Reopening Trade And Value Rebound

Last Friday when lockdown and COVID news were front and center, we showed how performance was largely reminiscent of the performance during the COVID Crash lasting from 2/19/20 to 3/23/20. Today, that relationship is largely being flipped back on its head with the three deciles of the worst-performing stocks during the COVID Crash now the top performers in today’s session. All other deciles are also higher to start the week but to a much more modest degree.

Looking at some other themes of today’s price action, those stocks that were up the least on a year-to-date basis through the end of last week are underperforming with an average gain of only 13 bps. All other deciles are up around half of one percent or more.

While that relationship is somewhat messy, there is also a clear theme today of value outperformance. As shown in the second chart below, the S&P 500 members with the lowest P/S ratios are outperforming today. The first decile of stocks with the lowest price to sales multiples are up 1.82% on average. That compares to the other end of the spectrum where the stocks trading at the highest premium to sales are down 1.14% on average.

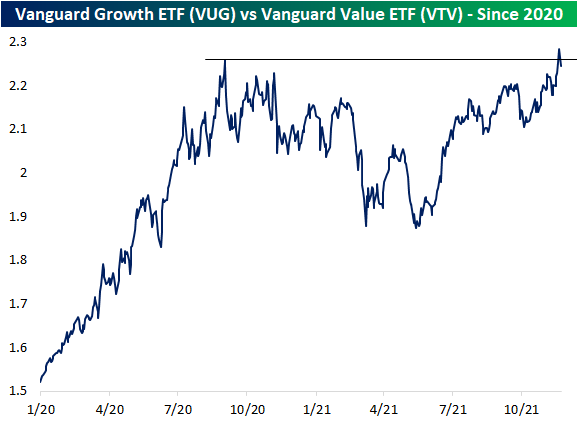

Taking a longer-term look at the relationship of value and growth, in the chart below we show the ratio of the Vanguard Growth ETF (VUG) versus the Vanguard Value ETF (VTV). As shown, the line has been trending higher since the late spring and it even broke out to a new high at the end of last week. The underperformance of growth stocks today is leading that line to fall back below those prior highs.