Put Some ZIP In Your Portfolio With Maritime Shipper ZIM

I have selected ZIM Integrated Shipping Services (ZIM) as one of the key maritime shippers that is currently benefiting from the above issues. I believe it will continue to do so. In fact, I think it is the best of the best.

What could cause me to change my analysis? If we all retrenched into our caves and hunkered down, buying nothing but bales and bales of toilet paper, I suppose we might see a significant slowdown in the global trade of essential as well as non-essential goods. barring that kind of lockdown scenario, I expect the world's best shippers to continue to reap the higher prices they are now receiving in order to "deliver the goods."

Why are ports all over the world so congested?

Using the United States as the best example of a developed nation with a large consumer base, in 2020 billions of dollars were printed in order to protect the income for so many who had either lost their jobs or were afraid to go to their jobs. While some citizens found that working from home or some other remote location allowed them to continue earning their salary, others desperately needed that hand up.

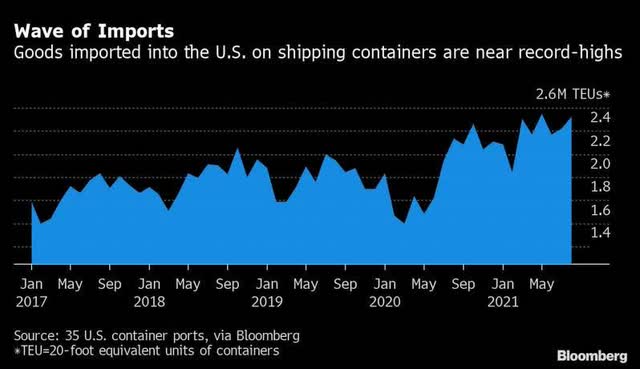

However, the money that was distributed went to all citizens regardless of need. As a result, many people had more discretionary income as a result of the COVID-19 pandemic then they had before it. With nowhere to go in terms of travel, less dining out and going to theme parks and such, many people had money burning a hole in their pockets. When finally they could spend that money somewhere besides Amazon, the floodgates were opened.

Source: marinetraffic.com

Buying switched from disinfectants, trinkets, and home-delivered pizza to new homes in different locations, furnishings and appliances for those new homes, clothing, home renovation fixtures and lots and lots of consumer goods. This trend might have reached its peak this quarter, but the idea that it will suddenly evaporate is completely misguided.

We may make progress around the edges, but I do not see a sudden opening of international commerce anytime soon. There will be those who disagree and if they take action on that disagreement and sell or short some of the fine shipping companies I have researched it would be a fine time to buy even more.

What options do the ports have to be able to move more goods?

Very few. The president may proclaim that he is going to increase operations at US ports to a 24/7 operation at each one of them. He can proclaim all he likes, but unless he is prepared to forcibly induct a civilian conservation corps of untrained additional workers -- with all the problems that would entail -- then there are simply not enough longshoremen and other portside workers to be able to take this on. Besides, a Union Man in good standing for 50 years does not want to rile the ILWU (International Longshore and Warehouse Union.) This union makes Hoffa and the Teamsters look like saints.

Speaking of the Teamsters, even if somehow all those additional dockworkers could be recruited and trained in time to have any effect, there is the issue of hiring hundreds or thousands of additional truck drivers. Again, edicts alone do not create qualified truck drivers.

Even if we could hire enough longshoremen, truck drivers, and other essential personnel, we still face the issue of training them to safely do the job. It takes months of training and years of experience to do it right. Add to this the fact that there are empty containers blocking access that have to be moved by trucking companies in order to clear the space needed for incoming containers.

Even then, US ports highways and railways would require massive new infrastructure and upgrades to be able to handle all the container ships and dry bulk carrier's goods and grains. To simply fill a pothole these days road crews have to reduce traffic to one lane. To take on the massive task of increasing the road and rail infrastructure to get the products out of the ports once the ships have unloaded would mean traffic tie-ups for months on end.

These facts are frustrating to us all. It would be nice to be able to wave a magic wand and open up the ports and railways and highways two incoming goods. But there is no magic wand. And this would not be the time to make the situation worse well providing the optics of making it better.

