ORCL: Monster RPO Figures Send The Tech Stock Soaring

Photo by BoliviaInteligente on Unsplash

Oracle Corp. (ORCL) reported brilliant fiscal first-quarter results as the company’s remaining performance obligations (RPO) jumped 359% to over $455 billion, an amazing $300 billion increase during the quarter.

Over the next few months, the company expects to sign up several additional, multi-billion-dollar customers, and the RPO backlog is likely to exceed half-a-trillion dollars. In addition, MultiCloud database revenue from Amazon.com Inc. (AMZN), Alphabet Inc. (GOOGL), and Microsoft Corp. (MSFT) grew at the incredible rate of 1,529%.

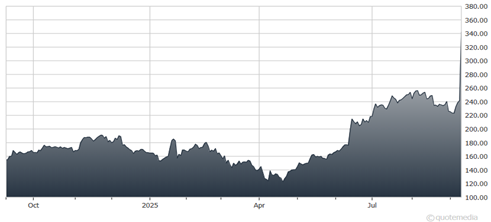

Oracle Corp. (ORCL)

Meanwhile, operating income during the first quarter increased 7% to $4.3 billion, even though net income was relatively flat at $2.9 billion due to higher interest expense and higher taxes. For the full year, operating income is expected to grow at a mid-teens rate and at a higher rate in fiscal 2027. Earnings per share declined 2% to $1.01 during the quarter.

Capital expenditures for the full year are expected to approximate $35 billion. During the quarter, the company paid $1.4 billion in dividends and repurchased 440,000 of its shares for $95 million.

Chairman and CTO Larry Ellison stated, “We expect MultiCloud revenue to grow substantially every quarter for several years as we deliver another 37 datacenters to our three Hyperscaler partners, for a total of 71.”

AI inferencing (reasoning) models will be much bigger than AI training models, and Oracle is aggressively pursuing both areas – with AI agents already generating programs to automate all processes, including legal, financial, and sale processes. Oracle believes we will soon see robotic factories, cars, drug design systems, greenhouses, etc. – with everything changing thanks to AI.

Recommended Action: Buy ORCL.

More By This Author:

META & GOOGL: Beneficiaries Of Strong Digital Ad Growth

Gold: Blasting Higher As Rate Cut Bets Surge

Alibaba Group: Why Its Earnings "Miss" Wasn't Much Of One At All

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more