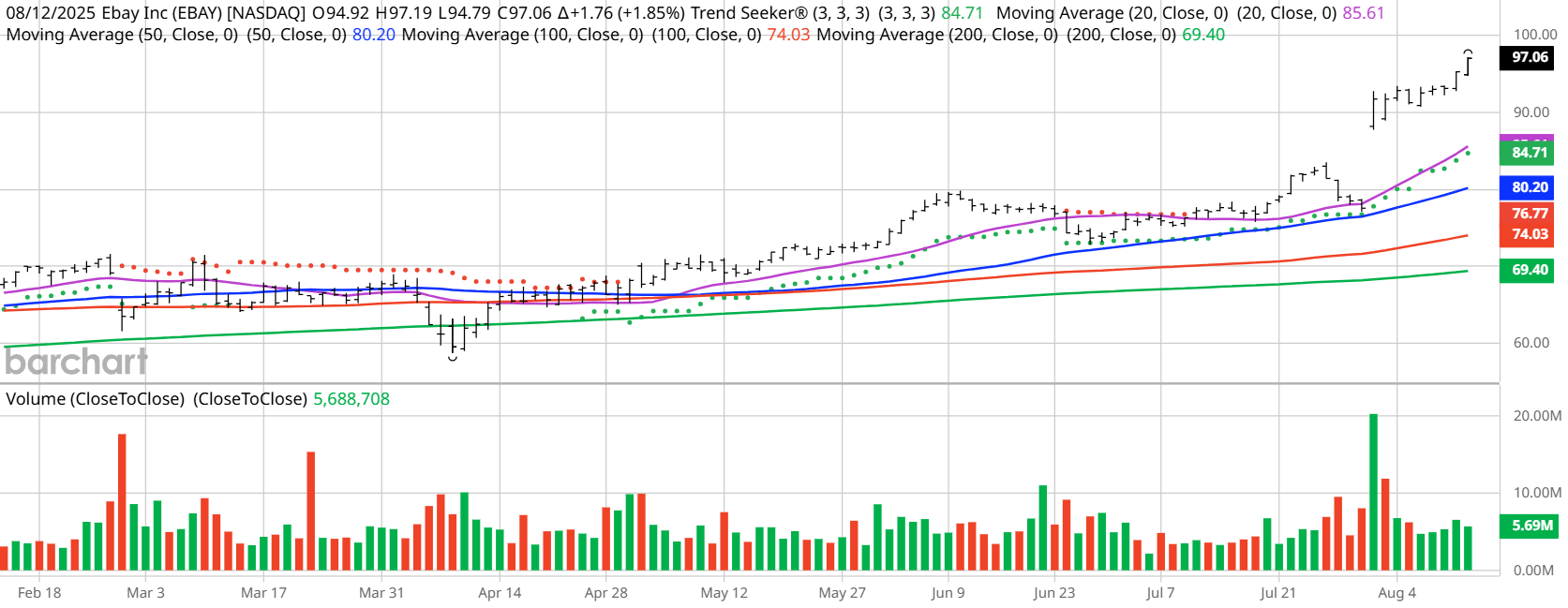

- eBay is showing strong technical momentum, hitting new all-time highs in morning trading on Wednesday.

- The stock maintains a 100% “Buy” opinion from Barchart’s indicators.

- The stock gained nearly 76% over the past year and trades above key moving averages.

- Fundamentals are solid with projected revenue and earnings growth, but eBay’s valuation is mixed with some analysts calling it overvalued.

Today’s Featured Stock

Valued at $44.4 billion, eBay (EBAY) is an online shopping site that allows visitors to browse through available products listed for sale or auction through the company’s online storefront. Over the years, the company has evolved from a relatively small community user-based auction site to a commercial behemoth.

What I’m Watching

I found today’s Chart of the Day by using Barchart’s powerful screening functions to sort for stocks with the highest technical buy signals; superior current momentum in both strength and direction; and a Trend Seeker “buy” signal. I then used Barchart’s Flipcharts feature to review the charts for consistent price appreciation. EBAY checks those boxes. Since the Trend Seeker signaled a buy on July 10, the stock has gained 25.69%.

EBAY Price vs. Daily Moving Averages:

Barchart Technical Indicators for eBay

eBay shares hit a new all-time high on Aug. 13, touching new highs above $98 in morning trading.

- eBay has a Weighted Alpha of +89.64.

- EBAY has an 100% “Buy” opinion from Barchart.

- The stock gained 74.47% over the past year.

- EBAY has its Trend Seeker “Buy” signal intact.

- eBay is trading above its 20-, 50-, and 100-day moving averages.

- The stock made 13 new highs and gained 26.03% in the last month.

- Relative Strength Index (RSI) is at 81.16%.

- There’s a technical support level around $95.50.

Don’t Forget the Fundamentals

- $44.4 billion market capitalization.

- 23.13x trailing price-earnings ratio.

- 1.2% dividend yield.

- Revenue is projected to grow 5.45% this year and another 4.76% next year.

- Earnings are estimated to increase 11.92% this year and an additional 9.01% next year.

Analyst and Investor Sentiment on eBay

I don’t buy stocks because everyone else is buying, but I do realize that if major firms and investors are dumping a stock, it’s hard to make money swimming against the tide.

It looks like Wall Street analysts are bullish on EBAY, but Morningstar is not.

- The Wall Street analysts tracked by Barchart have issued 9 “Strong Buy,” 2 “Moderate Buy,” 17 “Hold,” and 2 “Sell” opinions on the stock.

- Their price targets are between $60-$107.

- Value Line gives the stock its above-average rating.

- CFRA’s MarketScope Advisor gives the stock a 4-star “Buy” rating with a price target of $107.

- Morningstar thinks the stock is overvalued by 51% with a fair value of $63.

- 8,011 individual investors on Motley Fool think the stock will beat the market while 1,550 think it won’t.

- 99,110 investors monitor the stock on Seeking Alpha, which rates the stock a “Hold.”

The Bottom Line on eBay

EBAY currently has momentum and is hitting new highs.

I caution that EBAY is volatile and even speculative in the current environment, which means investors should use strict risk management and stop-loss strategies.

More By This Author:

Penny Stock ARTW Has Doubled In Just The Last Month

This AI Stock Has Nearly Tripled In The Last Year

There's Nothing Soft About Microsoft Stock

Disclosure:

The Barchart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stocks are ...

more