Post-Fed Rate Cut: Buy, Hold, Or Sell Nvidia Stock?

Image Source: Pixabay

NVIDIA Corporation (NVDA - Free Report) has crushed bubble fears and has seen a meteoric rise in the past few years amid the advent of artificial intelligence (AI).

CEO Jensen Huang, however, believes NVIDIA’s growth story is just beginning, while the Federal Reserve’s recent jumbo interest rate cuts should help the company access cheaper capital. So, is this the most opportune moment to place bets on the stock? Let’s take a closer look.

Why a Rate Cut Will Boost NVIDIA Stock

In Wednesday’s concluded policy meeting, the Fed trimmed interest rates by half a point to support economic growth and stabilize the labor market. For the first time in four years, the Fed eased its monetary policy and kept the interest rates at 4.75% to 5%.

The Summary of Economic Projections further showed that most Fed officials expect another 50-basis point rate cut by the end of the year, followed by 100 and 50-basis point rate cuts in 2025 and 2026, respectively.

A lower interest rate environment bodes well for NVIDIA since the semiconductor behemoth’s cash flows essential for growth initiatives aren’t affected. At the same time the company’s cost of borrowings gets reduced, eventually boosting the profit margins vis-à-vis the share price.

Post-Rate Cut: NVIDIA Stock Beats the S&P 500’s Return

NVIDIA stock has always performed well after interest rate cut announcements. As a result, the company’s share price increased nearly 4% on Thursday.

According to Dow Jones Market Data, the NVIDIA stock gained, on average, 6.9%, 16.6%, 16.7%, and 20.7% in the month, three months, six months and 12 months following a rate cut.

On the other hand, going back to the 1990s, the S&P 500 Index, on average, gained only 2.9% in the 12 months after a rate cut, indicating NVIDIA stock has more upside than most of the listed stocks in the broader index.

Another Reason Why NVIDIA Stock Popped Yesterday

It’s not just the long-awaited big Fed rate cut that pushed the NVIDIA stock higher yesterday. CEO Jensen Huang’s encouraging comments on the AI movement at the Dreamforce technological gathering hosted by Salesforce, Inc. (CRM - Free Report) also had investors pouring into NVDA stock.

Huang said the AI industry is transforming from tools to an industry of skills, and there is a huge opportunity in the field of AI that NVIDIA can exploit. This has given investors all the more reason to believe that NVIDIA’s stunning growth isn’t over yet. Even though NVIDIA stock has fallen off its record highs, its shares have outpaced the Semiconductor - General industry this year (+138.1% vs +89%).

Image Source: Zacks Investment Research

NVIDIA’s advanced chips are needed to train large language models like ChatGPT and Gemini and function AI interfaces. NVIDIA stock, thus, is expected to gain as the AI industry is projected to grow from around $184 billion this year to $826 billion by 2030, according to Statista.

Moreover, AI is here to stay as its foundation is based on practical applications, unlike the dot com era when companies were involved in speculative businesses.

3 Key Reasons to be Bullish on NVIDIA Stock

Encouraging developments on Blackwell chip production, dominance in the graphic processing units (GPU) market and capability to generate profits consistently also act as tailwinds for the NVIDIA stock.

Huang confirmed that NVIDIA has ramped up the production of cutting-edge Blackwell chips as demand has soared among the likes of Meta Platforms, Inc. (META - Free Report), Alphabet Inc. (GOOGL - Free Report), and Microsoft Corporation (MSFT - Free Report). After all, the Blackwell B200 chip has more AI throughput than the current Hopper H100 chip.

Meanwhile, NVIDIA accounts for the bulk of the share in the GPU market as more developers depend on the CUDA software platform, unlike Advanced Micro Devices, Inc.’s (AMD) not-so-efficient ROCm software platform. NVIDIA, thus, is well-poised to make the most of the rise in the GPU market, which is likely to expand to $1,414.39 billion by 2034 from $75.77 billion this year, per Precedence Research.

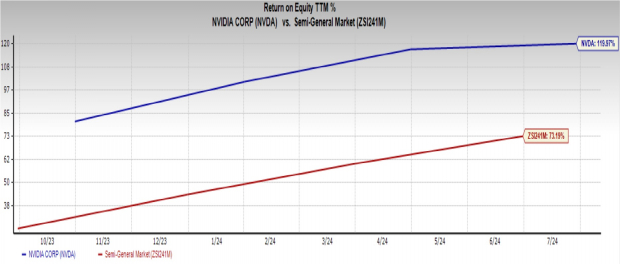

Fundamentally, the NVIDIA stock is sound. This is because its return on equity (ROE) is around 120% compared with the industry’s 73.2%. An ROE above 100% indicates that the company’s net income is more than the equity or that it has given a strong performance.

Image Source: Zacks Investment Research

NVIDIA Stock is Expensive – Here’s How to Trade it

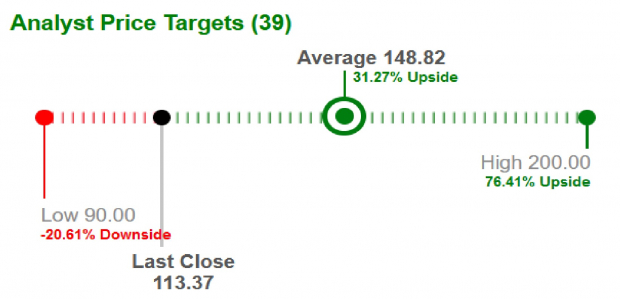

Given the positives, things are looking brighter for the NVIDIA stock. Prominent brokers have increased NVDA’s average short-term price target by 31.3% from the stock’s last closing price of $113.37. The highest price target is $200, an upside of 76.4%.

Image Source: Zacks Investment Research

However, the NVDA stock is still pricey. Per the price/earnings, the NVDA stock, presently, trades at 42.0X forward earnings. However, NVDA’s rivals or the peer group’s forward earnings multiple is 16.4X.

Image Source: Zacks Investment Research

Therefore, investors should wait for the right entry point to buy the stock so it doesn’t burn a hole in your pocket. Those who have invested in NVIDIA should stick to it since the stock has a strong upside. The company currently has a Zacks Rank #3 (Hold).

More By This Author:

Buy 3 High Dividend-Paying Stocks With Attractive Short-Term Returns

Solar Stocks Rally After Presidential Debate: Should Investors Give Chase?

Kimberly-Clark Stock Up 20% YTD: Should You Buy or Hold Tight?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more