How does port, rail, and trucking constrictions and impediments affect global shippers?

it makes them temporarily more profitable. Again, there will be those who see this essential part of the supply chain declining from peak congestion and conclude that shipping rates will be coming down. This could happen for a couple weeks, perhaps a month, perhaps at one or two ports, or even more. But the trend of rates remaining, if not at a peak at least quite high, is the investor's friend in the shipping arena.

With a roughly 40% chance that any individual ship's cargo will arrive from manufacturer to builder, retailer, or consumer on time, shippers must respond by allowing for all of these possible problems and also will always be more willing to go out on a limb for clients who are bidding the highest prices to get their products from one destination to another.

Which shipping companies are likely to reward investors the best?

The glib answer Is that the entire industry will be likely to benefit. But I am not looking to find some company that has six or seven vessels or vessels that are older or companies that have too much debt from obtaining said vessels. I want to stick with the quality companies. The one that clearly bubbles to the top is ZIM Integrated Shipping Services Ltd.

ZIM is no new kid on the block. Founded in 1945, it is now an Israeli company with its headquarters in Haifa, Israel. ZIM provides container shipping and related services in Israel and internationally. No small fry in the business, ZIM operates a fleet of 101 vessels. Most of these are leased ships. ZIM leases the ships on a long-term basis but has the right to charter them out short or long term. They do own some newer ships that give them assets to use without having to bid for leasable ships. The combination of these two approaches gives ZIM maximum flexibility.

While ZIM competes in a crowded market, the market is a responsible one. It is not the Wild West, as some other analysts have written. All the players understand that they cannot simply raise their rates into the stratosphere without sovereign nations' regulators coming to the rescue of beleaguered consumers. This recognition may make it difficult to raise prices further, but if it reduces the chances of government intervention in the freight markets, it is the right path to take. Besides, charging more isn't necessary for the shares to be a great value at the current price.

Highly liquid, ZIM is currently selling about 15% off its high from last month. The company is set to declare earnings today, November 17, so that will make it a volatile day for the company's shares.

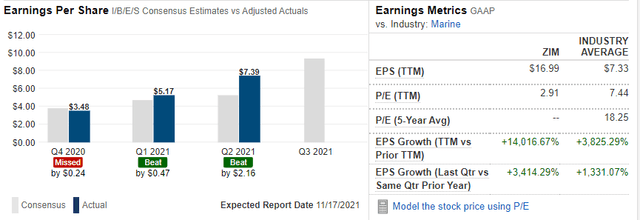

Source: Seeking Alpha

To help you make your decision, here are some key metrics:

