Renault: Steady Sailing Though Troubled Waters

On February 14, 2019, Renault presented its Q4 2018 and full year results. After the second half of the year, full of dramatic twists and turns, the conference call was highly anticipated by analysts and French retail investors alike. The last 180 days for the French manufacturer were eventful indeed. In November Carlos Ghosn, legendary Renault CEO and creator of the triumvirate of Renault, Nissan and Mitsubishi, was arrested over charges of financial misconduct. This event has shaken confidence of the market in the sustainability of the Alliance (for readers who are not fully familiar with sequence of events following arrest of Carlos Ghosn and for those who would like to refresh their memory, here is a good analysis of the crisis along with short recap of events following the arrest of Ghosn)

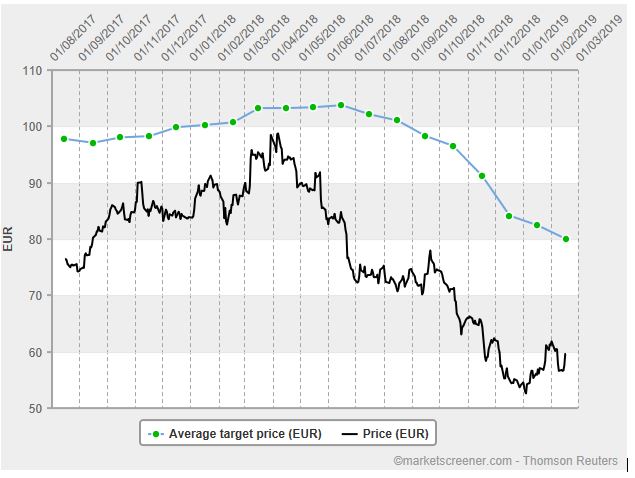

In November we also witnessed an American embargo imposed on Iran, Renault’s sixth biggest market, and economic troubles in three other key markets: Argentina, Brazil and Turkey. The consensus was clear: it is going to be difficult for Renault to report upbeat results. As we can see, prior to the call the average price target for Renault shares was getting lower and lower dropping by 15% from €95 average price tag in October 2018 down to €80 in February.

Renault, however, surprised many with rather stable results, in line with general three-point guidance declared on previous earning call:

-Increase Group revenues (at constant rates)

-Maintain operating margin above 6% and

-Generate positive operational free cash flow.

French car manufacturer managed to hit all three key goals: increasing revenue at constant rates by 2,5%, scoring operating margins at 6,3% of revenues and generating positive cash flow of € 607 mln.

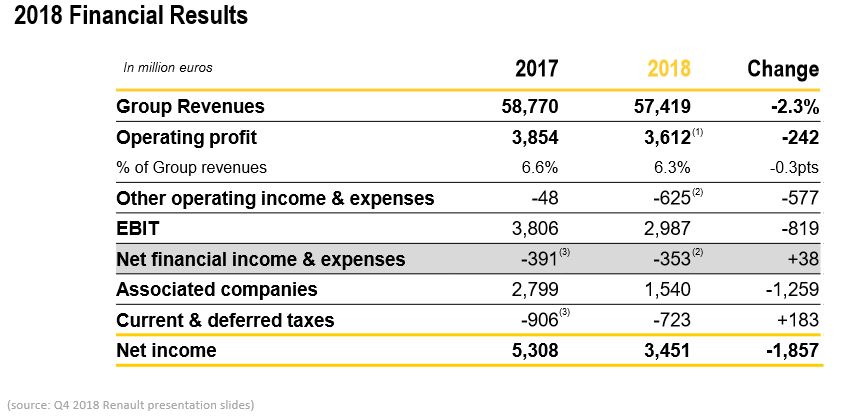

This, however, did not mean that financial situation has improved. On the contrary. In nominal terms revenue decreased by 2,3% down to €57.419 million and even that has been achieved by acquisition of Jinbei & Huasong: China-based light commercial vehicle manufacturer which contributed with sales accounted for165k units to the top line. Operating margins went down from 6.6% comparing on year-to-year basis and free cash flow dived by 35% from €945 down to €607 mln. All this doom and gloom must be looked at from the perspective of very troubled half of the year, and if we take this into account, then we can say that Renault passed difficult stress test, while keeping eyes on the long-term growth plan in rapidly changing and extremely demanding environment of automotive industry.

