Canadian Perspective – July Dividend Income Report

Image Source: Pixabay

Performance in Review

Let’s start with the numbers as of August 8th, 2025 (before the bell):

Original amount invested in September 2017 (no additional capital added): $108,760.02.

- Current portfolio value: $310,234.85

- Dividends paid: $5,260.53 (TTM)

- Average yield: 1.70%

- 2024 performance: +26.00%

- VFV.TO= +35.24%, XIU.TO = +20.72%

- Dividend growth: +12.22%

Total return since inception (Sep 2017 – August 2025): 185.25%

Annualized return (since September 2017 – 92 months): 14.48%

Vanguard S&P 500 Index ETF (VFV.TO) annualized return (since Sept 2017): 15.99% (total return 215.70%)

iShares S&P/TSX 60 ETF (XIU.TO) annualized return (since Sept 2017): 11.70% (total return 135.70%)

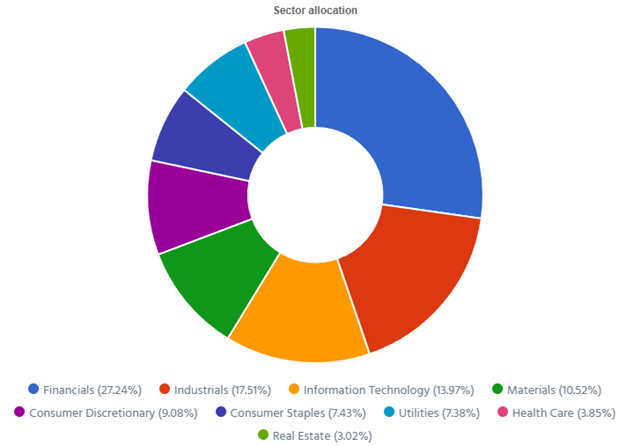

Dynamic sector allocation calculated by DSR PRO as of August 8th, 2025.

Trump Wins… So Far

One of the most significant advantages of sticking to a straightforward strategy is that you can go on vacation, hike for a few days, and completely disconnect from the stock market without worrying about something happening.

I’ve missed three full weeks of stock market action. I didn’t watch my portfolio or companies’ earnings reports. By most people’s standards, I’m late in the game right now. You can say that or you might realize that you can’t even remember what happened in July of 2024.

What “just happened” won’t matter in a few months, let alone in a year or more. A stock goes up 5% on a day, another drops by 15%, and five years later, no one remembers.

So, while I was on vacation, earnings reports came in, Apple announced another $100B investment in the U.S., and the market liked that.

Telus spun off its wireless tower infrastructure operations and created Terrion, now Canada’s largest dedicated wireless tower operator. Right after this company’s creation, Telus sold 49.9% of its equity interest to La Caisse de Dépôt et Placements du Quebec for $1.26B. This move was made with two goals in mind:

- Paying off some debt (I like that).

- Enabling wholesale access and third-party co-location.

In theory, this move makes sense. Now, I like that Telus is deleveraging, and I’ll be following how much revenue the co-location of cell towers could bring to the table now that Telus’s tower network is half-owned by a third party. But let’s get back to the real news that I missed while on vacation.

After 52 different tariff rules and 178 deadlines, we have finally reached the official date of August 1st, when all has been said, done, and signed off on – supposedly.

This bad show (that gave Trump’s nickname TACO as Trump Always Chickens Out) is not over yet, but many trade deals are in the process of getting finalized.

Long story short, most countries that reached a “deal” are paying more tariffs than in 2024. There aren’t any “deals” but rather new trade agreements ensuring that many goods entering the U.S. will cost more, or will be sold elsewhere if demand slows down.

It will take some time for the economy to reflect the impacts of those “deals”. In the meantime, Trump wins.

Why do I say that Trump is winning? Well… numbers!

