Outperformance From Low Volatility

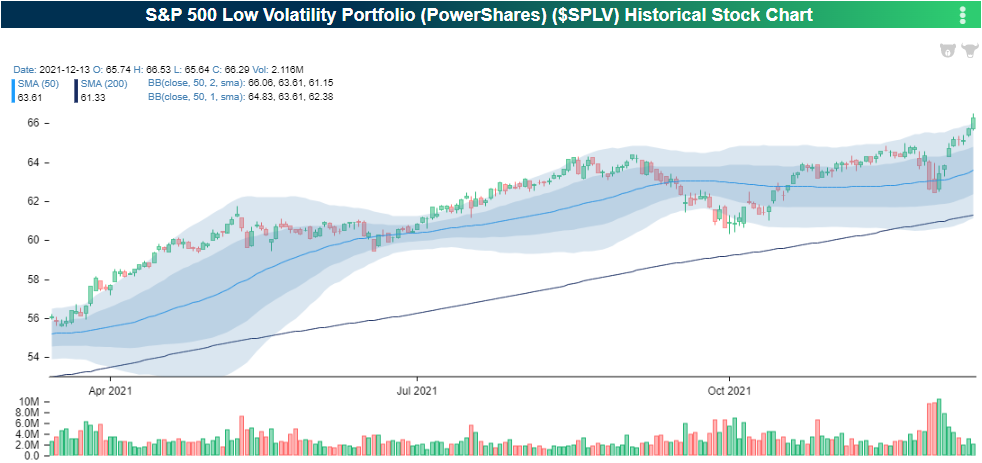

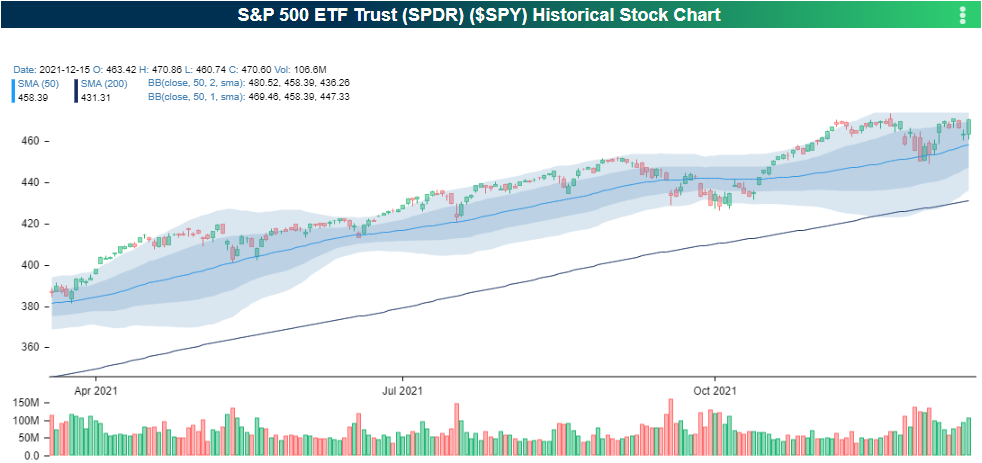

Over the last two weeks, low volatility names have outperformed the broader market. The PowerShares S&P 500 Low Volatility ETF (SPLV) has ticked 6.83% higher over the last 10 trading days as of yesterday’s close. During the same time period, the SPDR S&P 500 ETF (SPY) moved 4.36% higher. Investors have poured into safer names so far in December, but SPLV has still underperformed SPY on a YTD basis. Over the last three months, the performance of these two ETF’s has been essentially identical with SPLV breaking out to all-time highs, while SPY struggles to break out. Although investors are not necessarily selling off equities broadly, they are gaining exposure to lower volatility names, which could be interpreted as taking a more conservative posture.

(Click on image to enlarge)

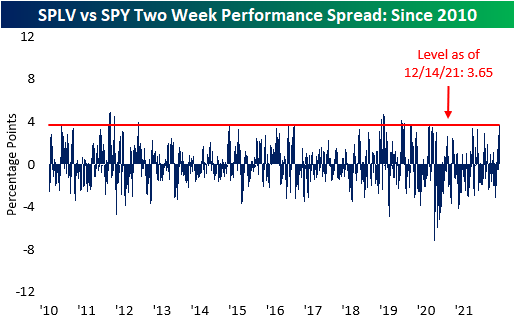

The two-week performance spread between SPLV and SPY is currently at an elevated level, and as of earlier this week (12/14) was at its widest level since 1/31/20, which is less than a month before the COVID correction began. Investors should watch the performance of low volatility names moving forward, as continued outperformance would signal that investors are becoming increasingly risk-averse.