Pure-Play Quantum Computing Stocks Up 12% In July; Still Down 29% YTD

Image Source: Unsplash

What Is Quantum Computing?

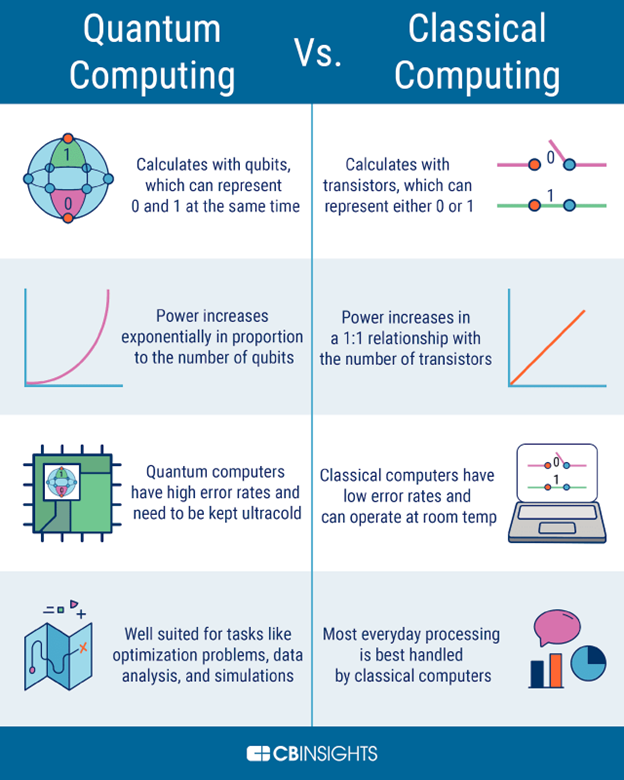

- Currently, computers operate on a binary system that are equipped with chips that use bits to perform computations. These bits are limited, though, and can only show a value of zero or one, so it takes a lot of zeros and ones arranged in specific orders for a computer to do anything.

- On the other hand, however, quantum computers operate with subatomic particles that use quantum bits (qubits) to allow the particles to exist simultaneously in more than one state. This increases processing speeds dramatically and quicker processing speeds mean that computers can tackle more complex problems, which will improve predictive analytics, pattern recognition and complex optimization tasks.

Source: CBInsights

Building a quantum computer is extremely expensive, complex and massive, and needs to be kept in stable laboratory conditions, and cooled to nearly absolute zero (-459 degrees Fahrenheit) and, as such, are primarily confined to very few small, innovative companies developing and leveraging quantum computing.

The munKNEE Pure-Play Quantum Computing Stocks Portfolio

Our Pure-Play Quantum Computing Stocks Portfolio only consists of those companies that concentrate all their efforts on a single line of business, in this case quantum computing (QC). Companies that are also involved in the research and development of quantum computing but are also involved in other aspects of AI technology, such as Microsoft (MSFT), Nvidia (NVDA), Alphabet (GOOGL), Amazon (AMZN), Advanced Micro Devices (AMD), IBM, Intel (INTC), Honeywell Int'l (HON), and Baidu (BIDU), are excluded from this analysis.

There are only 4 pure-play QC companies and below is how they performed, in descending order, in July and YTD along with a description of their business focus, market capitalization and any news, analyses and/or commentary that explains their stock movements in July, where available.

- Quantum Computing (QUBT): UP 36.0% in July; DOWN 25.3% YTD

- Company Focus: developing photonic qubits that offer a number of key advantages over trapped ions or superconducting qubits

- Market Capitalization: $58M

- Latest News, Analyses and/or Commentary:

- IonQ (IONQ): UP 15.9% in July; DOWN 34.2% YTD

- Company Focus: planning to build a network of quantum computers accessible via the cloud using trapped-ion technology in its processing units which relies on suspending ions in space using electromagnetic fields, and transmitting information through the movement of those ions in a “shared trap.”

- Market Capitalization: $1,590M

- Latest News, Analyses and/or Commentary:

- Rigetti Computing (RGTI): DOWN 3.7% in July; UP 5.1% YTD

- Company Focus: specializes in superconducting qubit technology and has developed a suite of software tools and algorithms for programming and simulating quantum computations

- Market Capitalization: $163M

- Latest News, Analyses and/or Commentary:

- D-Wave Quantum (QBTS): DOWN 12.3% in July; UP 13.6% YTD

- Company Focus: focuses on quantum annealing technology

- Market Capitalization: $128M

- Latest News, Analyses and/or Commentary:

Summary

The above 4 pure-play QC stocks have an average market capitalization of $485M and were UP 11.5%, on average, in July but are still DOWN 28.5%, on average, YTD.

Please note: If you Comment on this article (see below) you will automatically be entered in TalkMarkets' contest (register here) to win an Amazon Echo Show device which has a retail value of $229 and have the ability to engage directly with me and other commentators.

More By This Author:

Micro/Small Cap AI Stocks Portfolio Up 14% In July; Now Up Marginally YTD

Pure-Play Cloud Computing SaaS Stocks Lagged Expectations In July: Down 3%

Pure-Play Cyber Security Software Stocks Portfolio Down 12.5% In July; CrowdStrike Down 39%

Disclosure: None

This article has been composed with the exclusive application of the human intelligence (HI) of the author. No artificial intelligence (AI) technology has been deployed. ...

more