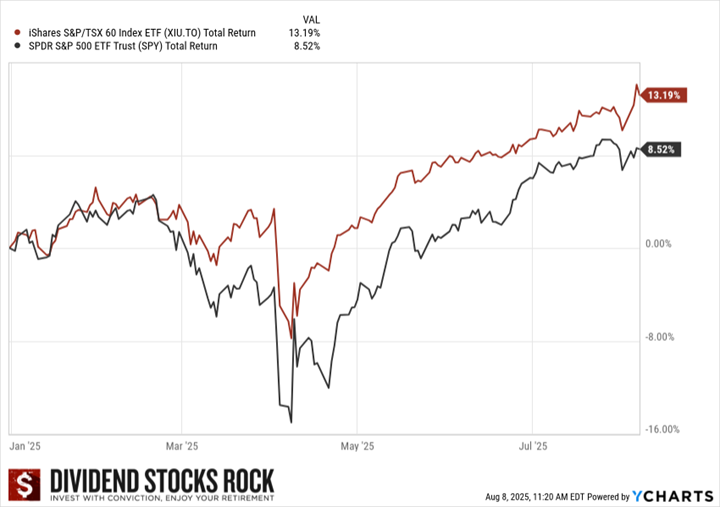

XIU.TO and SPY Performance since January 2025.

While most investors expected the worst (and I couldn’t argue with that), the stock market remains on fire in 2025. The S&P 500 is up 8.5% and the Canadian market is up by 13%! I must admit, I didn’t see that in my crystal ball.

One more reason to stay invested all the time!

So, in the short term, Trump is winning his big bet that other countries will fold and pay the fees. History has shown us that whenever tariffs increase, the other countries fight back with higher tariffs, too. This time, it’s not happening, at least not yet.

However, winning a marathon during the first 5km doesn’t mean much as there are 37km more to complete in order to win the race.

There are a lot of moving parts right now. Many goods will officially increase in price, which is bad for consumers and bad for inflation. This will continue to feed the feud between the FED’s chairman, Jerome Powell (who was named by Trump), and Trump, who now can’t wait to see him gone as Powell hasn’t moved on interest rates (yet).

Trump fired the labor statistics chief after she reviewed employment numbers which showed a weaker U.S. economy. I’m not here to tell you which numbers are right or wrong, but we can see a pattern where if you don’t do and say what the President wants, you’d better make sure your emergency fund is fully funded.

In the meantime, I see lots of smoke around the U.S. economy. If goods prices increase, consumers will have difficulty coping with more inflation. It could lead to a softer job market. You guessed it, those moving parts could eventually hurt the stock market. After all, AI won’t be the solution to everything.

Canada didn’t get a deal…and it doesn’t matter much (yet)

Another interesting twist: Canada didn’t sign anything before the deadline. I saw big headlines of massive tariffs increases. But in reality, RBC reported that 90% of Canadian merchandise exports to the U.S. are USMCA-compliant and therefore enter duty-free.

This explains why the Canadian stock market hasn’t crashed just yet. For most companies, it’s business as usual. As I said, the story is not over yet, but so far, so good!

The only thing you can do as an investor is to be sure you hold A-Quality stocks for what’s coming up in both the near and long term!

I have reviewed 13 companies’ earnings in this report and that should tell me whether I’m holding the “right ones”, or not! ?.

Smith Manoeuvre Update

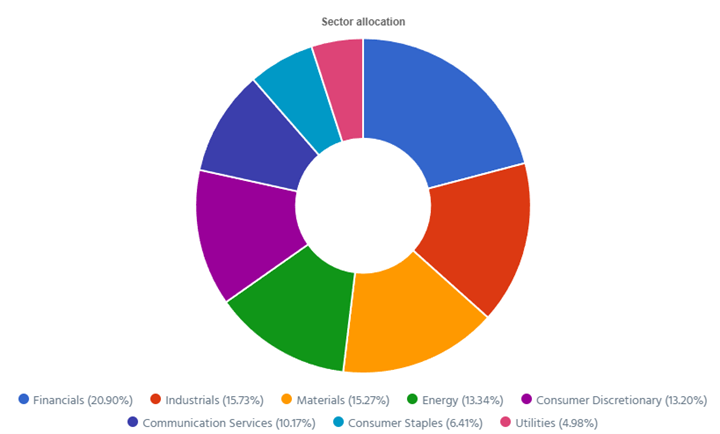

Slowly but surely, the portfolio is taking shape with 13 companies spread across 8 sectors. My goal is to build a portfolio of thriving companies with a solid dividend triangle (e.g. with positive revenue, EPS and dividend growth trends). The current portfolio yield is at 3.31% with a 5-year CAGR dividend growth rate of 10.65%.