Source: Fidelity.com

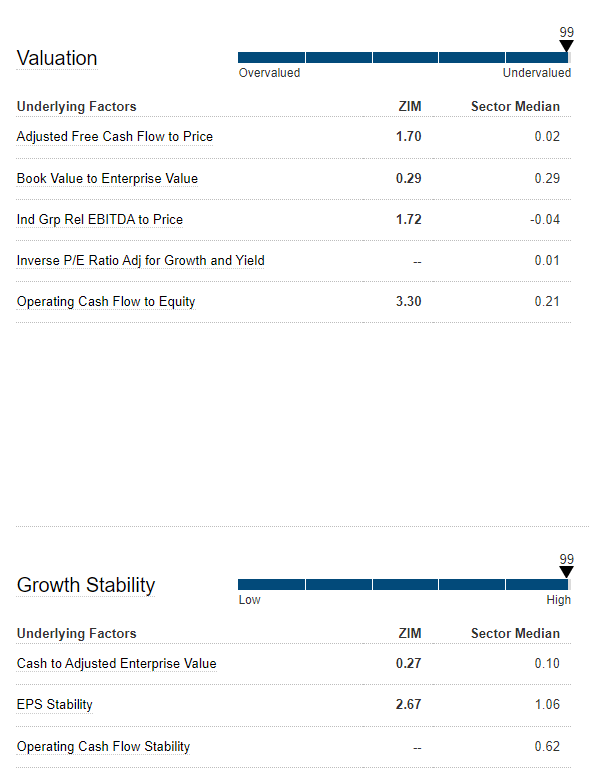

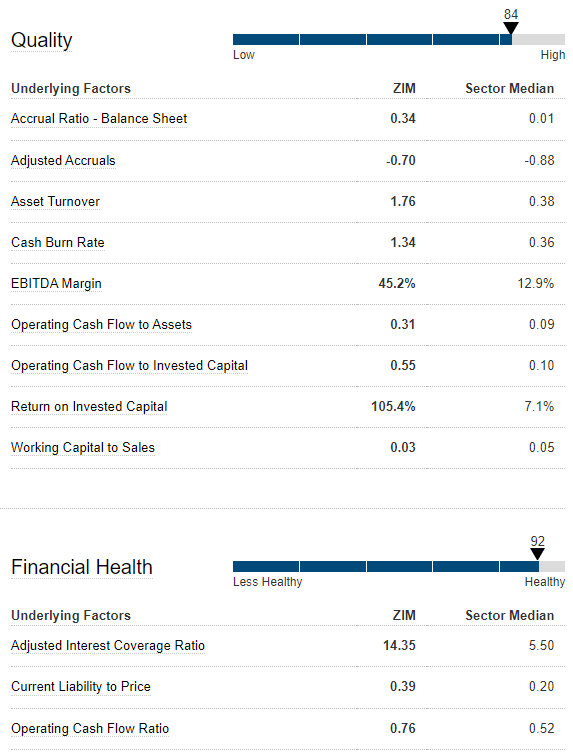

And here are some fundamental analysis indicators of value from S&P Market Intelligence:

Source: Fidelity.com

Are there risks with this company?

There are risks with any investment. If container rates come down that will affect the company adversely. I don't see them coming down more than incrementally for the next 3-9 months, but it is a possibility.

Ocean transportation is a commoditized service and ZIM is not the biggest kid on the block. Companies with deeper pockets might be able to afford to slash rates to gain market share.

Oil prices could skyrocket - they have done it before. ZIM's new build projects will be LNG powered, but the primary fuel of their existing fleet is a crude oil product.

I don't see any of these as major factors in my consideration of to buy or not to buy. If container prices stay even within 20% of current pricing, this is a company with real assets, little debt, a great business plan and excellent management.

Source: PLS Logistics.com

Update: This morning's Q3 earnings release

- Net income for the third quarter of 2021 was $1.46 billion or $12.16 per diluted share, compared to $144 million or $1.36 per diluted share in the third quarter of 2020, a year-over-year increase of 913% and 794%, respectively

- Adjusted EBITDA for the third quarter of 2021 was $2.08 billion, compared to $262 million in the third quarter of 2020, a year-over-year increase of 693%

- Operating income (EBIT) for the third quarter of 2021 was $1.86 billion, compared to $189 million in the third quarter of 2020, a year-over-year increase of 884%. Reconciliation items between operating income (EBIT) and Adjusted EBIT in the third quarter of 2021 were negligible

- Revenues for the third quarter of 2021 were $3.14 billion, compared to $1.01 billion in the third quarter of 2020, a year-over-year increase of 210%

- ZIM carried 884 thousand TEUs in the third quarter of 2021, a year-over-year increase of 16%

- The average freight rate per TEU in the third quarter of 2021 was $3,226, a year-over-year increase of 174%

- Net leverage ratio of 0.0x at September 30, 2021, compared to 1.2x at December 31, 2020

- Announced the strategic long-term chartering agreement and option exercise with Seaspan for a total of 15 x 7,000 TEU LNG-fueled vessels, further demonstrating ZIM's commitment to reducing its carbon footprint

- During the third quarter of 2021 and subsequent to quarter end, ZIM purchased eight (8) second-hand vessels for total consideration of approximately $355 million

Eli Glickman, ZIM President & CEO, stated, "We are very proud of ZIM's significant accomplishments since our IPO earlier this year. The company's continued outstanding performance is a direct result of our team's strong execution and success proactively capitalizing on both the highly attractive market and our differentiated approach… Importantly, we have once again delivered industry-leading margins, outperforming the sector's average."

Mr. Glickman added, "During a time when we have posted record quarterly results, we are pleased to further allocate capital to enhance our commercial prospects and unlock shareholder value. …we are now transitioning to paying quarterly dividends to provide shareholders with an immediate and more frequent return. Accordingly, we will be paying in December 2021 a $2.50 per share interim dividend for the third quarter, representing approximately 20% of quarterly net income."

At these prices, I am a buyer.

Disclosure: I/we have a beneficial long position in the shares of ZIM either through stock ownership, options, or other derivatives.

Disclaimer: Unless you are a client of my advisory firm, ...

more