Alibaba Group: Why Its Earnings "Miss" Wasn't Much Of One At All

Image Source: Unsplash

Alibaba Group Holding Ltd. (BABA) reported what we would call the greatest earnings “miss” of all time last week. Indeed, to call this quarter a “miss” would be extremely misleading, writes Tom Hayes, editor of HedgeFundTips.

Top-line revenues were $34.5 billion (+2% year-over-year), falling $910 million short, and adjusted earnings per share of $2.06 came in $0.10 less than expected. But the Cloud segment posted its fastest growth in over three years, accelerating 26% year-over-year to $4.66 billion, while adjusted EBITA also rose 26% to $412 million.

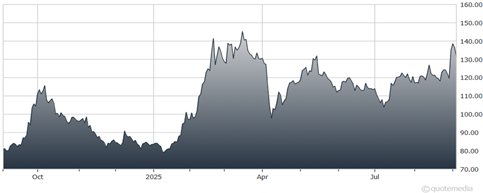

Alibaba Group Holding Ltd. (BABA) Stock Chart

Management expects continued acceleration over the next few quarters, with all signs pointing to +30% top-line growth, as Alibaba extends its lead as China’s #1 cloud infrastructure provider, holding and expanding its roughly 40% market share.

Alibaba’s newly organized China E-commerce group, including Taobao, Tmall, Ele.me, and Fliggy, reported 10% year-over-year revenue growth to $19.5 billion. Adjusted EBITA fell 21% year-over-year to $5.36 billion as heavier investments in instant commerce weighed on near-term profitability, though, excluding these investments, profitability would have improved.

Customer management revenue increased 10%, supported by last year’s 0.6% software service fee and stronger advertising demand. Double-digit growth in 88VIP memberships, now exceeding 53 million, was another key driver.

Alibaba International delivered 19% year-over-year revenue growth, reaching $4.85 billion. Adjusted EBITA improved 98% year-over-year to a loss of just $8 million, with profitability expected in the upcoming quarter.

Management repurchased 7 million ADSs for $815 million at about $116 per share, with $19.3 billion in buyback dry powder remaining. Alibaba ended the quarter with $81.7 billion in cash and a net cash position just under $50 billion, roughly 15% of its market cap.

About the Author

Thomas J. Hayes is the founder, chairman, and managing member of Great Hill Capital, LLC (a long/short equity manager based in New York City). Before starting his own firm, Mr. Hayes worked with Cornwall Capital, LP (one of the firms featured in The Big Short book and movie).

On a weekly basis, he publishes his timely stock market commentary, Hedge Fund Tips with Tom Hayes videocast and podcast. He has a wide following in the investment management, hedge fund, and media community.

More By This Author:

ETFs: As Funds Proliferate, Investors Should Keep This In Mind

Kraft Heinz: What I'm Recommending In The Wake Of Its Break Up News

ROST: Fighting Off Tariff Impacts And Taking Care Of Shareholders

(MoneyShow Editor’s Note: Tom is speaking at our 2025 MoneyShow Masters Symposium Sarasota, scheduled for Dec. 1-3. more