Dynamic sector allocation was calculated by DSR PRO.

- The portfolio value is now at $21,950.02

- The portfolio debt is at $18,250.

- The annual income is $727.34

- To report my Smith Manoeuvre, I export the Excel data from my DSR PRO dashboard.

Smith Manoeuvre Portfolio Summary

Here’s my SM portfolio summary as of August 8th, 2025 (before the bell):

(Click on image to enlarge)

Smith Manoeuvre Portfolio Summary table.

Adding Stella-Jones (SJ.TO)

As I just got back from vacation, I didn’t invest my latest $750 (that is not part of the portfolio summary yet). However, I can tell you that I’ll be using the remaining cash plus the $750 to buy shares of Stella-Jones. This company is already part of my pension portfolio. Therefore, I’m adding to an existing position. SJ is currently in a slowdown (revenue and EPS are stagnant), which has brought its PE ratio to around 13. This sounds like a great time to add more to a great dividend grower!

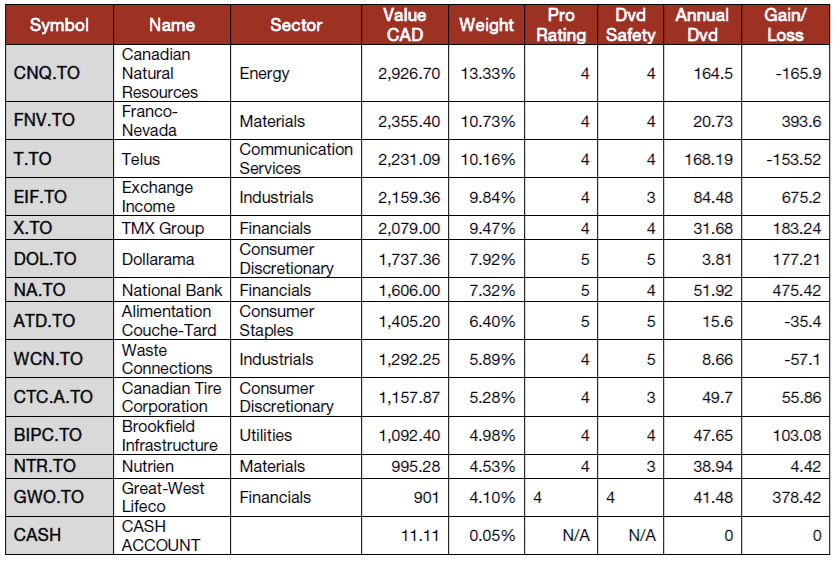

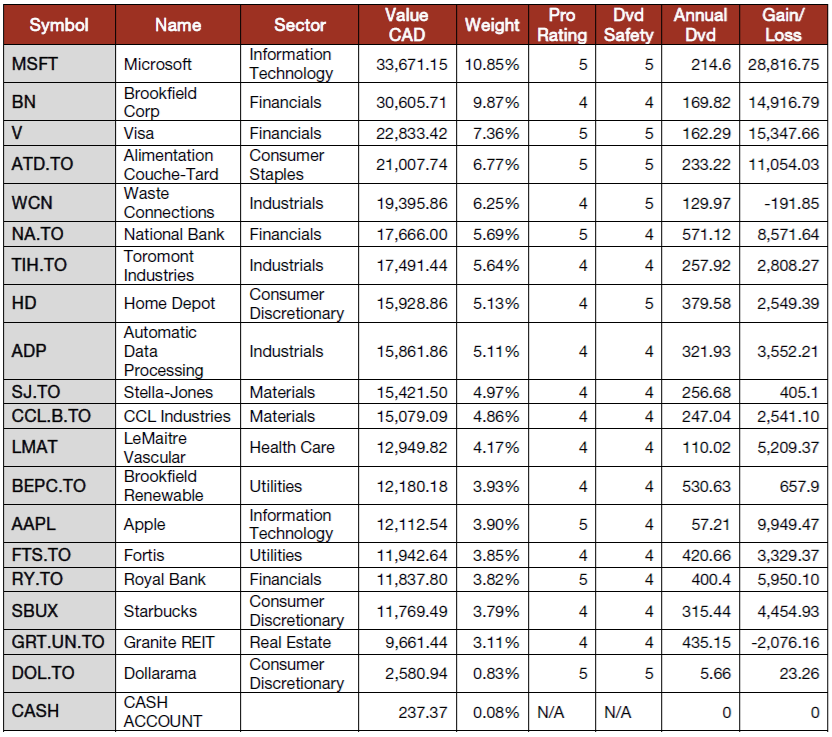

Pension Portfolio Summary

Here’s my pension plan portfolio summary as of August 8th, 2025 (before the bell):

(Click on image to enlarge)

Pension Portfolio Summary table.