The reason why I consider this quarter as a decent performance is the view which can we get by looking closer under the bonnet of the earning call.

Starting from the Sales, organic sales dropped y-o-y by 44 thousand units, thus decreasing its share in global market by 0.3% , but if we take into consideration forces majeure such as American embargo on Iran, which reduced units sales for year 2018 by 60.732 units plus Argentinian and Turkish economic meltdown affecting Renault by lowering its sales by another 63.669 units (while increasing market share in Argentina!), we starts to get much more positive image on Renault performance, especially when we will add numbers brought by newly acquired J&H. The acquisition also helped French group to move towards its plans to reduce its exposure to European market by increasing share of international sales up to over 50% (50,6% vs 49,2% in 2017).

Group revenues for year 2018 were equal to € 57.419 million, down from €58.770mln, a significant drop of 2.3%, (- €1.351 mln), but even here we need to look closer, since Renault CFO, Clotilde Delbos, stressed that top line was heavily affected by FX, reducing revenues by whooping €2.224 mln. If we would add such amount to the revenues we would get €59.643, increase by 1.48% from previous year. In year 2017, however, the top line was also affected by adverse exchange rates development, reducing revenues by €924 million. Therefore adjusted 2017 FX revenues would be equal to 59.694, higher than revenues from year 2018 by just €51 million. So, basically, we can say that revenues were flat due to acquisition of Chinese LCV manufacturer J&H. Unfortunately, Renault does not provide information about revenues contribution by brands (excluding AVTOVAZ, producent of Lada), so we cannot judge how much decline of organic revenue we have witnessed in previous year. However, we can try to calculate very rough estimation for J&H contribution to the revenue of Renault Group. J&H sales attributable to Renault for year 2018 were equal approximately 165.000 units, with arithmetic average of price equal to 94.300 Renminbi. If we apply conversion price of Yuan to Euro 0.13, we end up with attributable revenues around €2 billion. And ff we would subtract this number from revenues, the organic revenue dropped by 5.7%! And that doesn’t even consider the fact that sales financing revenues increased, thus cratering organic automotive revenues further by €695 million (or 145 if we take into consideration changes in accounting treatment of interest rate subsidies, reducing automotive revenues by €550 milllion on comparative basis).

One would think, that such extreme drop in revenues had to make big impact on operating margins, making impossible for Renault to keep its operating margins over 6%. Well, such person would be partially correct. While operating profit for a group as a whole has declined moderately by 0,3% down to 6,3% (€3.612 mln versus €3.854 in previous year), automotive segment excluding AvtoVaz has seen reduction of 0.8 percentage points, scoring 4,3%, well beyond the target of 6%. Moreover, second quarter had seen operating margins for automotive segment at level of 4,1% only.

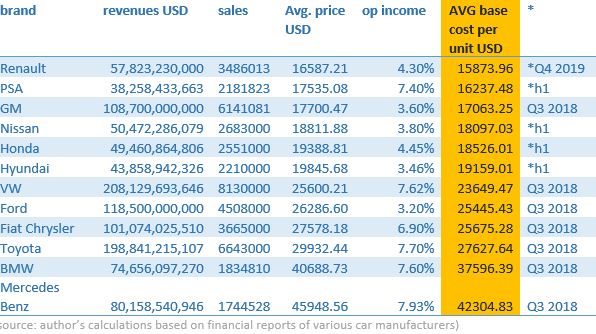

This gives us a glimpse at the biggest Renault moat: cost leadership. The average cost of producing a vehicle for Renault Group (excluding AvtoVaz) in year 2018 was equal to just €14.047, or $15.873 (calculated as automotive revenues less operating margins divided by unit sales) , firmly placing the group at the first place in automotive industry, at least if we consider big groups with international presence (excluding KIA for which I could not find reliable data). (tab below)

The incredible ability to maintain decent operating margins despite such drop in revenues has been attributed to cost reductions derived from application of Monozukuri - Japanese manufacturing methods and changed mix of sold cars in favour of cheaper brands and models, mostly due to continuous increase of Dacia popularity- the indisputable leader of value-for-money car in small cars, as well as in family SUV category.

