PEP: A Taste Of Resilience In Uncertain Times

Investors have long looked at consumer staples as anchors in their portfolios. These businesses may not deliver hyper-growth, but they often weather storms better than flashier sectors. That doesn’t mean they’re immune to short-term challenges, though — especially when volumes decline and margins feel the pinch. Let’s dig into a household name that has been under pressure lately, but still shows why it remains a dividend growth classic.

Built on Snacks and Sips

PepsiCo (PEP) is more than soda. It’s a global food-and-beverage powerhouse with a brand portfolio stretching from Doritos and Lay’s to Gatorade and Quaker Oats. Its operations are split between convenience foods (about 55% of sales) and beverages (about 45%).

- Snacks: Frito-Lay North America dominates the savory snack market with Lay’s, Cheetos, Doritos, and Ruffles.

- Beverages: Includes carbonated soft drinks (Pepsi, Mountain Dew) and non-carbonated drinks like Gatorade, Starbucks RTD coffee, and Aquafina.

- Global Reach: Operations span across North America, Latin America, EMEA, and APAC, giving PepsiCo geographic diversification that few can match.

- Integration: A vertically integrated supply chain and direct-store-delivery model provide shelf dominance and operational efficiency.

(Click on image to enlarge)

Some of PepsiCo’s Iconic Brands from its 2025 CAGNY presentation.

When a Snack Giant Faces Pressure

Bull Case – Brands That Endure

PepsiCo’s strength lies in its diversified portfolio and global scale. Even in challenging times, the company leans on recurring demand for its core products and pricing power built on brand loyalty.

- Resilient Demand: Snacks and beverages are everyday staples, offering a predictable revenue stream.

- Balanced Model: With snacks and beverages under one roof, Pepsi can bundle offerings to retailers and secure premium shelf space.

- International Growth: Emerging markets continue to be strong growth drivers, particularly in India, Latin America, and the EMEA region.

- Product Evolution: Acquisitions like Siete Foods and Poppi give PepsiCo exposure to healthier trends.

- Moat: Its scale in logistics, retail leverage, and marketing creates high barriers for competitors.

Bottom line: PepsiCo continues to deliver long-term revenue stability, with innovation and international markets keeping the growth engine running.

Bear Case – Volumes Don’t Lie

Despite its advantages, PepsiCo is not immune to shifting consumer habits or cost headwinds.

- Soft Volumes: Since 2023, U.S. snacks and beverages have shown ~2% volume declines, reflecting inflationary pressure on consumers.

- Margin Compression: Higher SG&A and commodity inflation have pushed operating margins down (notably from 18% in 2022 to below 8% in 2025).

- Regulatory Risks: Anti-sugar and anti-salt legislation could challenge both beverages and snacks globally.

- Competitive Pressures: Coca-Cola leads in beverages, while Mondelez and General Mills contest snack dominance.

- Currency & Global Risk: International strength is partially offset by FX volatility and geopolitical uncertainty.

Bottom line: The pressure on North American volumes and profitability explains why shares have drifted downward since their 2023 highs, despite solid international growth. Investors worry about whether Pepsi can reignite domestic momentum.

What’s New: Mixed Results in Q2 2025

PepsiCo’s latest quarter highlighted both its strengths and vulnerabilities:

- Revenue: +1% YoY, supported by 7% growth in EMEA and 5% in International Beverages.

- EPS: -5% YoY, as operating margin contracted to 7.9% from 18%.

- North America: Frito-Lay and PepsiCo Beverages volumes softened by ~2%, showing U.S. consumer pullback.

- International: Strong results in Latin America and EMEA offset domestic weakness.

- Guidance: 2025 outlook reaffirmed, signaling confidence despite cost pressures.

The Dividend Triangle in Action: Stability with Slower Growth

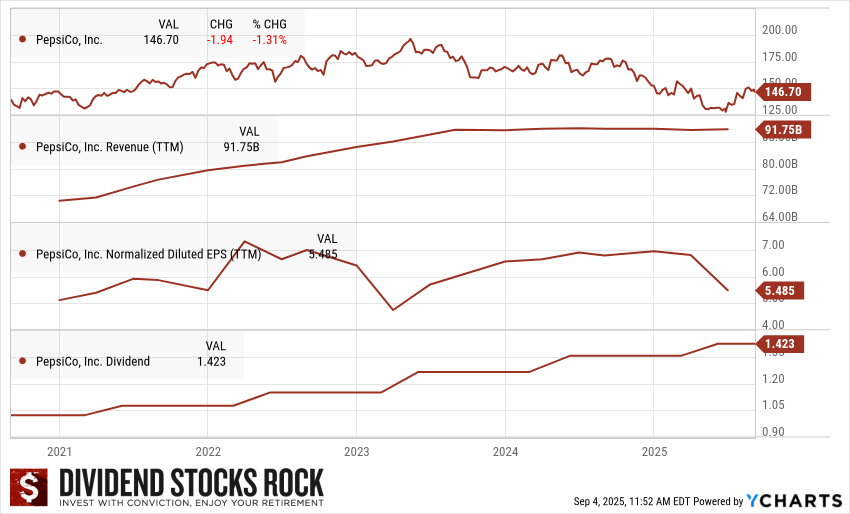

(Click on image to enlarge)

PepsiCo (PEP) 5-year Dividend Triangle Chart.

PepsiCo’s dividend triangle (revenue, EPS, dividend growth) shows a business still growing, but not as quickly as before:

- Revenue: Climbing steadily, reaching nearly $92B TTM, with international driving most gains.

- EPS: Pressured by margin compression, now ~$5.5, down from higher levels in 2022–23.

- Dividend: Consistently growing, now $1.42 quarterly, reflecting Pepsi’s commitment to income investors.

The dividend continues to grow even as earnings face pressure — a testament to PepsiCo’s stability, but also a reminder of the margin headwinds it must solve to sustain future hikes.

Final Words: Why Patience Matters

PepsiCo isn’t a growth rocket right now. North American volumes remain soft, and profitability has clearly slipped since 2023. That explains the stock’s pullback. But for patient investors, Pepsi’s international expansion, brand loyalty, and pricing power still make it a reliable income generator. Dividend growth may be modest in the short term, but the long-term case for resilience and global relevance remains intact.

More By This Author:

Processing Paychecks, Powering Dividends

Canadian Perspective – July Dividend Income Report

Equinix: Powering The Digital World’s Connections