Restaurant Stocks Getting Burnt

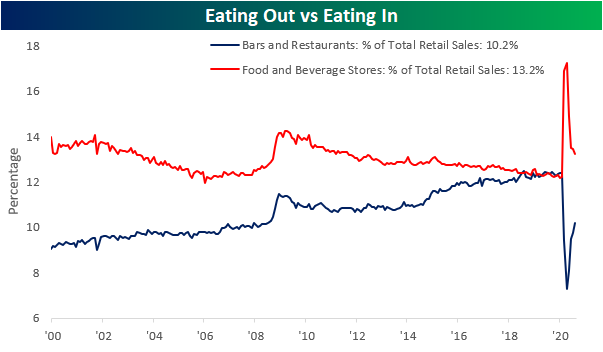

In our recap of last week’s retail sales report, we noted how there is evidence of a trend of Americans returning to spending habits prior to the pandemic. Namely, that can be seen through spending at bars and restaurants which was the strongest category in August having grown 4.71% month over month. The past decade has seen spending at bars and restaurants as a percentage of total retail sales gaining share and eventually overtaking spending at food and beverage stores. In other words, Americans began to spend more eating out than eating in; that is up until the pandemic. COVID’s reversal of this trend reached an apex in April, but more than half of that move has since been erased. Now bars and restaurants account for 10.2% of total retail sales versus 13.2% for food and beverage stores. So while bars and restaurants have taken a big hit and are far from out of the woods, recent months have seen improvements.

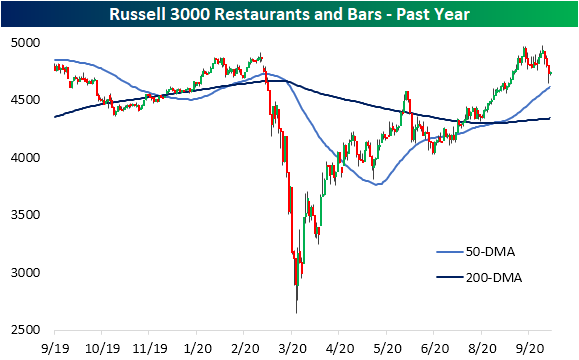

While aggregate spending data for bars and restaurants is not yet back to pre-pandemic levels, the Russell 3000 Restaurants and Bars group has managed to recover all of its COVID-Crash declines. Since its low in mid-March, the index has been trending higher having rallied 63.8%.

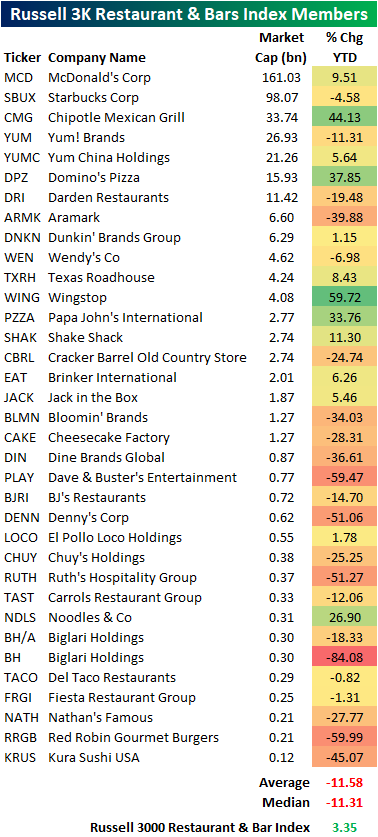

This index includes 35 stocks with a variety of niches ranging from fast food like McDonald’s (MCD) to coffee chains like Starbucks (SBUX) and Dunkin (DNKN) to less grab-and-go oriented chains like Dave and Buster’s (PLAY). Although the index may look like it has held up well at face value and is currently positive on a year to date basis, under the hood the individual stocks of the index are painting a weaker picture. Whereas the cap-weighted index is up 3.35% YTD, the average stock in the index is down 11.31%. In other words, the strength of the index is not so much a factor of broad strength of restaurant stocks, but instead is a result of solid performance of some key large-cap players like Chipotle (CMG), McDonald’s (MCD), and Domino’s (DPZ) to name a few.

Click here to view Bespoke’s premium membership options for our best research ...

more

You are right that even the successful food stores are coming under pressure as the beaten down chains start to adapt. Costs in general have gone up for everyone as well as the difficulties in selling and providing food to customers. That is, until lots of these restaurants determine to save money on rent and property.