Buy 3 High Dividend-Paying Stocks With Attractive Short-Term Returns

Image Source: Pixabay

The September syndrome is already visible in U.S. stock markets. September is known to be the worst-performing month for Wall Street. This year, too, the situation remains challenging. Major stock indexes suffered significant losses in the first week of this month. However, last week, was the best for these indexes in 2024.

Wall Street is currently riding on high expectations of the beginning of the interest rate cut regime by the Fed in the September FOMC meeting scheduled next week. The existing range of 5.25-5.5% marks a 23-year high level. If the Fed initiates a rate cut, it will be the first one since March 2020, at the onset of COVID-19.

At this stage, investment in stocks with high dividend yield strong price appreciation potential in the short term should enhance portfolio returns. Three such stocks are — The AES Corp. (AES - Free Report), Pfizer Inc. (PFE - Free Report), and Unum Group (UNM - Free Report). These stocks currently carry a Zacks Rank #2 (Buy).

Buy 3 High Dividend-Paying Stocks

The AES Corp.

The AES Corp. is one of the forerunners in the utility industry's transition to clean energy by investing in sustainable growth and innovative solutions while delivering superior results. In the second quarter of 2024, AES completed the construction or the acquisition of 976 megawatts (MW) of wind, solar and energy storage.

AES signed agreements to support 1.2 GW of new data center load at U.S utilities, 15-year PPAs for 727 MW of wind and solar to serve data center growth in Texas, and 310 MW retail supply to support data centers throughout Ohio. Looking ahead, the AES Indiana subsidiary plans to add up to 1,300 MW of wind, solar and battery energy storage by 2027.

AES has an expected revenue and earnings growth rate of 0.8% and 8%, respectively, for the current year. AES has a current dividend yield of 3.72%.

Robust Price Upside Potential for AES Stock

The short-term average price target of brokerage firms for AES represents an appreciation of 22.1% from the last closing price of $18.54. The brokerage target price is currently in the range of $19-$25.

Image Source: Zacks Investment Research

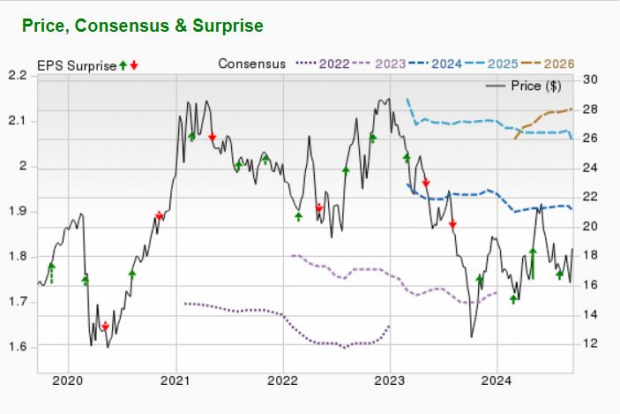

Pfizer Inc.

Pfizer is one of the largest and most successful drugmakers in the field of oncology. PFE’s position in oncology was strengthened with the addition of Seagen. Oncology sales comprise more than 26% of its total revenues. PFE’s oncology revenues grew 23% on an operational basis in the first half of 2024 driven by drugs like Xtandi, Lorbrena, Braftovi-Mektovi combination and Seagen’s cancer drugs.

Pfizer has committed significant resources toward the development of treatments in the fields of oncology, internal medicine, rare diseases, immunology, inflammation, vaccines and hospitals.

PFE has an expected revenue and earnings growth rate of 5.1% and 42.4%, respectively, for the current year. PFE has a current dividend yield of 5.74%.

Solid Price Upside Potential for PFE Shares

The short-term average price target of brokerage firms for Pfizer represents an appreciation of 13.9% from the last closing price of $29.27. The brokerage target price is currently in the range of $27-$45.

Image Source: Zacks Investment Research

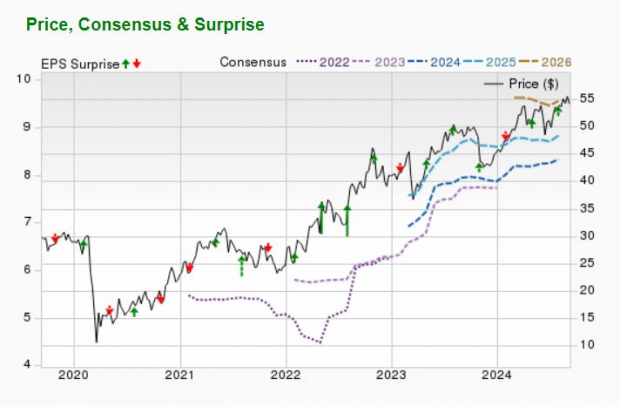

Unum Group

Unum’s conservative pricing and reservation practices have contributed to overall profitability. Sustained increase in premiums is fueled by high persistency levels in core business and strong sales volume, along with solid benefits experience. Geographic expansion has been paying off as acquired dental insurance businesses are growing in the United States and the United Kingdom.

We believe strong operating results have led to a solid level of statutory earnings and capital, boosting financial flexibility. UNM has continually enhanced shareholders’ value. For the long term, UNM expects sales growth in the range of 8-12%, premium growth in the band of 4-7% and adjusted operating EPS growth of 10-15%.

UNM has an expected revenue and earnings growth rate of 4.4% and 10.6%, respectively, for the current year. UNM has a current dividend yield of 3.05%.

Impressive Price Upside Potential for UNM Shares

The short-term average price target of brokerage firms for Unum represents an appreciation of 16.9% from the last closing price of $55.02. The brokerage target price is currently in the range of $52-$73.

Image Source: Zacks Investment Research

More By This Author:

Solar Stocks Rally After Presidential Debate: Should Investors Give Chase?

Kimberly-Clark Stock Up 20% YTD: Should You Buy or Hold Tight?

Time To Buy These Intriguing Transportation Stocks

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more