Pure-Play AI Chip Stocks Declined 5%, On Average, In July

Introduction

There are 6 stages involved in the production and distribution of semiconductor devices such as microprocessors, memory chips, and sensors, involving multiple companies, each with their own specialized contributions. Those six are:

- EDA (electronic design automation) companies with sophisticated software that assist engineers in the custom design and development of complex chips;

- equipment and material suppliers that provide essential equipment for manufacturing chips such as lithography machines, etching, test and packaging equipment, automation and inspection systems and production materials such as chemicals, gases, wafers and packaging;

- factories (called foundries in semiconductor jargon) that concentrates all their efforts in the manufacturing of chips based on the designs provided by other semiconductor companies;

- companies that outsource the fabrication (or fab) of chips to specialized foundries while designing and selling the chips;

- companies that assemble chips into finished semiconductor components, tests for defects and do the very specialized packaging of the chips for shipping assembly.

- In addition, there are IDMs (Integrated Semiconductor Manufacturers) that do all of the above elements themselves to control the entire production process.

The 6 semiconductor segments (portfolios) are presented below, in descending order, for the month of July highlighting those constituents in each portfolio that had stock price changes of 5% or more, and any pertinent news, analyses and commentary.

- The Fabless Portfolio: down 0.3% in July

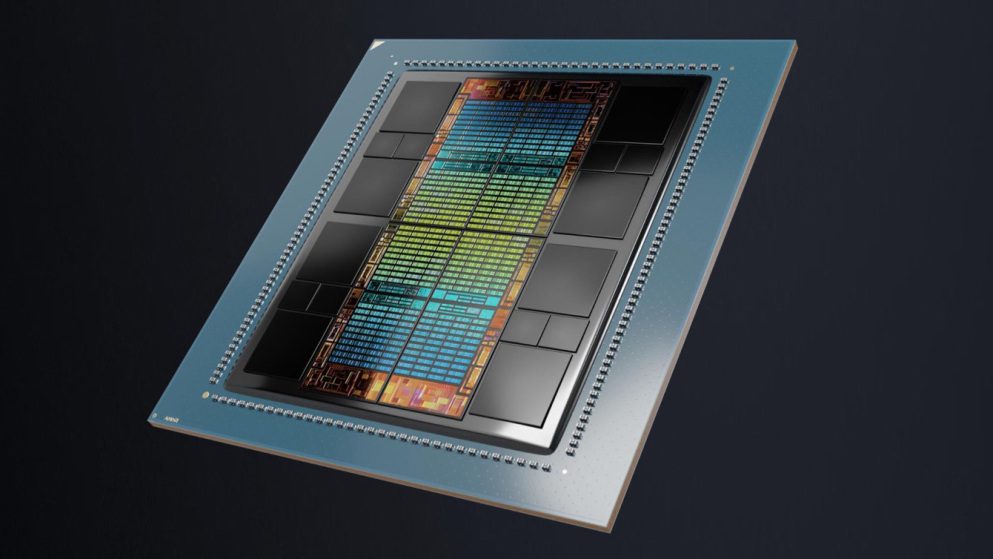

- Constituents with +/- 5% Price Changes: MPWR (+5.0%); NVDA (-5.3%); QCOM (-9.2%); AMD (-10.9%);

- Other Constituent Changes: AVGO (No Change); MRVL (-4.2%)

- Pertinent news, analyses and commentary:

- Do More U.S. Restrictions on China Make AMD a Risky Bet?

- Nvidia, AMD are among the chip stocks falling on China fears. Here’s why you shouldn’t panic

- Should You Consider Adding Marvell Technology (MRVL) to Your Portfolio?

- Nvidia and Broadcom (AVGO) Complete 10-for-1 Stock Splits. History Says They Will Do This Next

- The Foundries Portfolio: down 2.4%

- Constituents with +/- 5% Price Changes: None

- Other Constituents: TSM (-4.6%); UMC (-4.5%); TSEM (-3.4%); GFS (-0.9%)

- Pertinent news, analyses and commentary:

- The IDM Portfolio: down 2.5% in July

- Constituents with +/- 5% Price Changes: IFNNY (-5.2%); STM (-14.1%); MU (-16.5%)

- Other Constituents: TXN (+4.8%); ADI (+1.4%); INTC (No Change); NXPI (-2.3%); MCHP (-3.0%)

- Pertinent news, analyses and commentary:

- The Assembly, Test and Packaging Portfolio: down 5.7% in July

- Constituents with +/- 5% Price Changes: ASX (-12.2%); AMKR (-18.4%)

- Other Constituents: None

- Pertinent news, analyses and commentary:

- The Equipment and Material Suppliers Portfolio: down 8.2%

- Constituents with +/- 5% Price Changes: ASML (-8.4%); ENTG (-9.9%); AMAT (-10.6%); LRCX (-13.5%);

- Other Constituents: KLAC (-0.2%)

- Pertinent news, analyses and commentary:

- The EDA Software Portfolio: down 8.5% in July

- Constituents with +/- 5% Price Changes: SNPS (-6.2%); CDNS (-13.0%)

- Other Constituents: None

- Pertinent news, analyses and commentary:

Summary

On average, the above 6 segments were down 5.4% in July but remain up 22.6% YTD.

More By This Author:

Pure-Play Quantum Computing Stocks Up 12% In July; Still Down 29% YTD

Micro/Small Cap AI Stocks Portfolio Up 14% In July; Now Up Marginally YTD

Pure-Play Cloud Computing SaaS Stocks Lagged Expectations In July: Down 3%

Disclosure: None

This article has been composed with the exclusive application of the human intelligence (HI) of the author. No artificial intelligence (AI) technology has been deployed. ...

more