Time To Buy These Intriguing Transportation Stocks

Image Source: Pexels

Having generous dividends, the improved earnings outlook for several transportation stocks has become attractive.

Furthermore, these top transportation stocks have beta ratios under the preferred risk level of less than 1.0, suggesting they should be less volatile than the broader market.

C.H. Robinson Worldwide (CHRW - Free Report)

Coveting a Zacks Rank #1 (Strong Buy) is third-party logistics operator C.H. Robinson Worldwide. Seeing steady top line growth with sales projections edging toward $18 billion, C.H. Robinson’s increased profitability is very enticing as well.

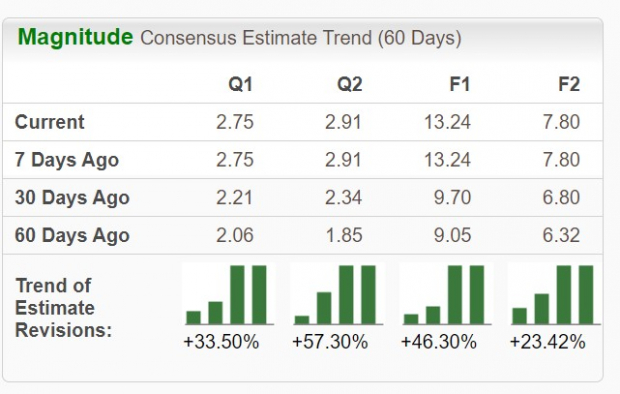

Annual earnings are expected to soar 25% in fiscal 2024 and are projected to increase another 12% in FY25 to $4.62 per share. More intriguing is that over the last 60 days, FY24 and FY25 EPS estimates have soared 15% and 11% respectively.

Image Source: Zacks Investment Research

Correlating with the trend of positive earnings estimate revisions, it’s noteworthy that C.H. Robinson’s Zacks Transportation-Services Industry is in the top 35% of over 250 Zacks industries.

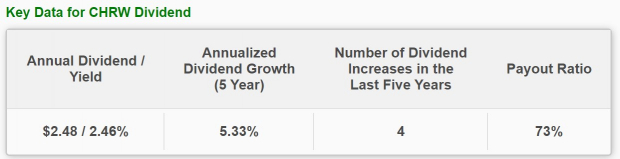

CHRW also offers a 2.46% annual dividend yield that tops the S&P 500’s 1.31% average while many of its industry peers don’t offer a payout.

Image Source: Zacks Investment Research

Euroseas (ESEA - Free Report)

Also sporting a Zacks Rank #1 (Strong Buy) is Euroseas which operates in the dry cargo, dry bulk, and container shipping markets. Euroseas’ Zacks Transportation-Shipping Industry is in the top 41% of all Zacks industries with EPS estimates soaring over the last 60 days as the company continues to capitalize on improved market rates.

Image Source: Zacks Investment Research

While Euroseas’ bottom line is naturally expected to contract after a record year that saw EPS at $14.98, ESEA still trades at an extremely cheap P/E multiple of 3.2X with rising earnings estimates offering further support.

Image Source: Zacks Investment Research

Attributed to its increased profitability, Euroseas currently has a 5.61% annual dividend that towers over the benchmark and is near its robust industry average of 5.85%.

Image Source: Zacks Investment Research

Cool Company (CLCO - Free Report)

Sporting a Zacks Rank #2 (Buy) is Cool Company which makes the case for being undervalued at 5.7X forward earnings. Already profitable, Cool Company went public in 2022 as an operator of fuel-efficient liquified natural gas carriers and also belongs to the Zacks-Shipping Industry.

Trading just over $10, Cool Company’s stock has a 14% dividend that certainly attracts the attention of income investors. More reassuring is that Cool Company has a very low beta ratio of 0.43 with a tight nit 52-week range of $10.07-$14.04.

Image Source: Zacks Investment Research

Like Euroseas, Cool Company’s bottom line is also expected to dip after a record year but earnings estimates for FY24 have risen 9% in the last 30 days with FY25 EPS estimates up 8%.

Image Source: Zacks Investment Research

Bottom Line

Rising earnings estimate revisions are a great sign that the increased probability of these top transportation stocks will indeed continue. This largely suggests more upside from their current levels and certainly makes now an ideal time to buy considering the attractive dividends they offer.

More By This Author:

Bear Of The Day: Exxon Mobile2 Food Stocks To Buy Amid Heightened Market Volatility

4 Insurance Stocks To Add For Better Returns In Sluggish September

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more