Pure Play Quantum Computing Portfolio Down 3% In May

Image Source: Unsplash

An Introduction

Only 4 companies are focused exclusively (i.e., pure play) on developing quantum capabilities and they have a realistic opportunity of soaring in the next few years. This article provides an explanation as to what quantum computing (QC) is all about, its merits and how these 4 companies performed in May, in descending order, and YTD, along with a description of their business focus, and their latest news, commentary and/or analysis.

What Is A Pure Play Company?

A pure play company concentrates all its efforts on a single line of business, and in this context, it’s quantum computing. Notably, those companies that are highly diversified, i.e., do not generate at least 50% of their sales from quantum computing products and services, such as *(Microsoft (MSFT), Nvidia (NVDA), Alphabet (GOOGL), Amazon (AMZN), Advanced Micro Devices (AMD), IBM, Intel (INTC), Honeywell Int'l (HON), Baidu (BIDU) and Micron Technology (MU) are excluded from our new Pure-Play Quantum Computing Portfolio which is replacing our Quantum Computing Hardware Developers Portfolio which contained a number of non-pure play constituents.

What is Quantum Computing?

In a nut shell, the better the computing power, and the more data, the better a model will perform and, as such, the race is on for companies to radically upgrade the computing power of their AI models. That's where "quantum computing" comes in. Check out this video on Quantum Computing: 4 Things You Need to Know.

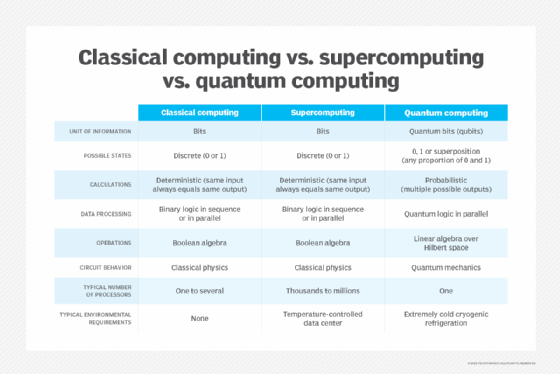

"Classical mechanics" explain how and why things work but the discovery of the electron unveiled a new world of super-small things that has its own set of rules known as "quantum mechanics".

AI is the biggest technological paradigm shift since the internet. In the early 1990s internet stocks started outperforming all other sectors in the market – and they didn’t stop outperforming for a whole decade:

- a $10,000 investment in Oracle (ORCL) in 1991, for example, would have turned into $900,000 (890%) by 1999,

- a $10,000 investment in Cisco (CSCO) would have turned into $1.4 million (+1,390%) and

- a $10,000 stake in Qualcomm (QCOM) would have grown to over $1.5 million (+1,490%).

The current convergence of AI and quantum computing has a realistic opportunity of experiencing the same type of returns in the next 10 years.

Here's a list of a number of companies building quantum computers, a description of their efforts and successes, and their stock performances year-to-date (YTD), market capitalizations, and stock prices as of the end of July.

The New Pure-Play Quantum Computing Portfolio

- IonQ (IONQ): DOWN 3.1% in May; DOWN 34.2% YTD

- develops QC hardware, is the first to have its computing systems available via all the major public cloud services, and plans to build a network of quantum computers accessible via the cloud.

- Market Capitalization: $1,630M

- Latest News, Commentary and/or Analysis:

- Quantum Computing (QUBT): DOWN 4.0% in May; DOWN 20.8% YTD

- is an innovative quantum optics and nanophononics technology company developing photonic qubits that offer a number of key advantages over trapped ions or superconducting qubits.

- Market Capitalization: $64M

- Latest News, Commentary and/or Analysis:

- None

- Rigetti Computing (RGTI): DOWN 11.3% in May; UP 7.1% YTD

- specializes in superconducting qubit technology and has developed a suite of software tools and algorithms for programming and simulating quantum computations.

- Market Capitalization: $175M

- Latest News, Commentary and/or Analysis:

- D-Wave Quantum (QBTS): DOWN 6.3% in May; UP 53.4% YTD

- is the leading provider of QC systems and software with a focus on quantum annealing technology.

- Market Capitalization: $225M

- Latest News, Commentary and/or Analysis:

Summary

On average, the above 4 pure play QC stocks were DOWN just 1.5% last week, DOWN 3.3% during the month of May and are now DOWN 25.2% YTD.

More By This Author:

Pure Play Cybersecurity Software Stocks Portfolio Down Almost 4% In May

Pure-Play Cloud Computing SaaS Stocks Portfolio Down 15% In May

Small Cap AI Stocks Portfolio Jumped 18% In May

Disclosure: None

This article has been composed with the exclusive application of the human intelligence (HI) of the author. No artificial intelligence (AI) technology has been deployed. ...

more