META & GOOGL: Beneficiaries Of Strong Digital Ad Growth

Image Source: Pixabay

We have a positive fundamental outlook for the interactive media and services sub-industry over the next 12 months, reflecting the improving digital advertising landscape and increasing opportunities to monetize AI investments. Companies like Meta Platforms Inc. (META) and Alphabet Inc. (GOOGL) are beneficiaries.

Although we project digital ad spending to grow through 2026, growth rates will likely decelerate as enterprise budgets tighten amid tariff concerns and a softer macroeconomic landscape. We note uncertainty around e-commerce trends/China spend, especially amid greater geopolitical pressure.

Challenges from verticals more tied to cyclical/economically sensitive industries (e.g., travel) could pull back digital ad spend. But increasing investments in Generative AI (GenAI) will likely improve content/recommendations and translate into a higher return on investment (ROI) for advertisers.

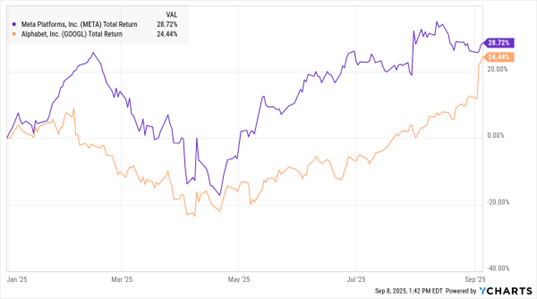

META, GOOGL (YTD % Change)

Data by YCharts

We think Magna Global’s global digital ad spending outlook, which calls for growth of about 8% in 2025, is attainable. We see a similar high-single-digit percentage pace in 2026, after increases of 13% in 2024 (+70% of total media ad spend) and 12% in 2023.

In the long term, we see an ongoing shift in total global advertising spend from traditional broadcast TV/radio and print media to Internet/digital media. This shift is led by the increasing time consumers spend on Internet/digital versus traditional media and the superior ROI for advertisers due to more precise targeting, richer feedback, and a more efficient ad buying process that is mostly auction-based and increasingly programmatic.

We expect revenue growth to remain healthy for social media participants Alphabet and Meta. We also underscore the tremendous profitability and substantial operating leverage inherent to the businesses in this sub-industry.

More By This Author:

Gold: Blasting Higher As Rate Cut Bets Surge

Alibaba Group: Why Its Earnings "Miss" Wasn't Much Of One At All

ETFs: As Funds Proliferate, Investors Should Keep This In Mind

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more