Total value: $310,234.85 (+$10,836.21 or +3.6% from last month).

Microsoft is a bulldozer

Microsoft (MSFT) crushed expectations with another strong quarter (revenue +18%, and EPS +24%). Revenue breakdown by segment revealed: Intelligent Cloud +26%, powered by 39% growth in Azure and other cloud services. Productivity and Business Processes +16%, with Microsoft?365 Commercial up 18%. Consumer cloud was up 20%, LinkedIn up 9% and Dynamics?365 up 23%. More Personal Computing was up 9%, featuring Windows OEM & Devices +3%, Xbox content & services +13%, and Search & news advertising +21%. Additionally, MSFT disclosed that capital expenditures rose 27% which underlined its aggressive investment posture in AI infrastructure.

Brookfield keeps raising money

Brookfield (BN) reported lower distributable earnings per share after realizations (-35%) this quarter. However, the distributable EPS before realizations was up 13%. BN’s asset management business generated a 16% increase in fee-related earnings supported by continued fundraising momentum across diversified fund offerings. Wealth solutions delivered strong financial results benefiting from strong investment performance and disciplined capital deployment. Total inflows were $22B during the quarter, including over $5B from its retail and wealth solutions clients. A three-for-two stock split was announced, aiming to enhance retail accessibility and liquidity of its shares.

Visa processes more profit each quarter

Visa (V) did it again with another double-digit growth quarter (revenue +14%, and EPS +23%). The increase was driven by broad-based business strength. Payment’s volume rose 8%, total cross-border volume grew 12% (with 11% growth excluding intra-Europe transactions), and processed transactions were up 10%. Service revenue reached $4.3B (+9%), data processing revenue was $5.15B (+15%), international transaction revenue of $3.63B (+14%), and other revenue was $1.03B (+32%). Client incentives rose 13% to $4B, which reflected higher volumes and increased contract activity. Overall, growth was fueled by resilient consumer spending and continued cross-border travel recovery.

Waste Connections is collecting more cash flow

Waste Connections (WCN) reported a good quarter with revenue up 7%, and EPS up by 4.7%.Core pricing in solid waste services increased by 6.6%, contributing to an approximate 70 basis point expansion in solid waste margins driven by strong pricing power and operational execution. WCN reaffirmed its full-year 2025 outlook: revenue of ~$9.45 billion, adjusted EBITDA of ~$3.12 billion (~33% margin), and adjusted free cash flow of ~$1.30 billion. Capital expenditures are expected to be between $1.20 billion and $1.25 billion, with operating cash flow projected in the range of $2.483 billion to $2.533 billion.

Toromont Industries is driving through tariff uncertainties

Toromont Industries reported a mixed quarter with revenue up 1%, but EPS fell by 7%. Revenue growth was primarily driven by a robust 13% increase at CIMCO, while the Equipment Group’s revenue remained relatively flat. Higher expenses and interest charges more than offset the revenue growth which hurt EPS. Bookings increased 14% compared to last year with higher bookings at both CIMCO and the Equipment Group. Backlog of $1.4 billion as of June 30, 2025, was up slightly from the $1.3 billion as of June 30, 2024. Backlog remains healthy reflecting deliveries and progress on construction schedules and good new booking activity and backlog related to the acquired business.

Automatic Data Processing is rolling payroll!

Automatic Data Processing (ADP) reported another strong quarter with revenue up 7.5% and EPS up 8%, beating analysts’ expectations. Employer Services revenue grew 8% (6% organic constant currency), driven by sustained client retention (92.1%) and a 1% rise in U.S. pays per control. PEO Services revenue increased 7% with average worksite employees up 3% to 761,000. Interest on funds held for clients climbed 11% to $308M. Full-year revenue reached $20.56 billion which was up 7% with +7% organic constant currency and balanced growth across both main segments. For FY26, ADP guides to 5–6% revenue growth, 50–70 bps of adjusted EBIT margin expansion, and 8–10% adjusted EPS growth.