EBIT for year 2018 was understandably lower (€2.987 mln) than in previous year (€3.806 mln), being negatively impacted by €625 million in extra expenses, but majority of these costs were non-recurring in nature. In 2018 company spent around 300 million on retirement program alone. Also, Argentinian hyperinflation caused impairment of Argentinian assets for €213 million, significantly contributing to reduction of EBIT. Surprisingly, net financial income & expenses improved over last year from €-391 to €-353 mln. Mostly due to the fact, taht cost of debt servicing has decreased in last year from 451 million to 332 million, even when net change in financial liabilities of automotive segment rose almost by €200 million. This shows Renault ability to tap the financial markets on better terms than in the past, thus significantly lowering weighted average cost of debt.

If somebody was hoping for better news from Renault's biggest partner in Alliance, would be bitterly disappointed. Nissan results in last year were also sub-par, therefore its contribution to Renault Group to the bottom line was lower by 13,4% (€1.540 vs 2.799 in 2017) on comparative basis, after we deduct 1.021 of extra dividends attributable to Renault from Nissan divestiture in Calsonic Kansei in year 2017.

These beating from all sides heavily affected Renault bottom line, lowering yearly net income of French Group to €3.451 mln, down from €5.308 mln, thus experiencing drop by 35%. It means, that new EPS dropped down to €12.24, a significant fall from 2017 €19.23 per share. As Tierry Bollore said during Q&A session “All-in-all, 2018 headwinds cost us about €3.6 billion in revenues and one point of operating profit margin”.

Yes. It is hard to disagree with Renault CEO. This was very difficult year for Renault indeed, but considering number of headwinds which French manufacturer had to experience, I conclude that Renault passed very difficult stress test, being able to fully cover its dividends by free cash flow (€607 million) and dividends (€828 million) received from listed companies. Moreover, current dividend yield became very attractive for potential investors, providing yield of little over 6,1%, even when proposed amount of €3.55 per share is in line with previous year (subject to approval on annual meeting). The pay-out ratio is on little high side, reaching 77%, however if we consider recent headwinds as one-off events, then we shall sleep well at night, knowing that our dividends are secure. Additionally, during Question and Answers session Renault representative hinted that dividends might be increased in not so distant future due to the fact that Renault Finance finished improving its balance sheet to meet European Central Bank requirements, and shall be in position to contribute to dividends in the future, however exact figures has not been declared.

2019 Outlook

Looking at the coming year, I am assured, that management has everything under control and Renault will get back to organic growth, thus improving significantly its bottom line. Accordingly to management forecast, in 2019 Brazil market shall rise by 10% and in Russia by 3%. There is also some small hope that INSTEX- new Iran trade mechanism implemented by EU, could be extended to non-humanitarian trade, thus allowing Renault group returning to Iran- Renault’s sixth biggest market before American embargo. Also, in second half of 2019 Renault will introduce new iterations of some of its models, alongside with first affordable coupe SUV crossover in a shape of Renault Arkana. If we add new EV SUV- K-ZE to the range for year 2019 then we shall rest assured that such mix shall boost sales.

