Post-Expiration Gives Some Ammo To Bears

I hope everyone had a great Father’s Day. For me, label it anything you want as long as I get time at my house with family. We are a small family so it’s always a highlight to have my kids, mom, brother, nieces and in-laws over. I beg my kids all the time to not buy me any gifts, just more family time, like staying in Vermont on Sundays through dinner. Like most weekend days, I wake up and make my little Post-It note list of things to do for the day. And I checked off everyone, including exciting things like going to the office, yard work, driving range and then visiting my dad at the cemetery. I usually leave a white Titleist golf ball on his headstone, but yesterday I decided to spice it up with a yellow ball. And I still miss him every single day.

Friday was options expiration. In the old days it was a massive quarterly expiration of derivatives, but times have really changed. Expirations have mostly becomes boring affairs with a huge surge in volume. The stock market did not behave well on Friday although I can’t assign too much importance to one day, especially a Friday in the summer with expiration. I sense that the 2023 high in the major indices hit intra-day on Friday may be a short-term peak.

Post-June expiration has not been kind to the bulls when the market has been in rally mode although post-Covid it hasn’t been bad. Additionally, small caps have a seasonal tendency to outperform from now until June 30th for what it’s worth.

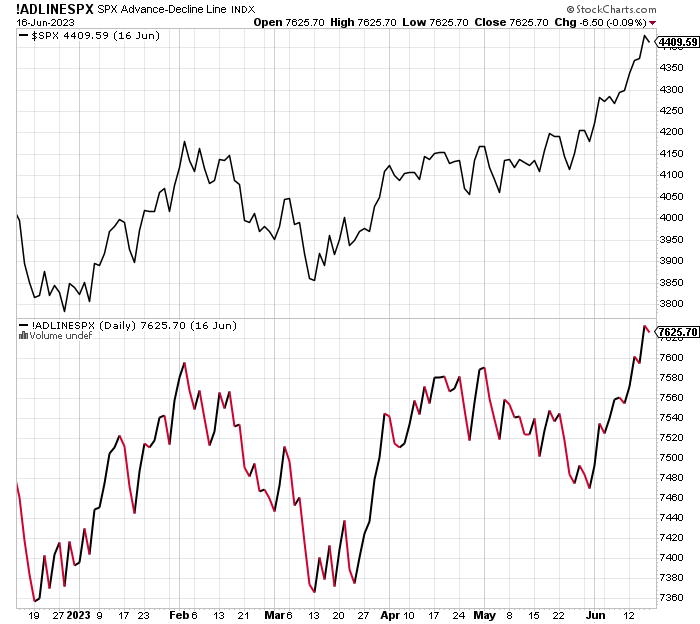

I am still in the boat where I have a tough time adding much exposure to the long side. Remember all those Chicken Little cries about the market falling and the rally being too narrow to succeed? Well, it really broadened out as you can see in the lower chart below. The S&P 500 Advance/Decline Line just made an all-time high. So much for 7 stocks accounting for all of the return.

In a perfect world, you know, the one we never get, stocks see a mild pullback this week and perhaps into next before running to new highs into the beginning of Q3.

On Friday we bought PMPIX, levered S&P 500. We sold TAN, levered inverse S&P 500, some QQQ, some levered NDX.

More By This Author:

Know When To Hold ‘Em, Know When To Fold ‘Em – Media’s Parade Of Pundits

The Fed Is Woefully Wrong & Jay Powell Has Become A Cocktail Party Punchline

Big Week Ahead – Bears May Get Something To Chew On

Please see HC's full disclosure here.