Stella-Jones’s wood demand is getting soft

Stella-Jones was still navigating a challenging environment and reported revenue down 1% and EPS down 1.5%. Segment results included utility poles at $476 million (+1% reported, –4% organic), railway ties at $240M (–11%), residential lumber at $246M (flat), industrial products at $46M (flat), and logs/lumber at $26M (+4%). Weakness in utility poles pricing, reduced railway tie demand due to a Class 1 railroad’s in-house treating shift, and a softer start to residential lumber demand weighed on results. Management revised its 2025 sales outlook down to approximately $3.5B from $3.6B, citing softer-than-expected utility poles and railway tie volumes in the first half.

LeMaitre Vascular: small niche, big growth

LeMaitre Vascular reported another solid quarter with revenue and EPS up 15%, beating analysts’ expectations. Key contributors included heavy gains in catheters (+27%) and grafts (+19%), supported by broad geographic strength: EMEA (+23%), Americas (+12%), and APAC (+12%). Price increases accounted for 8% of total revenue growth, alongside 7% from unit volume increases. Cash reserves rose by approximately $16.9 million sequentially, reaching $319.5 million which signal strong free cash flow generation and liquidity. Q3 2025 outlook includes sales of $61.2–$63.2 million (midpoint up 13–15% YoY) and EPS forecast of $0.54–$0.59 (midpoint +16%).

Brookfield Renewable produces renewable cash flow

Brookfield Renewable (BEP) reported another strong quarter with 10% FFO per share. Results were driven by inflation-linked contracts and BEPC’s execution of its ongoing commercial contracting activities and growth initiatives. BEPC inked a deal with Google to deliver up to 3,000 megawatts of hydroelectric capacity in the U.S. As digitalization and AI continue to reshape industry’s demand for energy in developed markets is surging at a pace not seen since the industrial revolution. Propelled by the growth of the global hyperscalers, BEPC is at the right place at the right time.

Apple is answering the call

Apple (AAPL) reported a solid quarter with revenue up 10% and EPS up 12%, beating analysts’ expectations. iPhone revenue surged 13% to approximately $44.6B. Mac revenue climbed 15% to around $8B, a rebound driven by M-series hardware momentum. Services revenue hit a record $27.4B, up 13%, and now accounts for roughly 29% of Apple’s total revenue. Offsetting these gains, iPad revenue declined by about 8%, and Wearables/Home & Accessories fell approximately 9%. AAPL flagged increased AI investments, including cautious and strategic potential acquisitions, reprioritized internal resources, and AI-enhanced Siri developments. The company will also invest an additional $100B in the U.S.

Fortis rarely disappoints

Fortis (FTS) reported a good quarter with EPS up 13%. The company initiated the conversion of 793?MW of coal-fired generation at TEP’s Springerville station to natural gas by 2030, aligning with its goal to be coal-free by 2032. Fortis has deployed $2.9B in capital expenditures during the first half of 2025, aligning with its $5.2B annual capex plan. The company reaffirmed its C$26.0 billion five-year capital plan, aiming to expand its rate base from US$39B (2024) to US$53B by 2029 by targeting a 6.5% CAGR. With growing earnings and a robust capital plan in place, Fortis reaffirmed its commitment to annual dividend growth of 4–6% through 2029.

Starbucks is brewing both hope and worries

Starbucks (SBUX) failed investors this quarter with revenue up 4%, but EPS down 46%. Global comparable store sales declined 2% driven by a 2% decline in comparable transactions, partially offset by a 1% increase in average ticket. EPS was hurt by smaller margins. GAAP operating margin shrank by 680 basis points to 9.9%, while non-GAAP margins dropped 660 basis points to 10.1% mainly due to deleverage, “Back to Starbucks” investments (including additional labor and Leadership Experience 2025), and inflation. CEO Brian Niccol emphasized that the “Back to Starbucks” turnaround plan is ahead of schedule.

