Overbought Conditions Finally End - But Can Bears Capitalize?

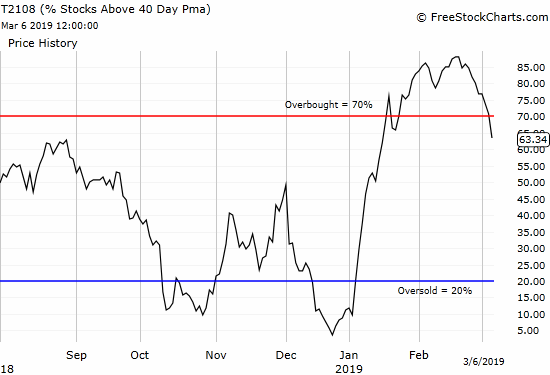

Last week, I described a mild bearish divergence between a decline in my favorite technical indicator, AT40 (T2108), the percentage of stocks trading above their respective 40-day moving averages (DMAs), and a levitating S&P 500 (SPY). This week, that divergence quickly transformed into an outright end to the stock market's extended overbought trading conditions; the stock market is overbought when AT40 closes above 70%.

Per rule, I switched my short-term trading call to (cautiously) bearish with the end of the overbought period. I started small and tentative with a few puts in Caterpillar (CAT) given it was starting to separate from its 200DMA.

As the trading day wound down into a definite negative position I also bought a number of put options on SPY.

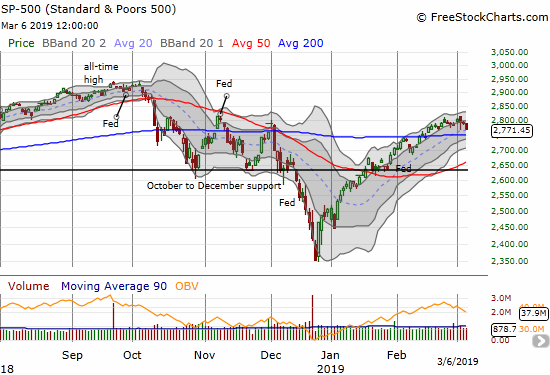

The key question is can the bears follow-through on this sell signal? The major indices are in various stages of weakness with small caps and financials already experiencing breakdowns and leading the way downward. The S&P 500 is just 1.1% off its recent high and comfortably above its 200DMA.

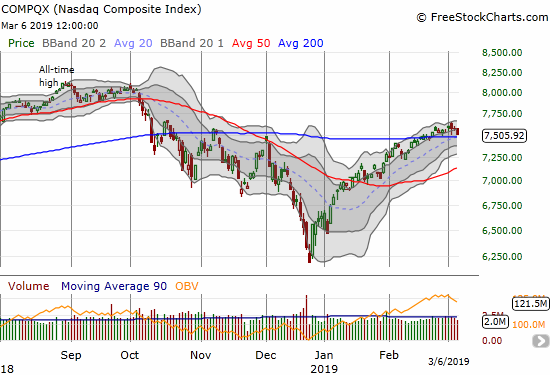

The NASDAQ (NDX) lost 0.9% and is almost sitting on top of its 200DMA.

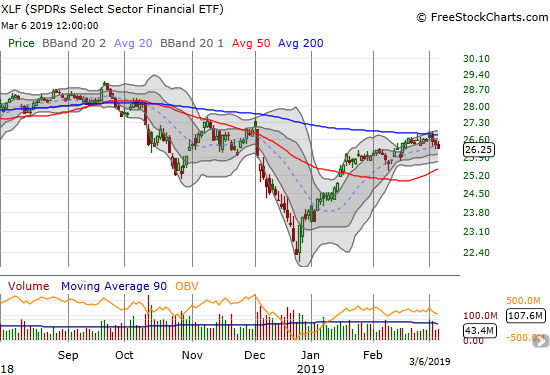

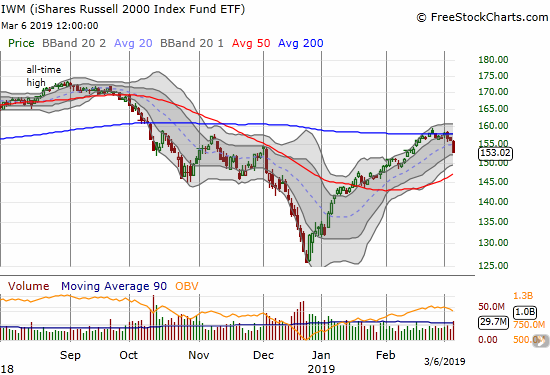

Most importantly, two major indices are in the process of losing their battles with their 200DMAs. The Financial Select Sector SPDR ETF (XLF) never broke out and is now waning. The iShares Russell 2000 ETF (IWM) outright lost its battle with 200DMA resistance with a 2.0% pullback.

Other indicators like the volatility index, the VIX, and indices like the iShares 20+ Year Treasury Bond ETF (TLT) are also demonstrating slightly elevated levels of concern in the market.

If the sellers are going to make any dent in the market, this is the window. If the stock market quickly recovers and hurtles back into overbought territory, likely led by the S&P 500 successfully defending its 200DMA support, the run to all-time highs could ensue through another extended overbought period. If sellers are able to press downward, I am not expecting a major calamity given what looks like solid support levels from 50DMAs.

Be careful out there!

Disclosure: long SPY puts, long CAT puts

Follow Dr. Duru’s commentary on financial markets via more

Quick follow-up to this post in light of the market's sharp rebound! drduru.com/.../t2108-update-190311/

Thanks for the link!

You're welcome! More to come as the market has broken out again, but it also remains precarious.

Yes, we are living in interesting times... not for the faint of heart.

Impressive.