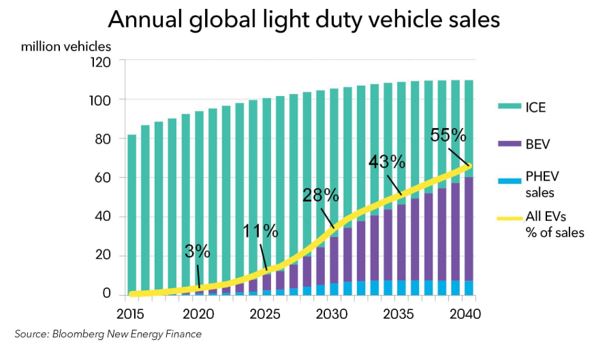

Mr Thierry Bollore, Renault CEO, was cautious with goals for Renault for year 2019. He hopes to increase revenues on constant exchange rates basis, to maintain group operating margins around 6% and again to generate positive automotive operational free cash flow. What was more important, Mr. Bollore, reiterated mid-term ambitions of achieving 70 billion in revenue, 7% of operational margins and 4,2billion in cost savings till year 2022. He also revealed, that EV segment of Renault Group achieved profitability, which is impressive indeed if we look at the price of Renault EV offerings in comparison to its counterparts. Renault ZOE base model can be purchased for only €23.200, and has range of 146 miles on full charge., being awarded by whatcar? for best electric car for less than £30.000. We shall not forget, that Renault, despite increased competition, was able to maintain its European leadership in EV market, rising sales of its EV offer by 37% y-o-y, and enjoying 22% of European market share. Right now, EV offering represents more than 3% of Group revenues, keeping its ahead of market average, we shall see 3% of EV participation in global car market in 2020. Additionally, Renault CEO, Mr Thierry Bollore reassured, that alliance has developed shared EV platform, the EV2020, and full range of new EV models shall follow in 2020 at, as usually in Renault case, very competitive price. “We are full, speed full throttle on this. And that's why we have been investing significantly in 2018 as well in order to have no limits to answer the market needs. We are investing a lot as you know for the next projects, not only in Europe, but also in China and all over the world. And we are making that happen because we have no fear to fuel not only the growth but the profitable growth that we need with electric cars today.”

Speaking of which, Renault kept CAPEX spending on high level, reaching level of almost 10% of its revenues, which bodes well for the future, especially that French producer is laser-focus on developing its EV segment and aiming to acquire significant share of Asian markets. The main focus in Asia remains China, where Renault and Alliance were busy buying out LCV manufacturers, ev startups, autonomous vehicle service, and charging solutions and services for EV. So, looking at the amount of time, money and effort dedicated to Middle Kingdom, we can certainly hold high hopes for Renault future on Asian markets- the biggest growth potential markets in the world in mid-term. And if we add increasing presence in America and leading position in Africa, I am assured that Renault will perform well in long-term, still having plenty of space for further growth (North America!).

Of course, we had also some insight on plans to reduce costs even further. Accordingly to FAST- new program introduced by Renault to increase its competitiveness, the company aims to reduce development cycle of new cars to three years, improve efficiency and reduce fixed costs by 5% per year over three years period. It is ambitious plan indeed, but some progress has been made already. In 2018 number of cars produced per employer has increased by 7% up to 77 cars per year, and some of Renault manufacturing facilities already reached final goal of producing over 100 cars per employee per year. Altogether total savings derived from FAST program alone shall reach €1billion within three years, significantly increasing Renault moat of a cost leader and improving operational margins at the same time.

But before some reaches long term horizons, there is always present time. And here Renault was struggling, which has been reflected in bottom line, shares price and most of its financial indicators. I believe that these headwinds are temporary, caused by market anxiety after arrest of Carlos Ghosn, meltdown of Argentinian and Turkish economy, American Embargo on Iran, introduction of WLTP protocol in Europe and some other non-recurring costs. But full valuation of the Renault Group will be performed in follow-up article.

Therefore, for now, Renault is a hold for current shareholders, and new investors shall wait until second quarter financial updates, where Renault financials shall reach inflection point.

Disclosure: Author is long Renault and has no plans to add/sell its holdings within next 72 hours.

Good article, thanks for sharing.

glad you like it.