Granite REIT is finally getting some love

GRT reported another good quarter (revenue +6.4%, and AFFO/unit up 5%) and finally got some love from the stock market. Revenue growth was driven by contractual rent adjustments, CPI-based rent increases, renewal and re-leasing activity, and the lease commencement of development and expansion projects completed in 2024. Granite raised its 2025 guidance and is now expecting FFO per unit between $5.75 and $5.90.

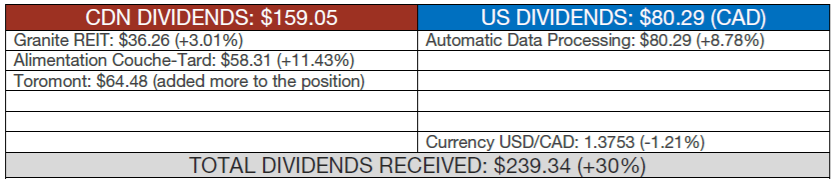

Dividend Income: $239.34 (+30% vs July 2024)

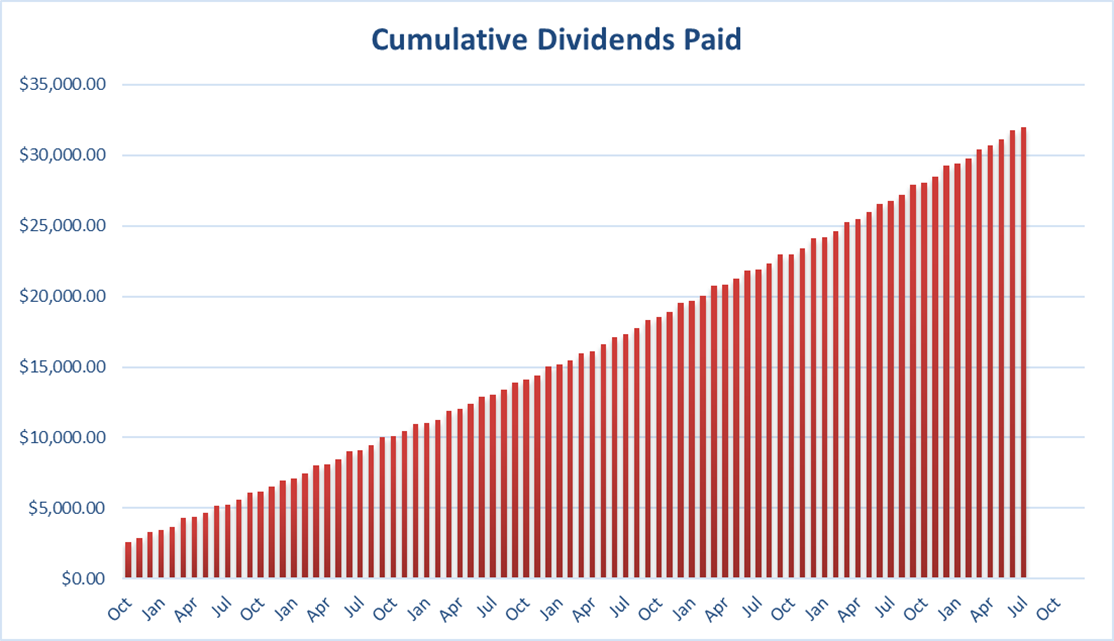

Pension Dividend Income Month over Month since Inception.

July is a slow month for dividends, with only four payments. However, after adding more capital to my position in Toromont, I increased my payouts by 30%. Granite, Couche-Tard and ADP are all showing an increase vs last year as well.

(Click on image to enlarge)

Total dividends received table.

Since I started this portfolio in September 2017, I have received a total of $32,015.17 CAD in dividends. Keep in mind that this is a “pure dividend growth portfolio” as no capital can be added to this account other than retained and/or reinvested dividends. Therefore, all dividend growth is coming from the stocks and not from any additional capital being added to the account.

(Click on image to enlarge)

Cumulative dividends received since inception.

Final Thoughts

After reviewing several of my holdings’ latest earnings reports, I could say that the future doesn’t look so bleak. However, as we all know, the market has a knack for shifting rapidly and surprising us. I expect lots of volatility this fall. Things will, in all probability, get very interesting!

More By This Author:

Equinix: Powering The Digital World’s Connections

MA: Turning Every Transaction Into Growth

9 Stocks On My Radar (Buy List)