Pullback Area About To Be Reached – Banks Trying

Boy, when the S&P 500 crashes into its average price of the last 200 days that is really like a 12 foot thick, impenetrable concrete wall that no market can even get through. Those nasty bears. Yes, I am of course being sarcastic. The Dow Industrials, S&P 400 and Russell 2000 did not even flinch on their way through those respective levels.

With today’s sharply lower open on the heels of a very heavy day last Friday, the stock market will likely hit my 2-3% pullback from last week’s high. If the strong uptrend remains in place, the pullback level is a point the bulls should try to make another stand. It doesn’t mean they have to or will be successful, but it is an area where they are supposed to fight.

Last week, I week I wrote about the semis and how they looked poised for higher prices. And we still own them although they certainly do not look as wonderful as they did a week ago. Today, let’s look at the banks which have some headwinds with slower economic growth and a flat to inverted yield where they derive so money.

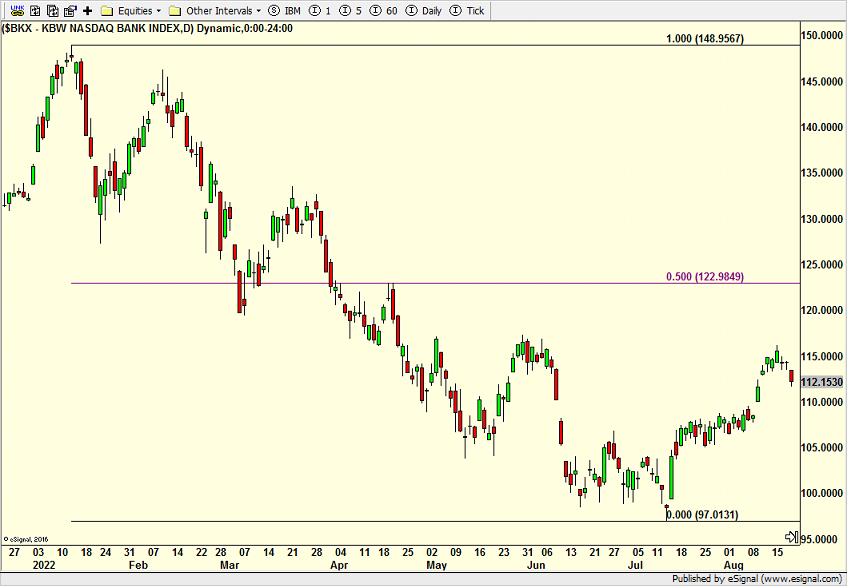

From high to low the banks plunged 35% this year and bottomed in July, well after the stock market. Unless I am really wrong and the rally ended, the banks should find a low and then exceed the early June highs before marching higher to regain 50% of the loss depicted by the horizontal purple line.

(Click on image to enlarge)

If you want to know my biggest concern about the market right now, it’s the high yield bond sector which is acting worse than the stock market. That needs to change or stocks will likely continue lower.

On Friday we bought FAUG and more ARAY. We sold SSO, HYG and some MDY.

More By This Author:

The Magical & Mystical 200 Day Moving Average

Face Ripping Rally

If I Am Wrong The Rally Has Ended

Please see HC's full disclosure here.